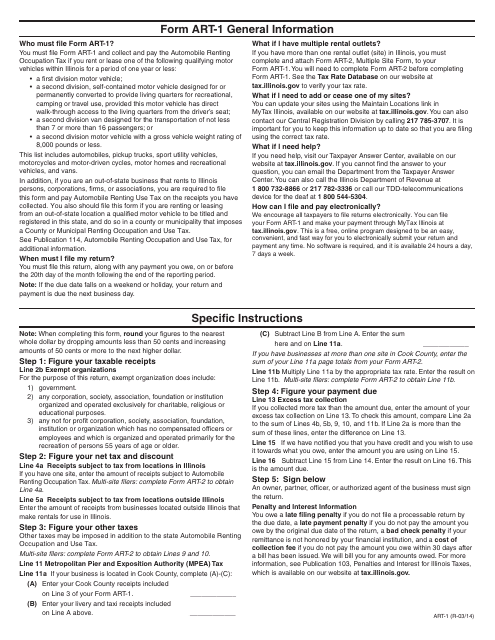

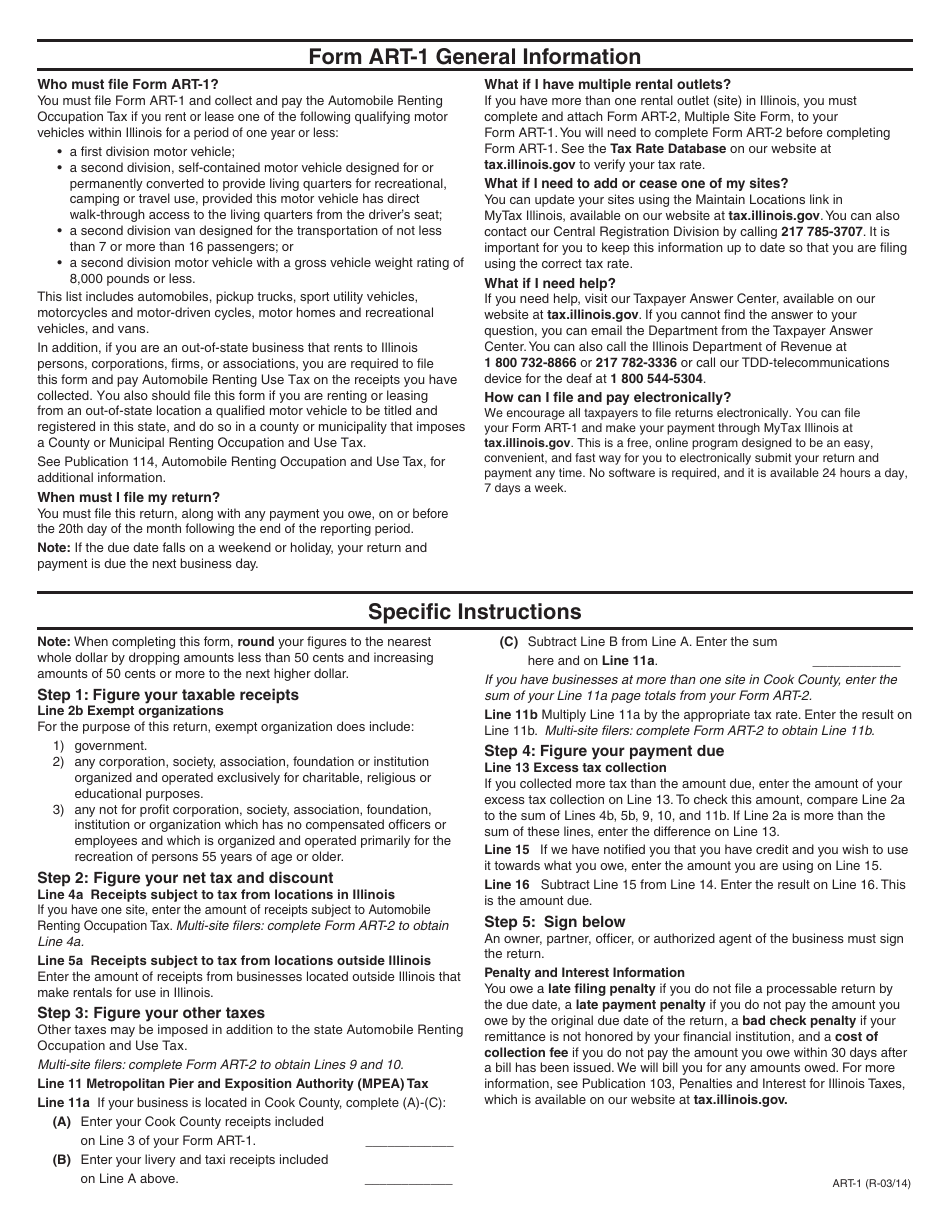

Instructions for Form ART-1 Automobile Renting Occupation and Use Tax Return - Illinois

This document contains official instructions for Form ART-1 , Automobile Renting Occupation and Use Tax Return - a form released and collected by the Illinois Department of Revenue.

FAQ

Q: What is Form ART-1?

A: Form ART-1 is the Automobile Renting Occupation and Use Tax Return for Illinois.

Q: What is the purpose of Form ART-1?

A: Form ART-1 is used to report and pay the Automobile Renting Occupation and Use Tax in Illinois.

Q: Who needs to file Form ART-1?

A: Any person or company engaged in the business of renting or leasing vehicles in Illinois needs to file Form ART-1.

Q: When is Form ART-1 due?

A: Form ART-1 is due on a monthly basis, with the return and payment due by the 20th day of the following month.

Q: What information do I need to complete Form ART-1?

A: You will need information about your rental or leasing activities in Illinois, such as total gross receipts, tax collected, and any exemptions claimed.

Q: Are there any exemptions available for the Automobile Renting Occupation and Use Tax?

A: Yes, there are certain exemptions available, such as rentals to governmental bodies, certain nonprofit organizations, and rentals to employees for business purposes.

Q: What happens if I fail to file or pay the Automobile Renting Occupation and Use Tax?

A: Failure to file or pay the tax can result in penalties, interest, and potential legal consequences, including license suspension.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Illinois Department of Revenue.