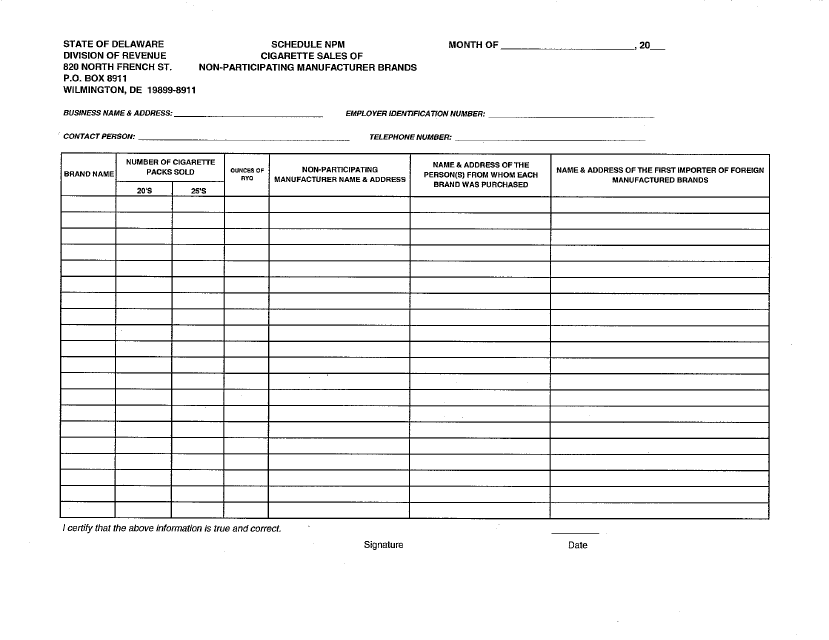

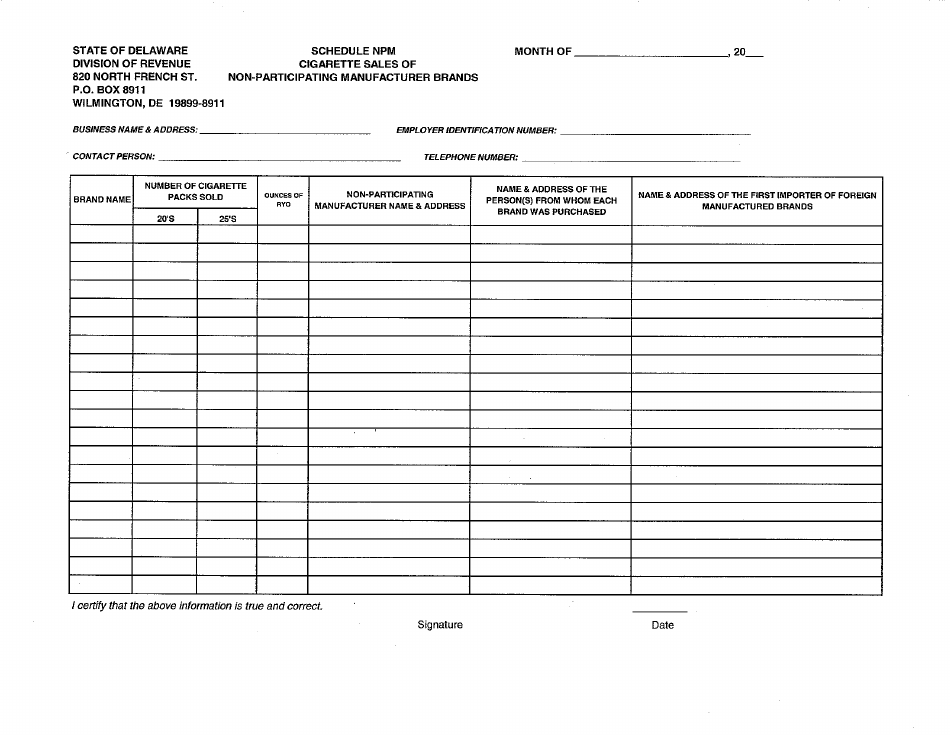

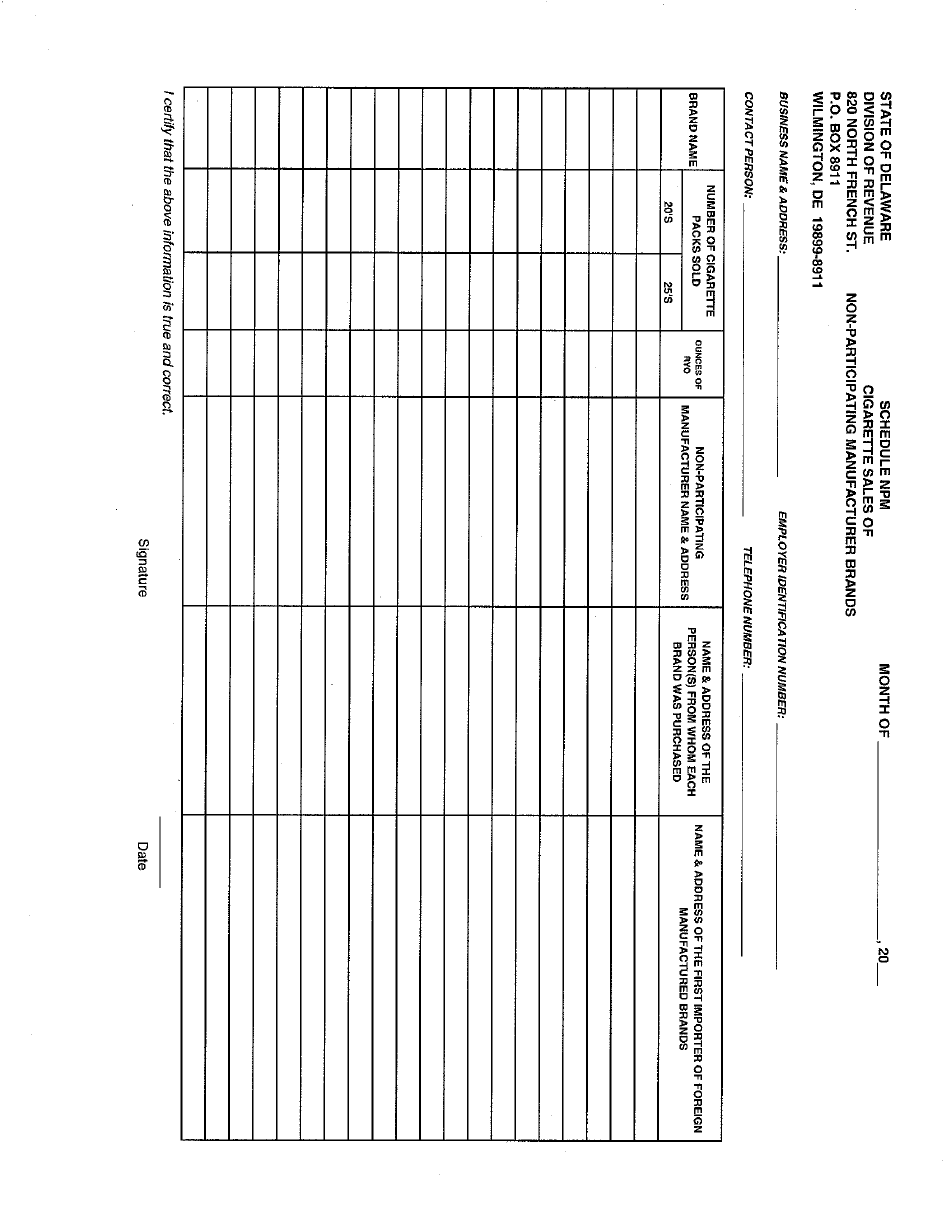

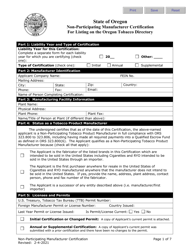

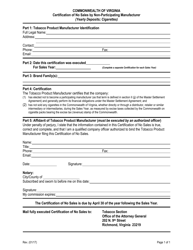

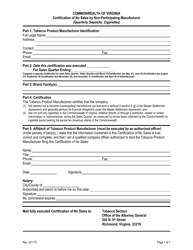

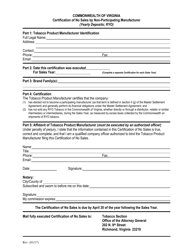

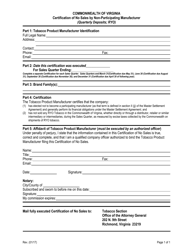

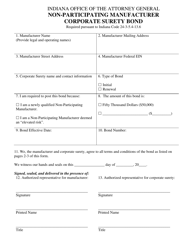

Schedule NPM Cigarette Sales of Non-participating Manufacturer Brands - Delaware

What Is Schedule NPM?

This is a legal form that was released by the Delaware Department of Finance - a government authority operating within Delaware. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule NPM Cigarette Sales?

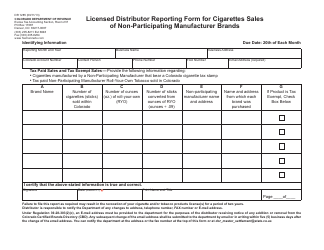

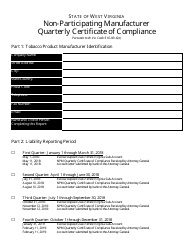

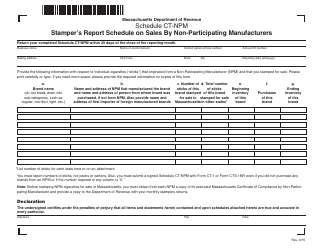

