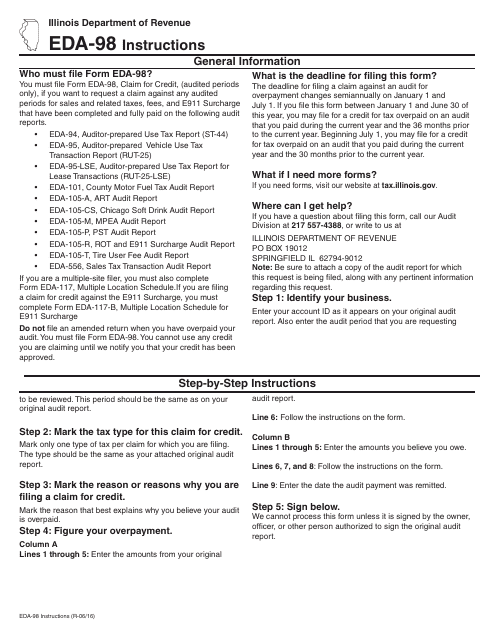

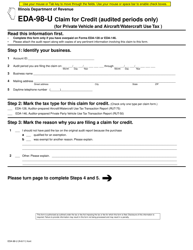

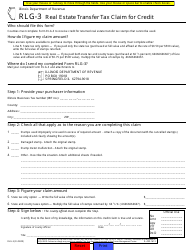

Instructions for Form EDA-98 Claim for Credit (Audited Periods Only) (Sales and Related Taxes, Fees, and E911 Surcharge) - Illinois

This document contains official instructions for Form EDA-98 , Claim for Credit (Audited Periods Only) (Sales and Related Taxes, Fees, and E911 Surcharge) - a form released and collected by the Illinois Department of Revenue. An up-to-date fillable Form EDA-98 is available for download through this link.

FAQ

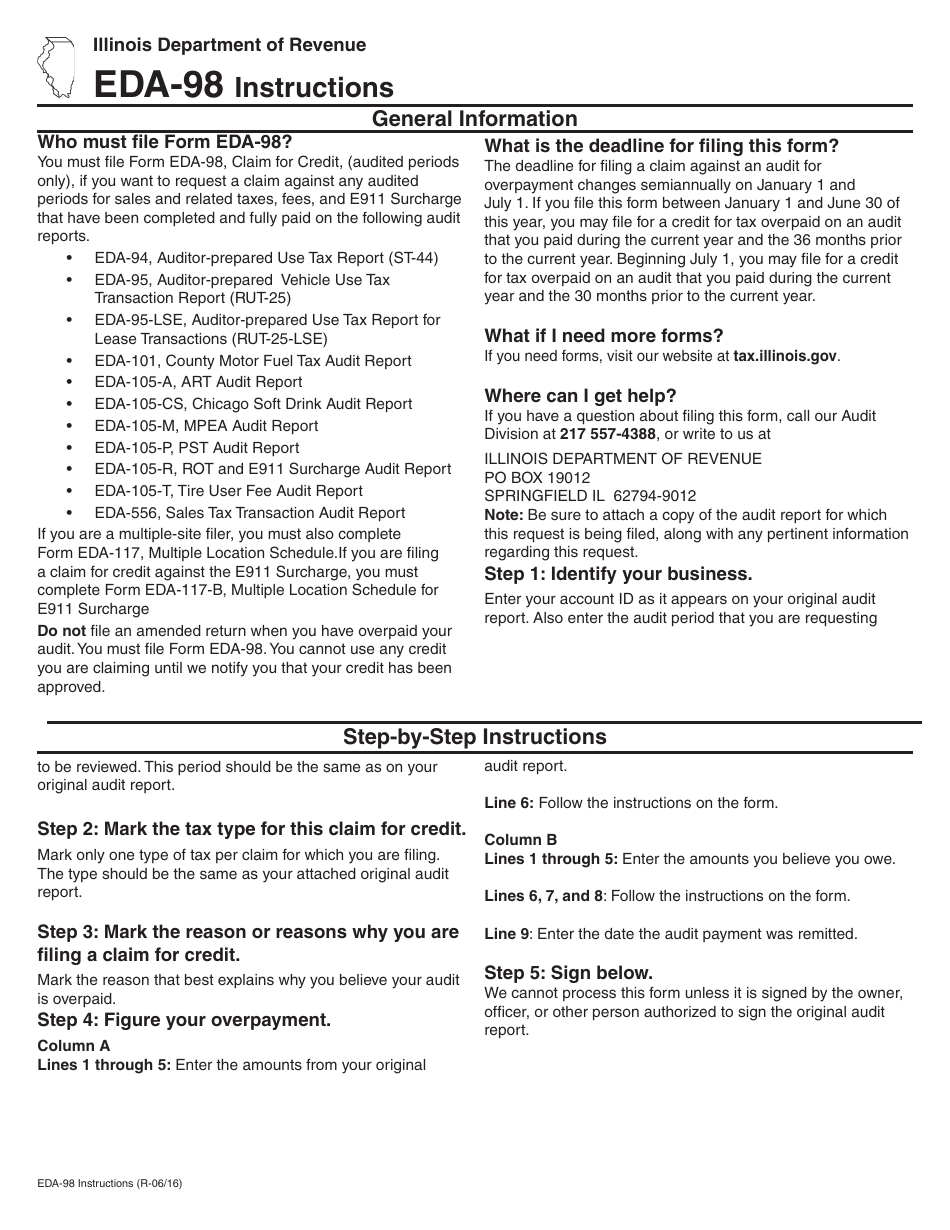

Q: What is Form EDA-98?

A: Form EDA-98 is a claim form for credit for sales and related taxes, fees, and E911 surcharge in Illinois.

Q: Who can use Form EDA-98?

A: Any business or individual who has paid sales and related taxes, fees, and E911 surcharge in Illinois during audited periods can use Form EDA-98.

Q: What is the purpose of Form EDA-98?

A: The purpose of Form EDA-98 is to claim a credit for the sales and related taxes, fees, and E911 surcharge that have been paid during audited periods in Illinois.

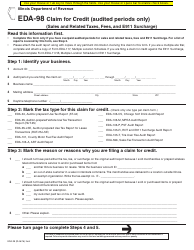

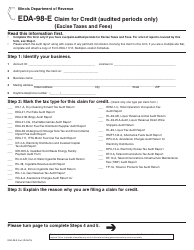

Q: What information do I need to complete Form EDA-98?

A: To complete Form EDA-98, you will need information such as your name, address, taxpayer identification number, and details of the audited periods and the sales and related taxes, fees, and E911 surcharge paid.

Q: Are there any deadlines for filing Form EDA-98?

A: Yes, there are specific deadlines for filing Form EDA-98. It is important to check the instructions provided with the form or consult with the Illinois Department of Revenue for the exact deadlines.

Q: What should I do after completing and filing Form EDA-98?

A: After completing and filing Form EDA-98, you should keep a copy for your records and follow any further instructions provided by the Illinois Department of Revenue.

Q: Can I amend or correct my Form EDA-98 after filing?

A: Yes, you can amend or correct your Form EDA-98 after filing. You will need to submit the amended form along with any necessary supporting documentation.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Illinois Department of Revenue.