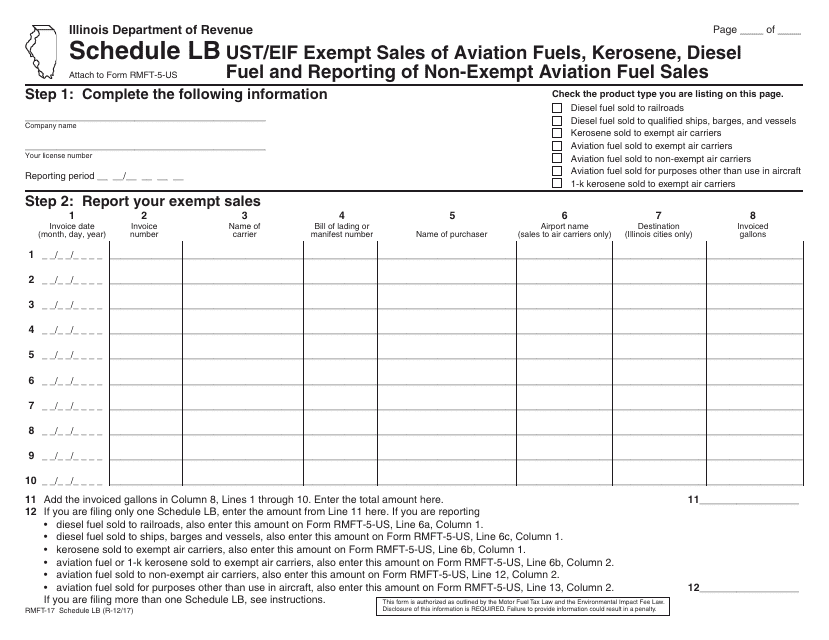

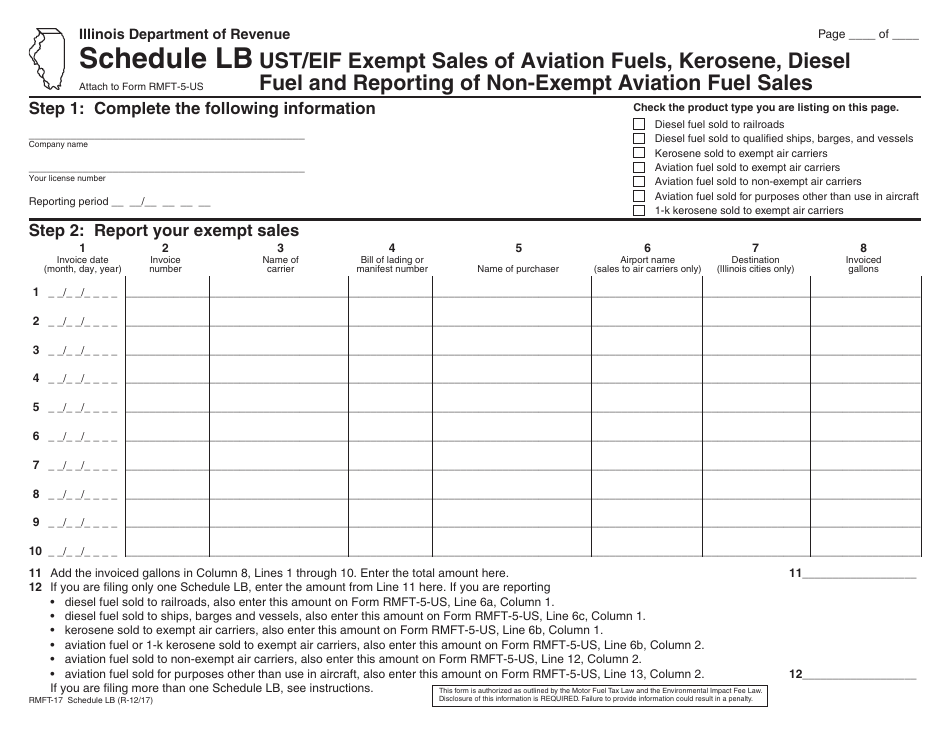

Form RMFT-17 Schedule LB Ust / Eif Exempt Sales of Aviation Fuels, Kerosene, Diesel Fuel and Reporting of Non-exempt Aviation Fuel Sales - Illinois

What Is Form RMFT-17 Schedule LB?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. Check the official instructions before completing and submitting the form.

FAQ

Q: What is the purpose of form RMFT-17 Schedule LB?

A: The purpose of form RMFT-17 Schedule LB is to report exempt sales of aviation fuels, kerosene, and diesel fuel, and to report non-exempt aviation fuel sales in the state of Illinois.

Q: What types of fuel sales are exempt from reporting on form RMFT-17 Schedule LB?

A: Aviation fuels, kerosene, and diesel fuel sales that are exempt from the reporting requirements are listed on form RMFT-17 Schedule LB.

Q: What types of fuel sales need to be reported on form RMFT-17 Schedule LB?

A: Non-exempt aviation fuel sales need to be reported on form RMFT-17 Schedule LB.

Q: Who is required to file form RMFT-17 Schedule LB?

A: Any person or entity engaged in the sale or distribution of aviation fuels, kerosene, or diesel fuel in Illinois is required to file form RMFT-17 Schedule LB.

Form Details:

- Released on December 1, 2017;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form RMFT-17 Schedule LB by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.