This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Form RC-55

for the current year.

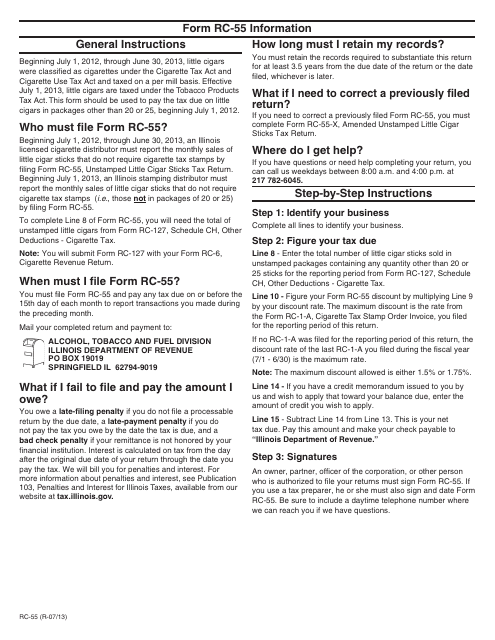

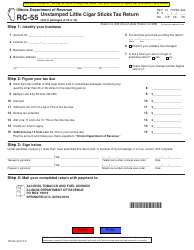

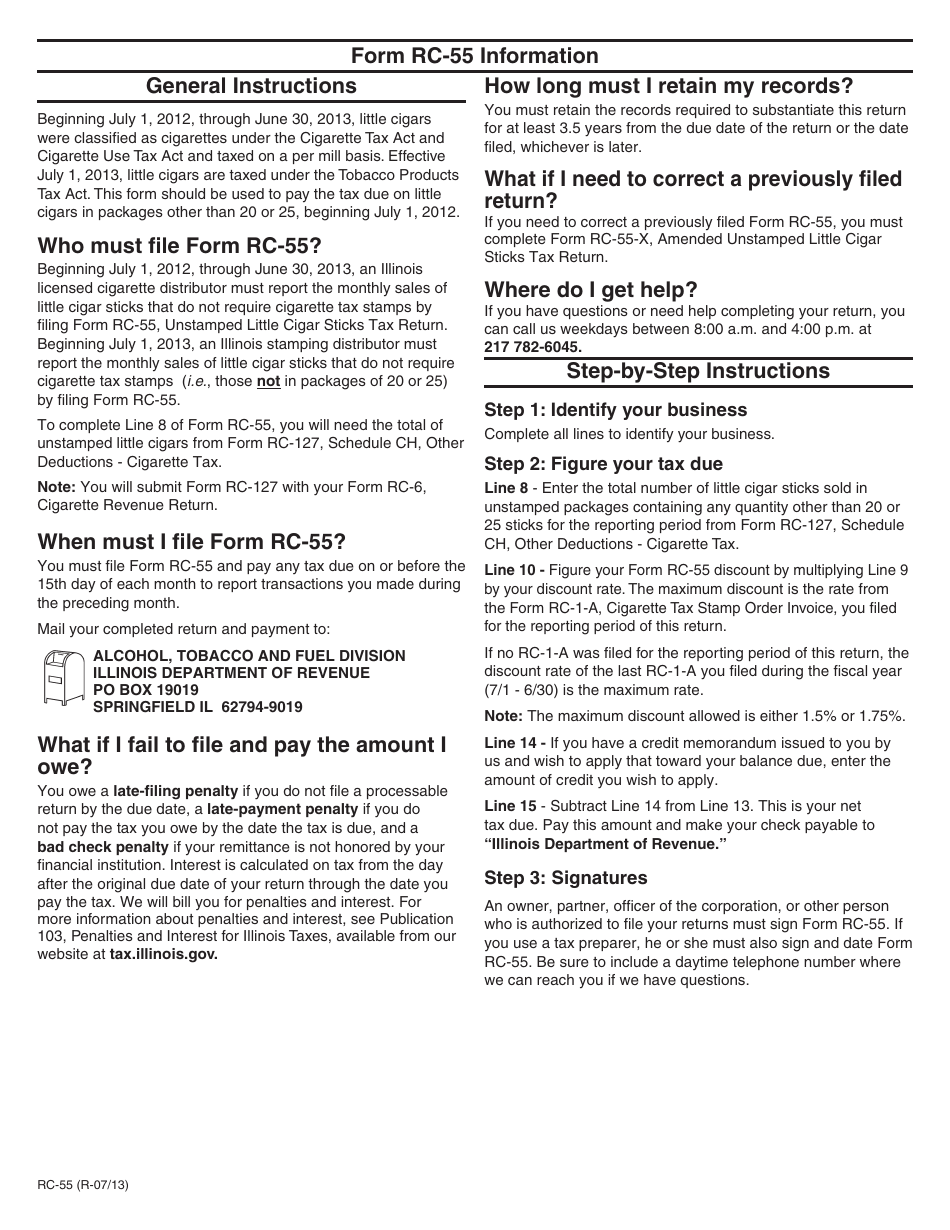

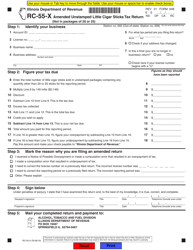

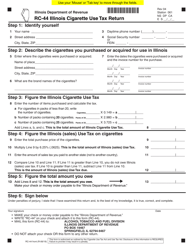

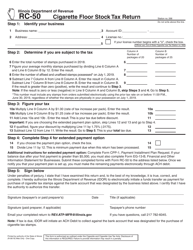

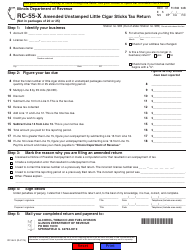

Instructions for Form RC-55 Unstamped Little Cigar Sticks Tax Return - Illinois

This document contains official instructions for Form RC-55 , Unstamped Little Cigar Sticks Tax Return - a form released and collected by the Illinois Department of Revenue. An up-to-date fillable Form 94A (RC-55) is available for download through this link.

FAQ

Q: What is Form RC-55?

A: Form RC-55 is the Unstamped Little Cigar Sticks Tax Return for Illinois.

Q: Who needs to file Form RC-55?

A: Any business that sells or distributes little cigar sticks in Illinois without the required tax stamps needs to file Form RC-55.

Q: What are little cigar sticks?

A: Little cigar sticks are small cigars that weigh less than three pounds per 1,000.

Q: What is the purpose of Form RC-55?

A: The purpose of Form RC-55 is to report and remit the tax due on unstamped little cigar sticks sold or distributed in Illinois.

Q: When is Form RC-55 due?

A: Form RC-55 is due quarterly, on the last day of the calendar month following the end of the quarter.

Q: Is there a penalty for late filing or non-filing?

A: Yes, there is a penalty for late filing or non-filing of Form RC-55. The penalty is based on the amount of tax due and the number of days past the due date.

Q: Can I claim a refund on Form RC-55?

A: No, Form RC-55 is used to report and remit the tax due on unstamped little cigar sticks and cannot be used to claim a refund.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Illinois Department of Revenue.