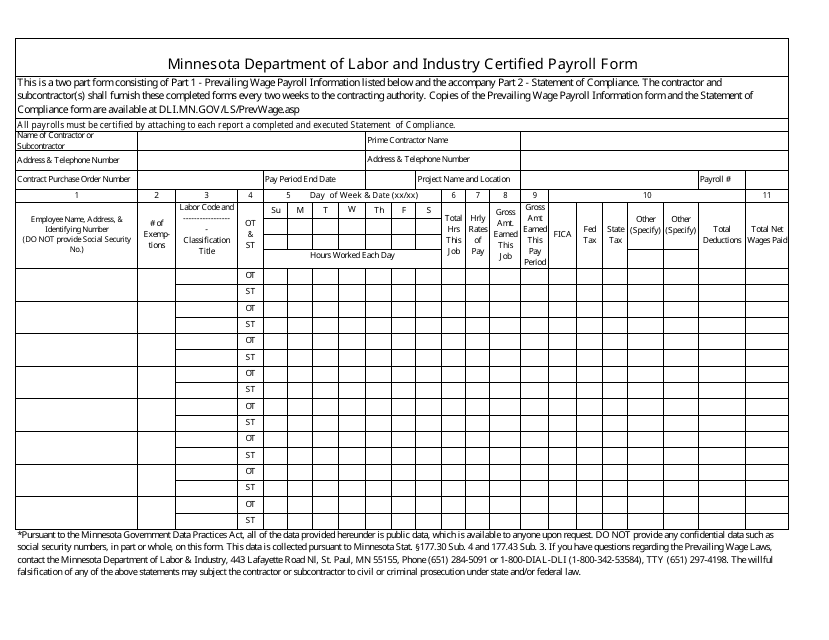

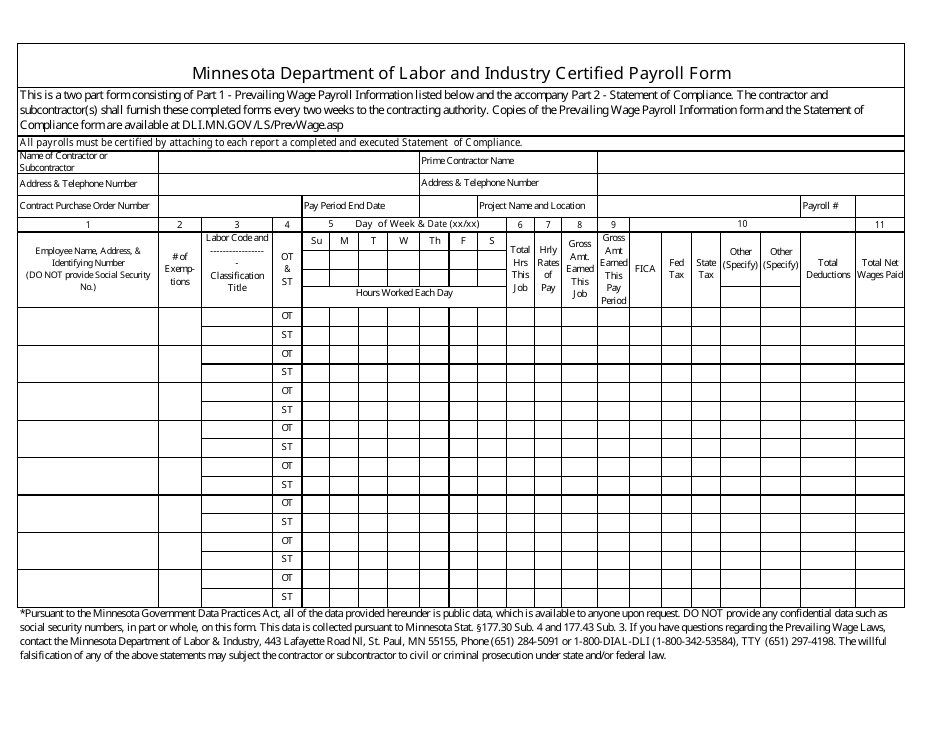

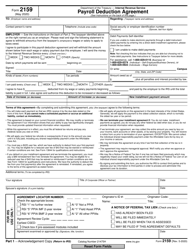

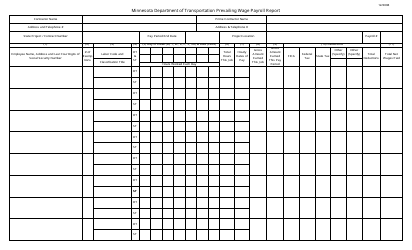

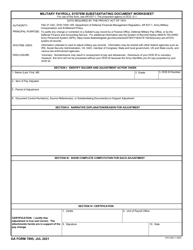

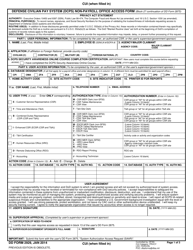

Certified Payroll Form - Minnesota

Certified Payroll Form is a legal document that was released by the Minnesota Department of Labor and Industry - a government authority operating within Minnesota.

