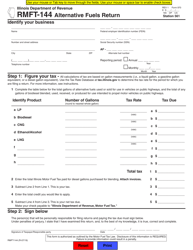

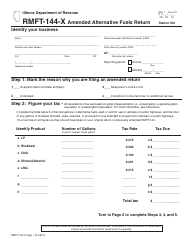

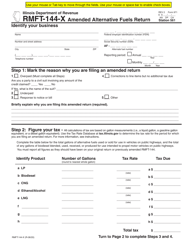

Instructions for Form RMFT-144 Alternative Fuels Return - Illinois

This document contains official instructions for Form RMFT-144 , Alternative Fuels Return - a form released and collected by the Illinois Department of Revenue. An up-to-date fillable Form RMFT-144 is available for download through this link.

FAQ

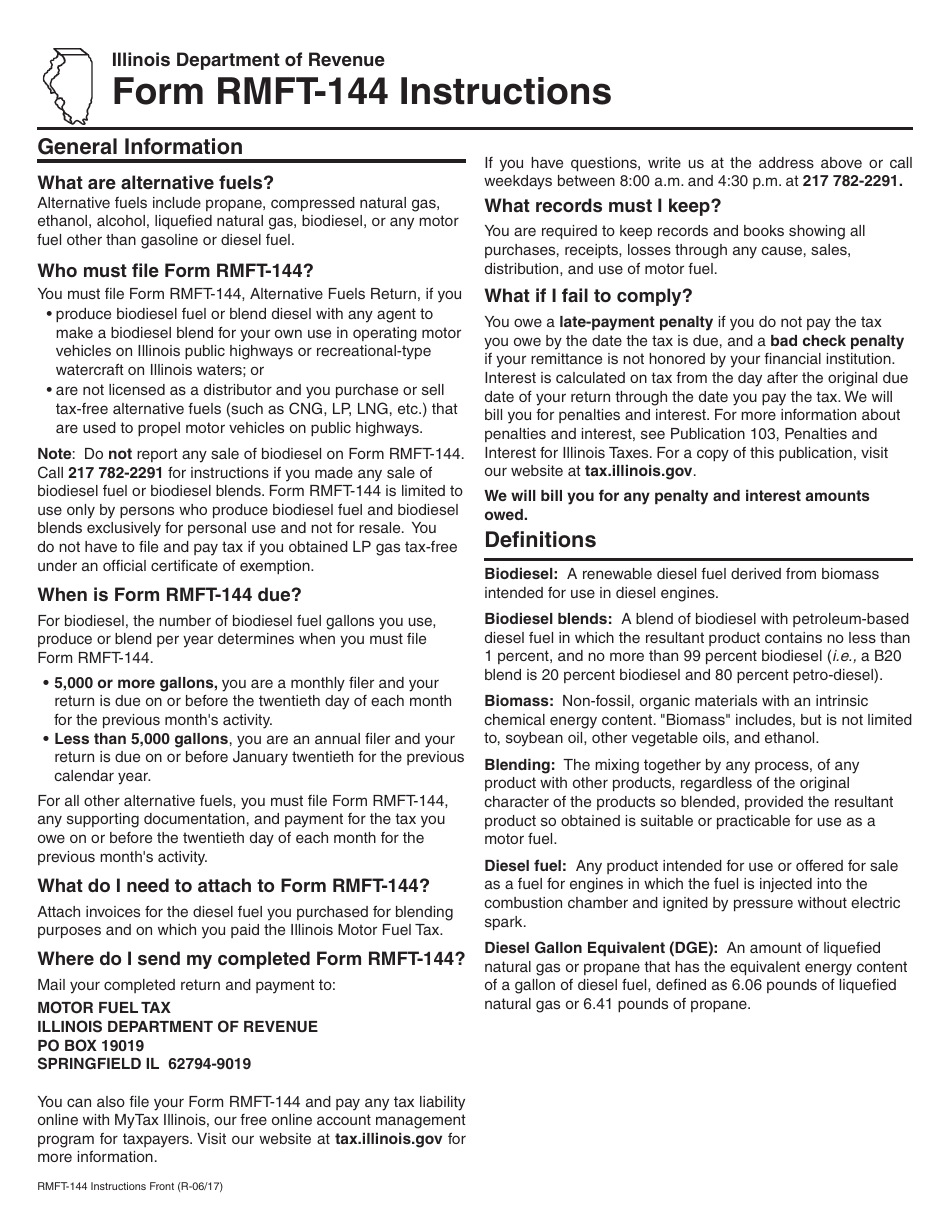

Q: What is Form RMFT-144?

A: Form RMFT-144 is the Alternative Fuels Return for the state of Illinois.

Q: Who needs to file Form RMFT-144?

