This version of the form is not currently in use and is provided for reference only. Download this version of

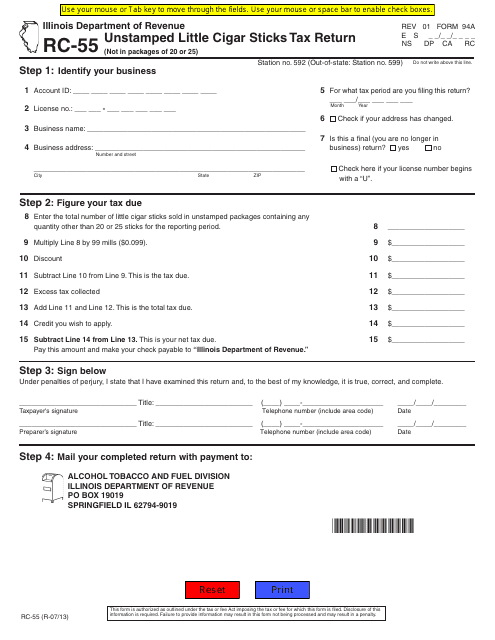

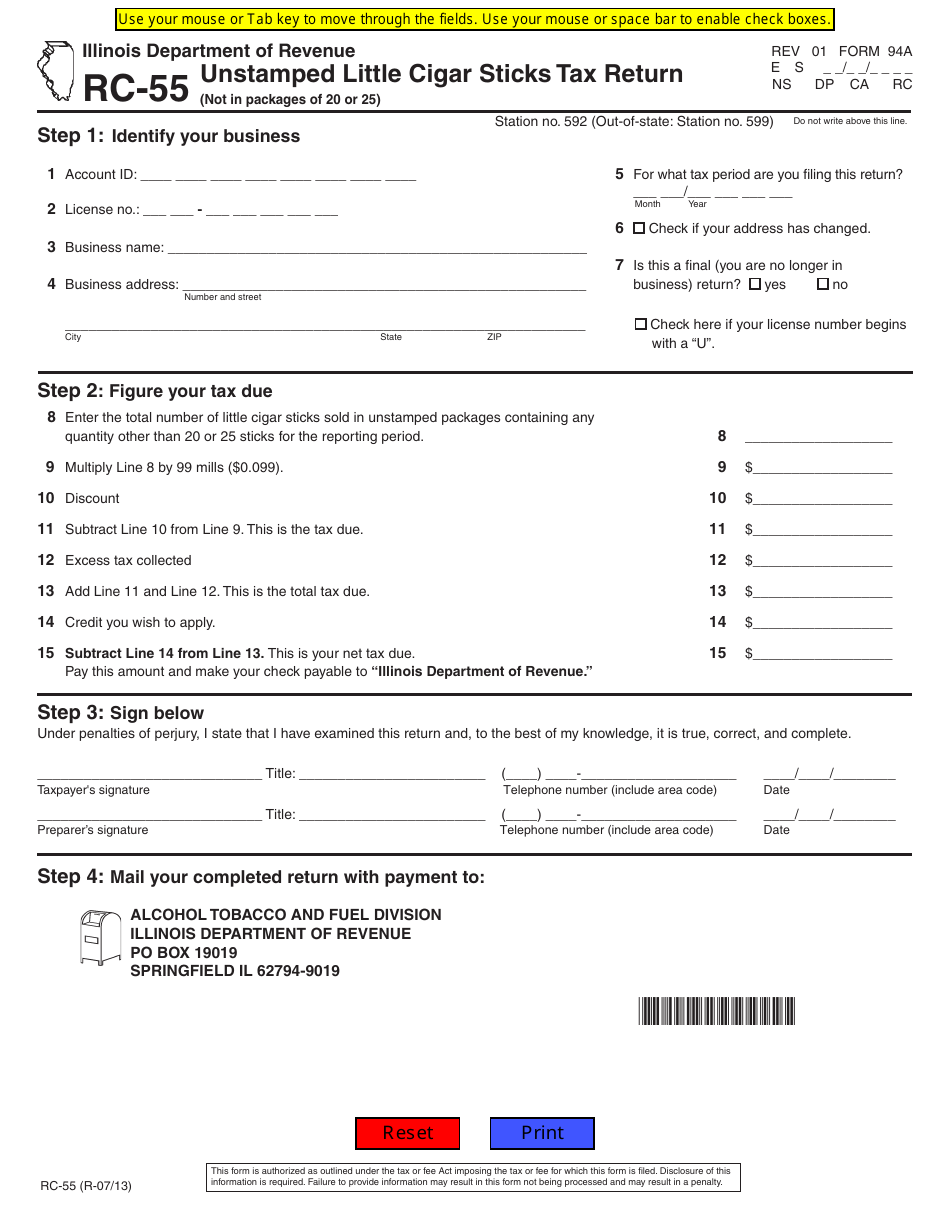

Form 94A (RC-55)

for the current year.

Form 94A (RC-55) Unstamped Little Cigar Sticks Tax Return - Illinois

What Is Form 94A (RC-55)?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form 94A (RC-55)?

A: Form 94A (RC-55) is the Tax Return form for reporting the Unstamped Little Cigar Sticks tax in Illinois.

Q: What is the Unstamped Little Cigar Sticks tax?

A: The Unstamped Little Cigar Sticks tax is a tax imposed on Little Cigar Sticks that do not have the required tax stamp affixed.

Q: Who is required to file Form 94A (RC-55)?

A: Any person or entity engaged in the sale or distribution of Unstamped Little Cigar Sticks in Illinois is required to file Form 94A (RC-55).

Q: When is the deadline for filing Form 94A (RC-55)?

A: The deadline for filing Form 94A (RC-55) is the 20th day of the month following the end of the reporting period.

Q: What happens if I do not file Form 94A (RC-55) or pay the Unstamped Little Cigar Sticks tax?

A: Failure to file Form 94A (RC-55) or pay the Unstamped Little Cigar Sticks tax may result in penalties and interest being assessed by the Illinois Department of Revenue.

Q: Are there any exemptions to the Unstamped Little Cigar Sticks tax?

A: Yes, there are certain exemptions to the Unstamped Little Cigar Sticks tax, such as sales to the federal government or sales for export.

Q: Can I amend my Form 94A (RC-55) if I made a mistake?

A: Yes, you can file an amended Form 94A (RC-55) to correct any mistakes or omissions on your original form.

Form Details:

- Released on July 1, 2013;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 94A (RC-55) by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.