FAQ

Q: What is a Certified Payroll Form?

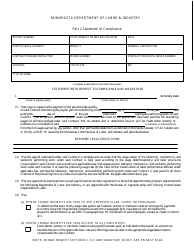

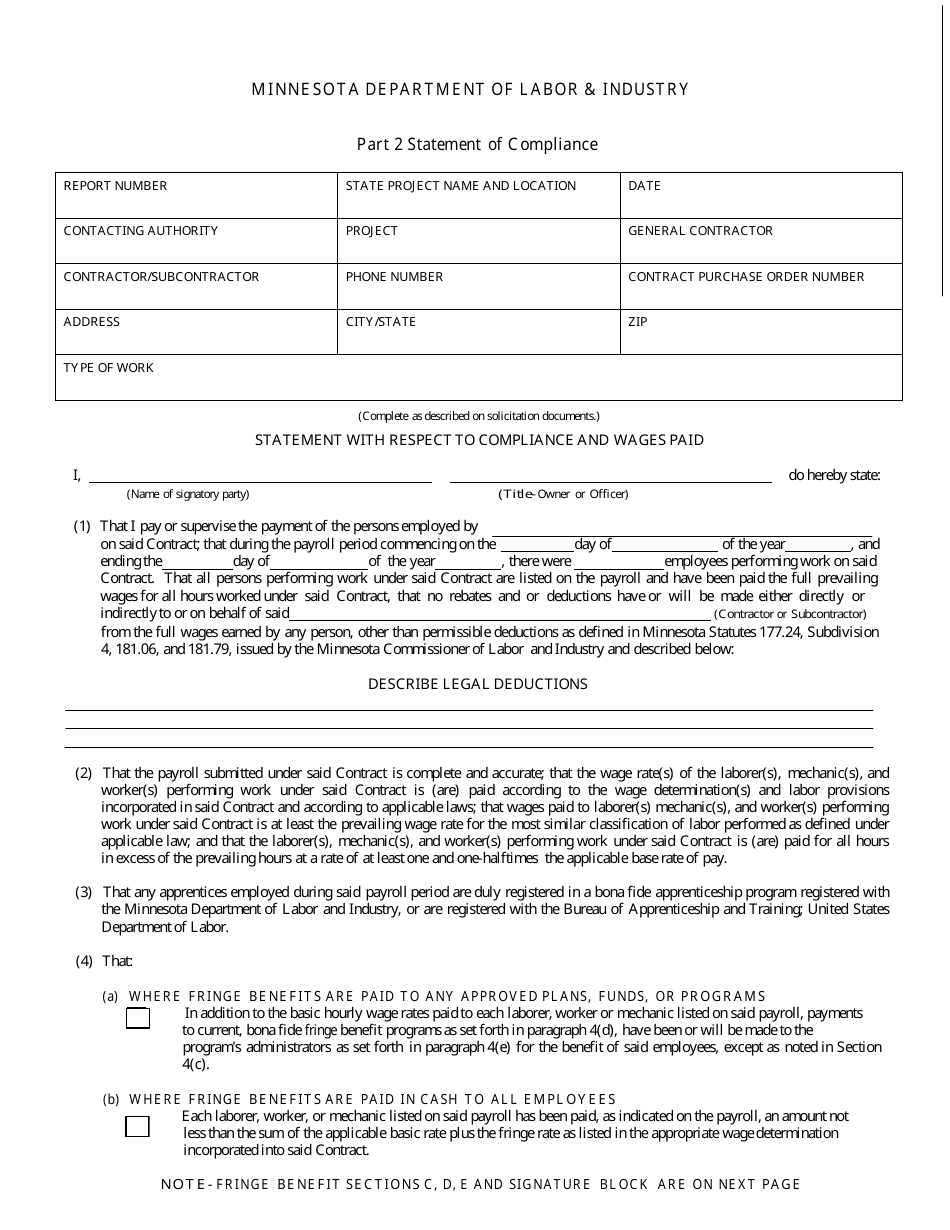

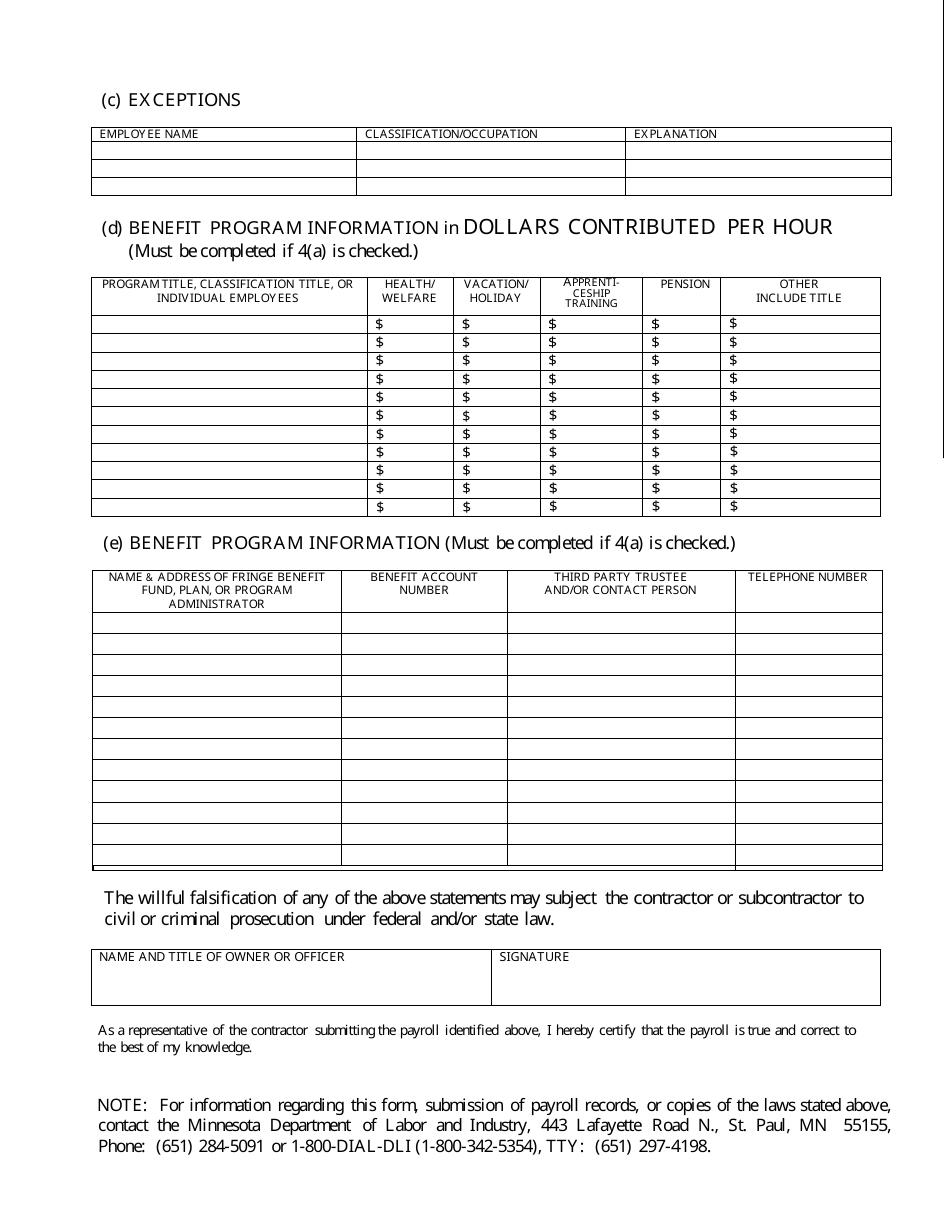

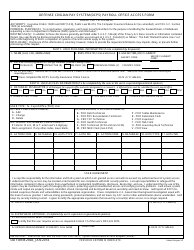

A: A Certified Payroll Form is a document required by the state of Minnesota to track and report wages and benefits paid to workers on public construction projects.

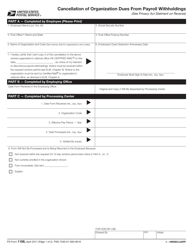

Q: Who needs to submit a Certified Payroll Form in Minnesota?

A: Contractors and subcontractors working on public construction projects in Minnesota are required to submit a Certified Payroll Form.

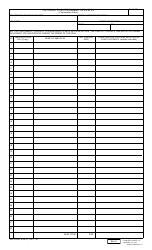

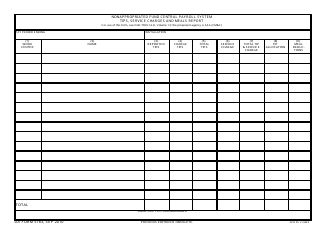

Q: What information is included in a Certified Payroll Form?

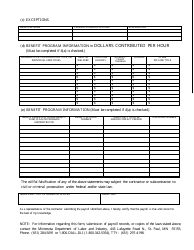

A: A Certified Payroll Form typically includes the names of workers, the hours they worked, their job classifications, wage rates, and any fringe benefits provided.

Q: How often do you need to submit a Certified Payroll Form in Minnesota?

A: The frequency of submitting Certified Payroll Forms in Minnesota can vary depending on the project, but typically they need to be submitted on a weekly basis.

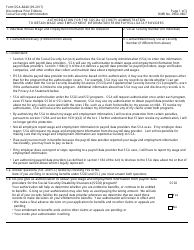

Q: What are the consequences for not submitting a Certified Payroll Form in Minnesota?

A: Failure to submit a Certified Payroll Form in Minnesota can result in penalties, including withholding of payments and potential legal action.

Form Details:

- The latest edition currently provided by the Minnesota Department of Labor and Industry;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Minnesota Department of Labor and Industry.