A: Any person or entity that sells or uses alternative fuels in Illinois needs to file Form RMFT-144.

Q: What are alternative fuels?

A: Alternative fuels include natural gas, propane, electricity, hydrogen, and other specified fuels.

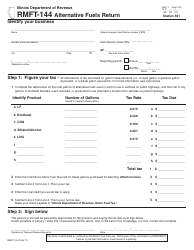

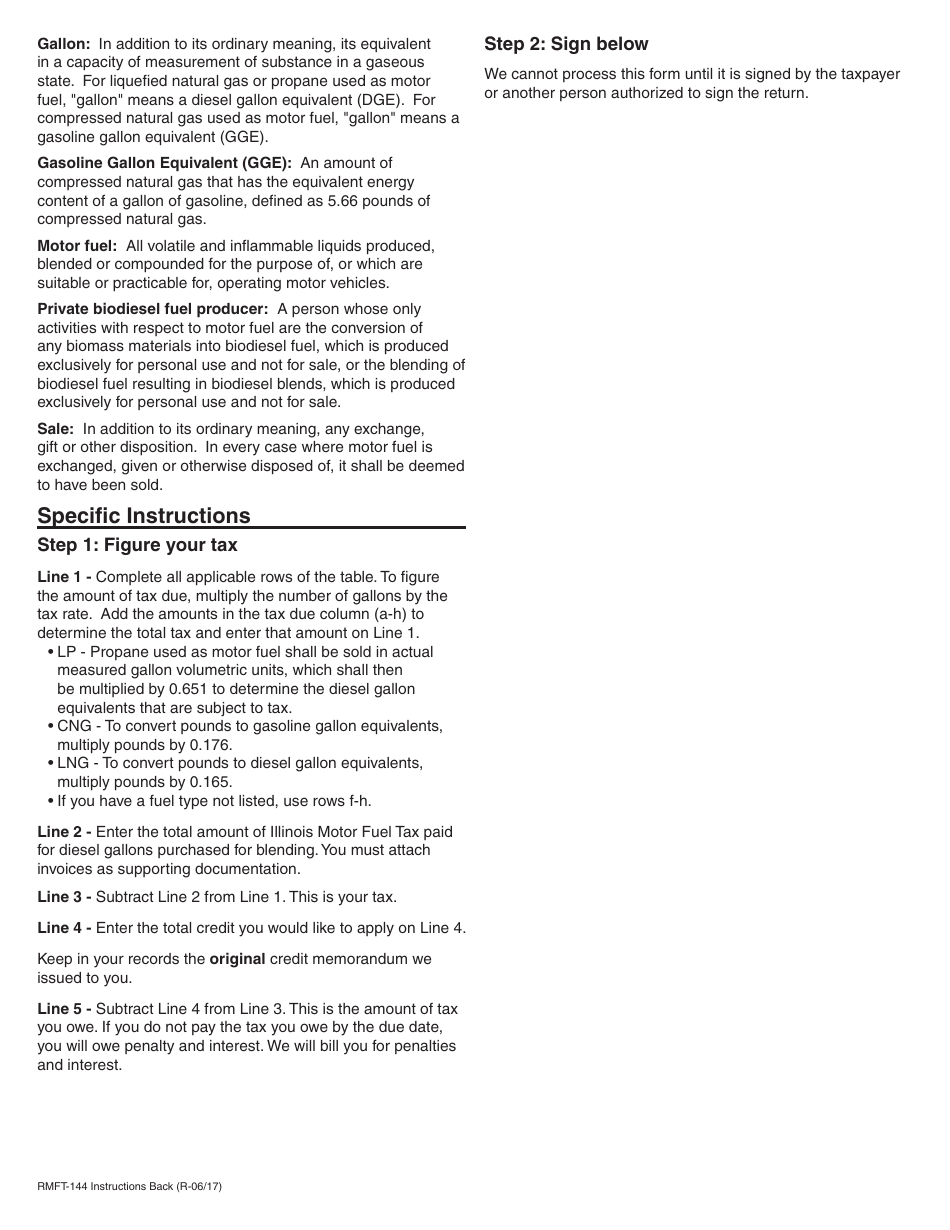

Q: What information is required on Form RMFT-144?

A: Form RMFT-144 requires information such as fuel type, gallons sold or used, and applicable tax rates.

Q: When is the deadline to file Form RMFT-144?

A: Form RMFT-144 must be filed on a monthly basis and the deadline is the 20th day of the following month.

Q: Are there any penalties for not filing Form RMFT-144?

A: Yes, failure to file Form RMFT-144 or pay the required taxes can result in penalties and interest charges.

Q: Is there any other information I should know?

A: It is important to keep accurate records of alternative fuel sales and usage to ensure compliance with Illinois tax laws.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Illinois Department of Revenue.