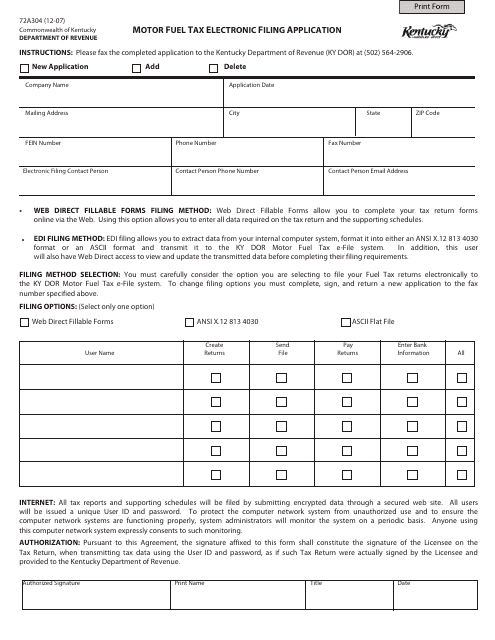

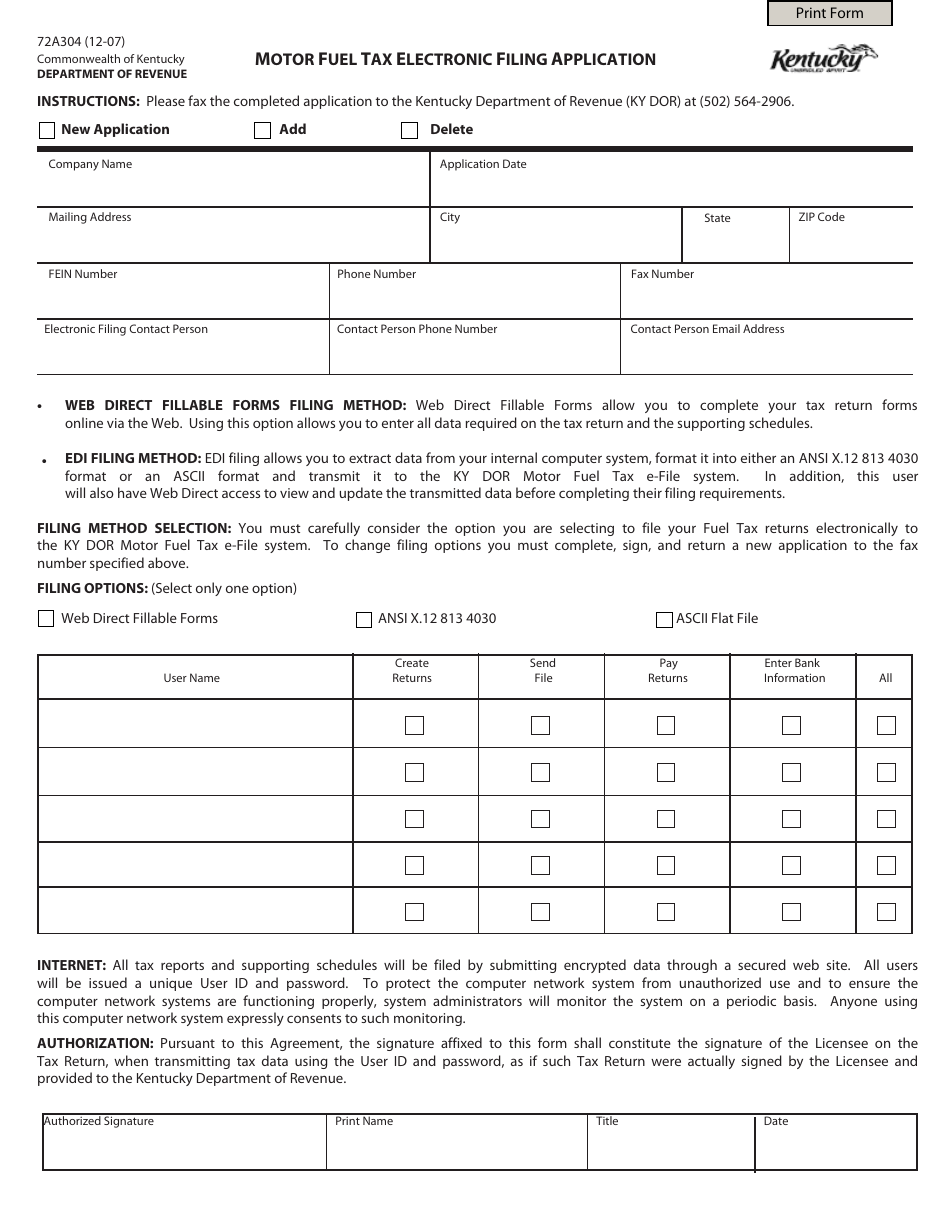

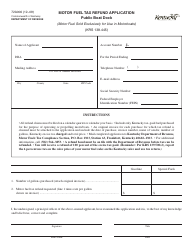

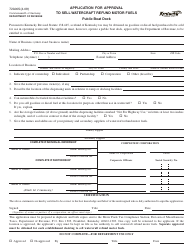

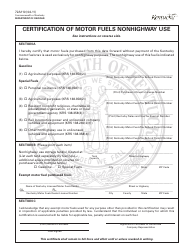

Form 72A304 Motor Fuel Tax Electronic Filing Application - Kentucky

What Is Form 72A304?

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form 72A304?

A: Form 72A304 is the Motor Fuel TaxElectronic Filing Application for Kentucky.

Q: What is the purpose of form 72A304?

A: The purpose of form 72A304 is to electronically file motor fuel tax returns in Kentucky.

Q: Who needs to file form 72A304?

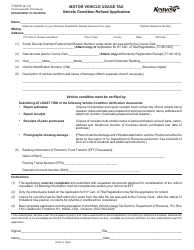

A: Anyone who is required to file motor fuel tax returns in Kentucky needs to file form 72A304.

Q: How do I file form 72A304?

A: Form 72A304 can be filed electronically.

Q: Is form 72A304 only for individuals?

A: No, form 72A304 is for both individuals and businesses.

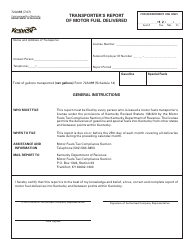

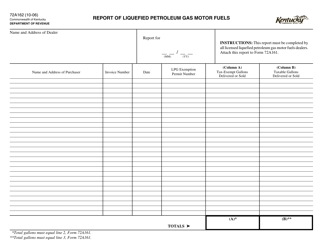

Q: What information is required on form 72A304?

A: Form 72A304 requires information such as business details, fuel type, gallons sold, and fuel tax owed.

Q: When is form 72A304 due?

A: Form 72A304 is due on the last day of the month following the end of the reporting period.

Q: Are there any penalties for late filing of form 72A304?

A: Yes, there are penalties for late filing of form 72A304, including interest charges and potential license revocation.

Q: Can form 72A304 be amended?

A: Yes, form 72A304 can be amended if there are errors or changes to the originally filed information.

Form Details:

- Released on December 1, 2007;

- The latest edition provided by the Kentucky Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 72A304 by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.