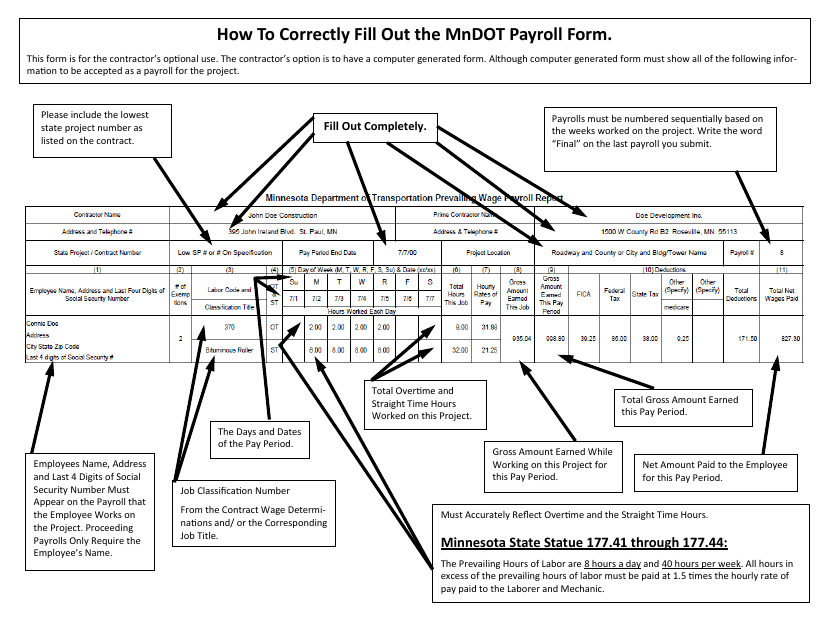

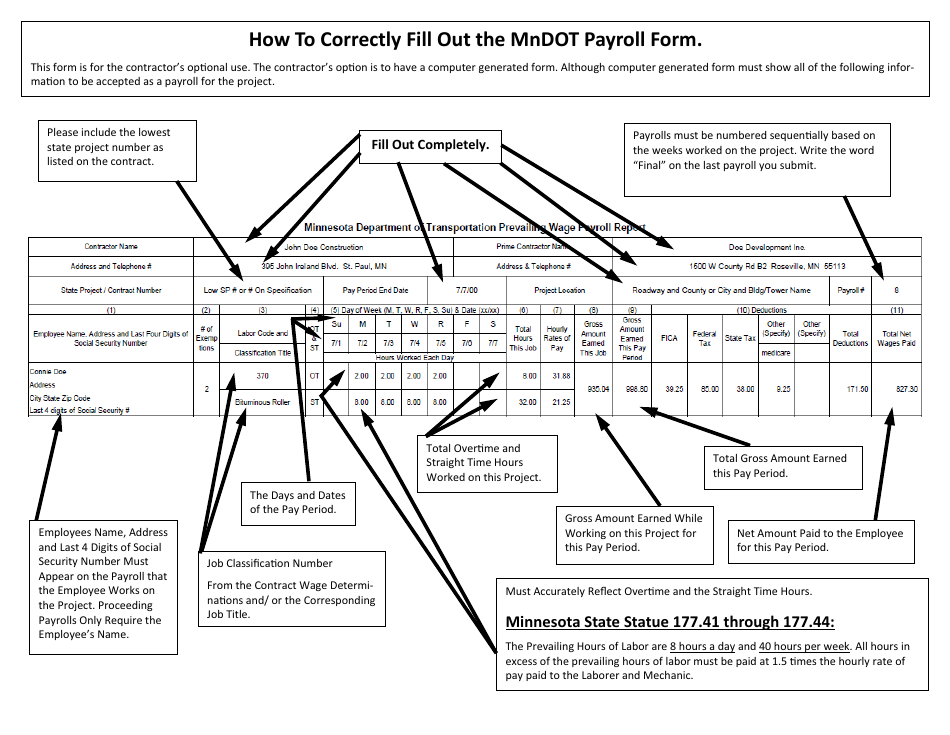

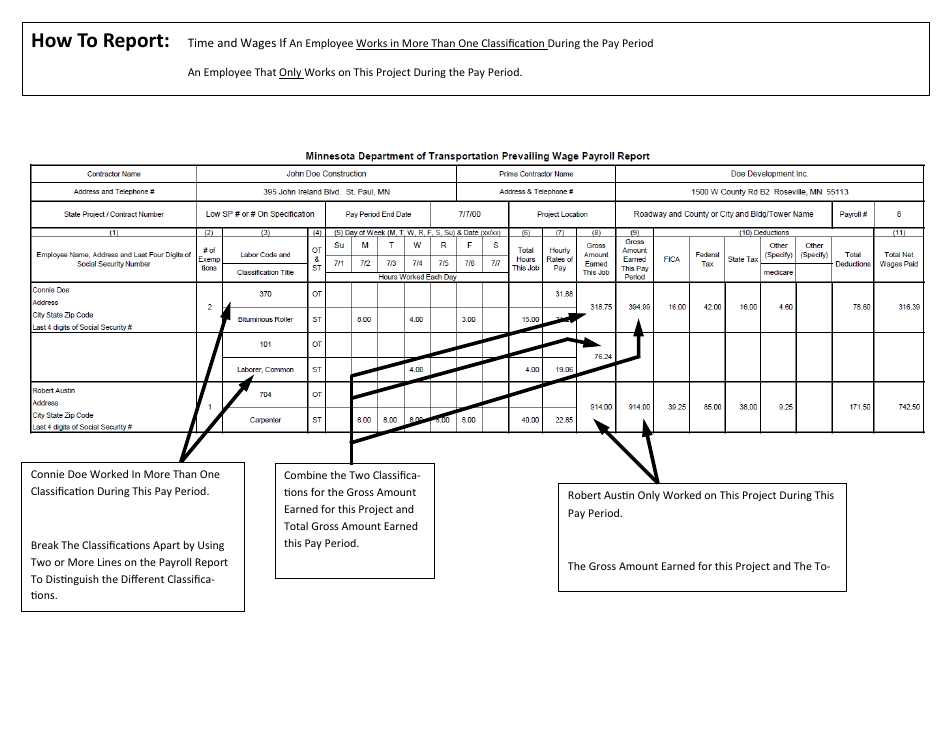

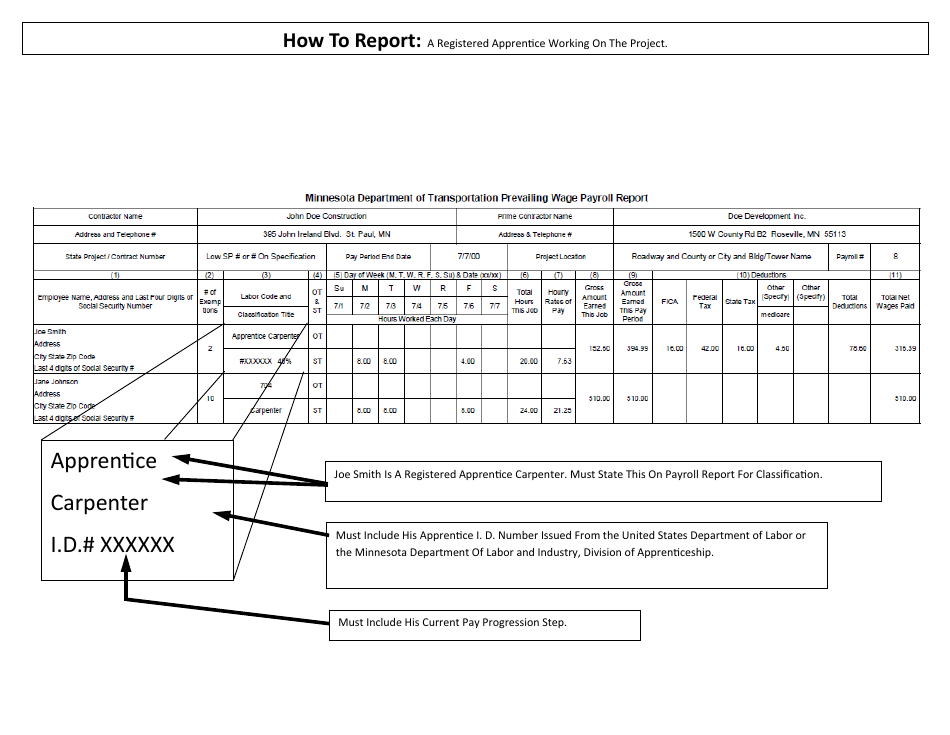

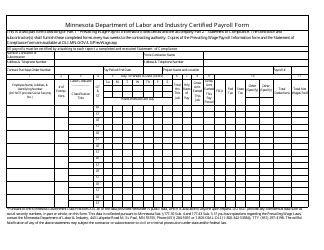

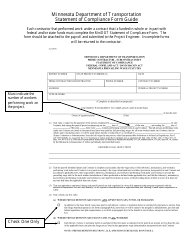

Instructions for Payroll Form - Minnesota

This document was released by Minnesota Department of Transportation and contains the most recent official instructions for Payroll Form .

FAQ

Q: What is the Payroll Form in Minnesota?

A: The Payroll Form in Minnesota is a form used to report wage and tax information for employees.

Q: Who needs to fill out the Payroll Form in Minnesota?

A: Employers in Minnesota need to fill out the Payroll Form for each of their employees.

Q: When is the deadline to submit the Payroll Form in Minnesota?

