Instructions for Form RUT-7-A Rolling Stock Certification for Aircraft, Watercraft, Limousines, and Rail Carrier Items - Illinois

This document contains official instructions for Form RUT-7-A , Rolling Stock Certification for Aircraft, Watercraft, Limousines, and Rail Carrier Items - a form released and collected by the Illinois Department of Revenue. An up-to-date fillable Form RUT-7-A is available for download through this link.

FAQ

Q: What is Form RUT-7-A?

A: Form RUT-7-A is a certification form for rolling stock items in Illinois.

Q: What is the purpose of Form RUT-7-A?

A: The purpose of Form RUT-7-A is to certify aircraft, watercraft, limousines, and rail carrier items as rolling stock.

Q: Who needs to fill out Form RUT-7-A?

A: Individuals or businesses in Illinois who own or lease rolling stock items like aircraft, watercraft, limousines, or rail carrier items need to fill out this form.

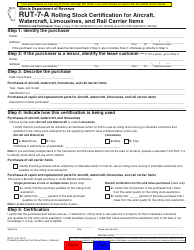

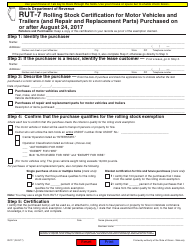

Q: What information do I need to provide on Form RUT-7-A?

A: You will need to provide details about the rolling stock items, including their make, model, identification number, and purchase or lease information.

Q: Are there any fees associated with Form RUT-7-A?

A: Yes, there may be a fee for filing Form RUT-7-A. The fee amount will depend on the value of the rolling stock items.

Q: When is Form RUT-7-A due?

A: Form RUT-7-A is due on or before the date the first quarterly installment payment of Illinois Use Tax is due.

Q: Can I claim a refund if I overpay the Use Tax on rolling stock items?

A: Yes, if you overpay the Use Tax on rolling stock items, you can request a refund by filing an amended return or a refund claim with the Illinois Department of Revenue.

Q: Is there any penalty for not filing or late filing of Form RUT-7-A?

A: Yes, failure to file or late filing of Form RUT-7-A can result in penalties, such as a late filing fee or additional taxes owed.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Illinois Department of Revenue.