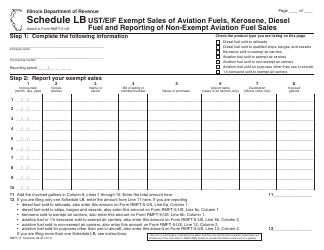

Instructions for Form RMFT-17 Schedule LB Ust / Eif Exempt Sales of Aviation Fuels, Kerosene, Diesel Fuel and Reporting of Non-exempt Aviation Fuel Sales - Illinois

This document contains official instructions for Form RMFT-17 Schedule LB, Ust/Eif Diesel Fuel and Reporting of Non-exempt Aviation Fuel Sales - a form released and collected by the Illinois Department of Revenue. An up-to-date fillable Form RMFT-17 Schedule LB is available for download through this link.

FAQ

Q: What is Form RMFT-17?

A: Form RMFT-17 is a tax form used to report exempt sales of aviation fuels, kerosene, and diesel fuel in Illinois.

Q: What is Schedule LB?

A: Schedule LB is a section of Form RMFT-17 used to report exempt sales of aviation fuels.

Q: What is Ust/Eif?

A: Ust/Eif stands for Underground Storage Tank/Environmental Impact Fee.

Q: What sales are exempt?

A: Exempt sales include sales of aviation fuels and certain other fuels that are not subject to the Ust/Eif tax.

Q: What is non-exempt aviation fuel?

A: Non-exempt aviation fuel is any aviation fuel that is subject to the Ust/Eif tax and needs to be reported separately on Schedule LB.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Illinois Department of Revenue.