A: The deadline to submit the Payroll Form in Minnesota is typically on a quarterly basis, by the end of the month following the end of each quarter.

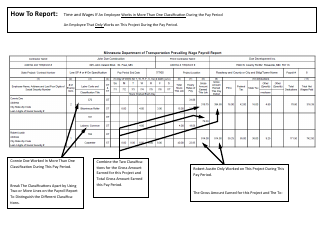

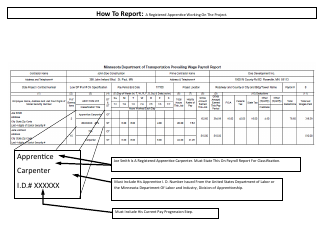

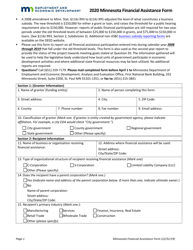

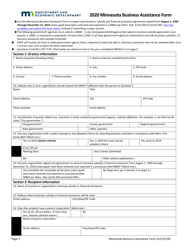

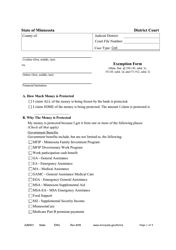

Q: What information is required on the Payroll Form in Minnesota?

A: The Payroll Form in Minnesota requires information such as employee names, Social Security numbers, wages earned, and taxes withheld.

Q: Are there any penalties for not filing the Payroll Form in Minnesota?

A: Yes, there can be penalties for not filing the Payroll Form in Minnesota, such as fines and interest on unpaid taxes.

Instruction Details:

- This 3-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library legal documents released by the Minnesota Department of Transportation.