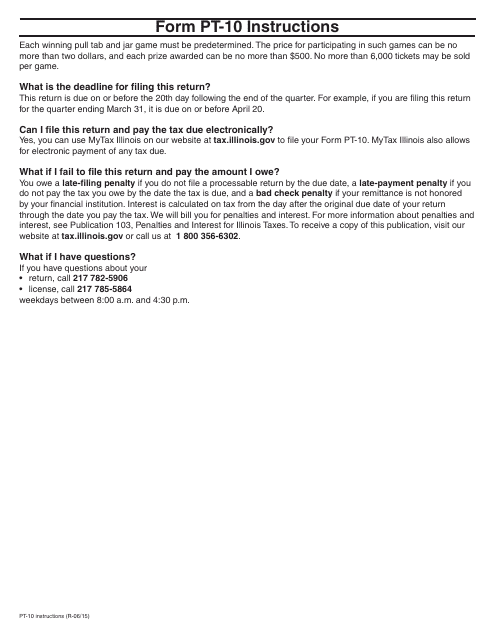

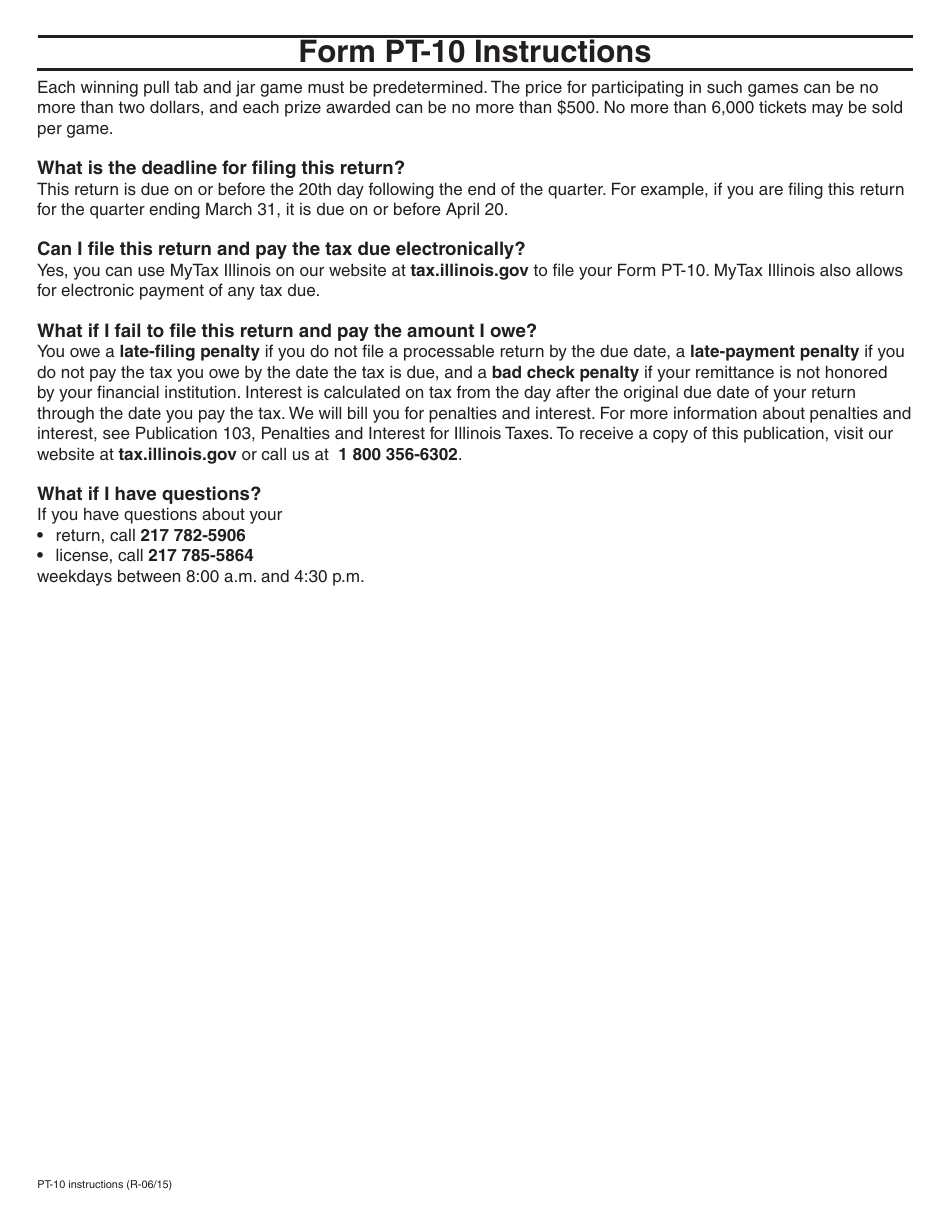

Instructions for Form PT-10 Pull Tabs and Jar Games Quarterly Tax Return - Illinois

This document contains official instructions for Form PT-10 , Pull Tabs and Jar Games Quarterly Tax Return - a form released and collected by the Illinois Department of Revenue.

FAQ

Q: What is Form PT-10?

A: Form PT-10 is the Pull Tabs and Jar Games Quarterly Tax Return for Illinois.

Q: Who needs to file Form PT-10?

A: Any person or organization conducting pull tabs or jar games in Illinois is required to file Form PT-10.

Q: How often does Form PT-10 need to be filed?

A: Form PT-10 needs to be filed quarterly, meaning every three months.

Q: What information is required on Form PT-10?

A: Form PT-10 requires information such as total sales, gross receipts, prizes paid, and net income from pull tabs and jar games.

Q: Are there any penalties for not filing Form PT-10?

A: Yes, there are penalties for failure to file or late filing of Form PT-10, including a monthly penalty of $50 or 10% of the tax due, whichever is greater.

Q: What is the deadline for filing Form PT-10?

A: The deadline for filing Form PT-10 is the last day of the month following the end of the quarter. For example, the deadline for the first quarter is April 30th.

Q: Do I need to include payment with Form PT-10?

A: Yes, payment of any tax due must be included with Form PT-10.

Q: Are there any exemptions or deductions available for pull tabs and jar games?

A: No, currently there are no exemptions or deductions available for pull tabs and jar games in Illinois.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Illinois Department of Revenue.