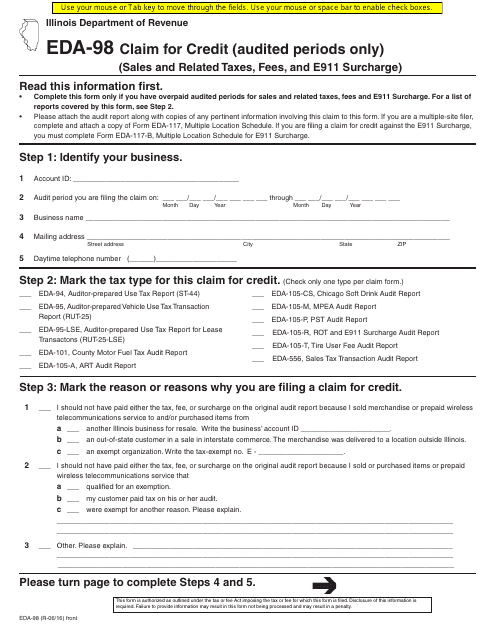

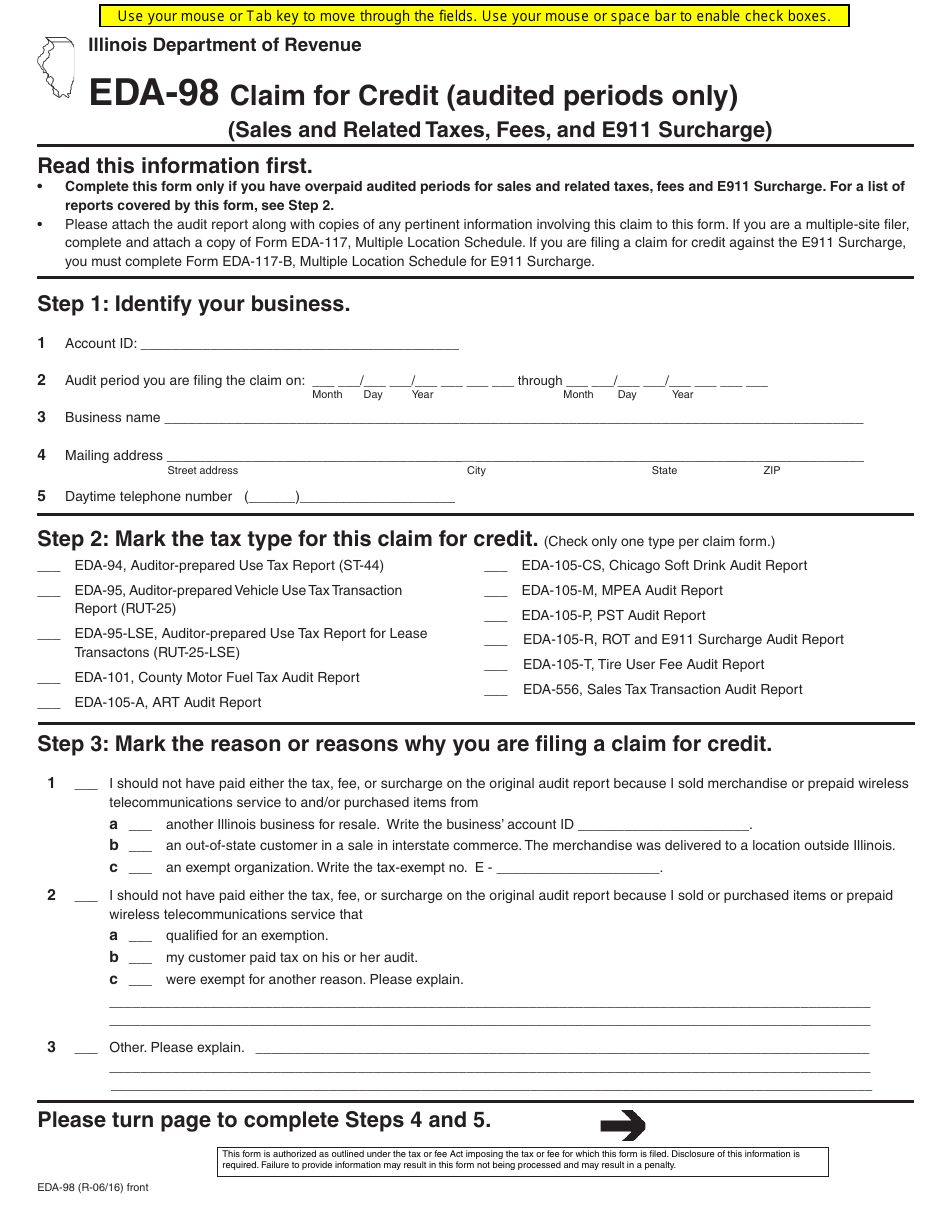

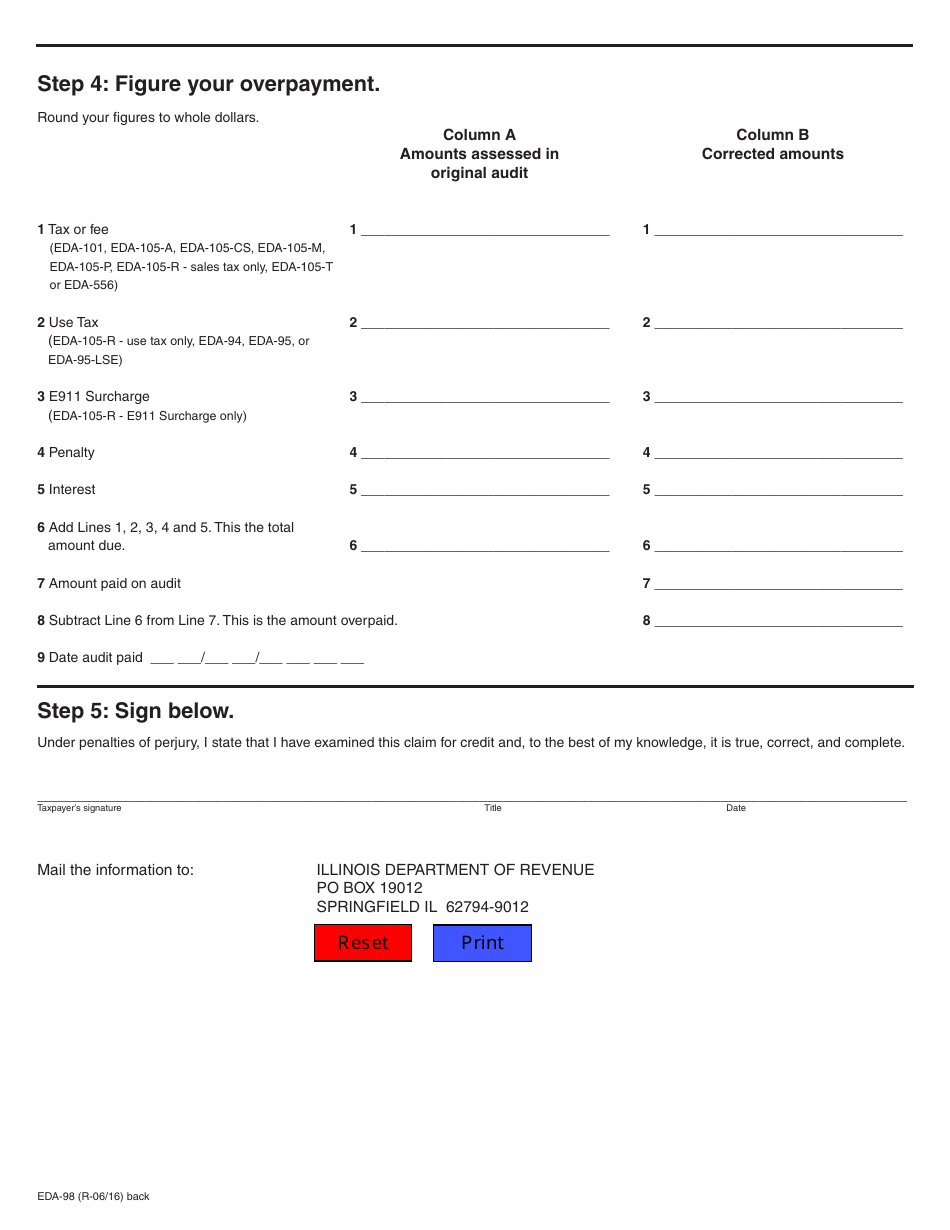

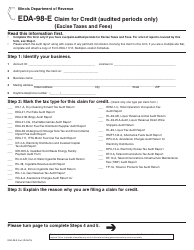

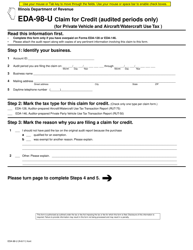

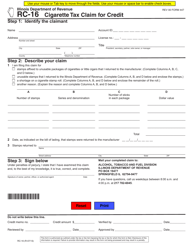

Form EDA-98 Claim for Credit (Audited Periods Only) (Sales and Related Taxes, Fees, and E911 Surcharge) - Illinois

What Is Form EDA-98?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form EDA-98?

A: Form EDA-98 is a claim for credit for sales and related taxes, fees, and E911 surcharge in Illinois.

Q: What does Form EDA-98 cover?

A: Form EDA-98 covers audited periods for claiming credits for sales and related taxes, fees, and E911 surcharge.

Q: Who can use Form EDA-98?

A: Anyone who has audited periods and wants to claim credit for sales and related taxes, fees, and E911 surcharge in Illinois can use Form EDA-98.

Q: What is the purpose of Form EDA-98?

A: The purpose of Form EDA-98 is to allow individuals or businesses to claim credit for sales and related taxes, fees, and E911 surcharge for audited periods in Illinois.

Form Details:

- Released on June 1, 2016;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form EDA-98 by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.