A: Schedule NPM Cigarette Sales refers to the reporting and payment requirements for non-participating manufacturer (NPM) brands of cigarettes sold in Delaware.

Q: What are non-participating manufacturer (NPM) brands?

A: Non-participating manufacturer (NPM) brands refer to cigarette brands that have not signed the Master Settlement Agreement (MSA) with the state of Delaware.

Q: What is the purpose of Schedule NPM Cigarette Sales?

A: The purpose of Schedule NPM Cigarette Sales is to ensure that NPM brands are properly reported and taxed, in accordance with Delaware's laws and regulations.

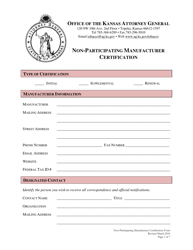

Q: Who needs to file Schedule NPM Cigarette Sales?

A: Any entity or person that sells or distributes NPM brand cigarettes in Delaware is required to file Schedule NPM Cigarette Sales.

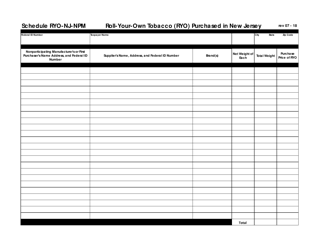

Q: What information needs to be reported on Schedule NPM Cigarette Sales?

A: Schedule NPM Cigarette Sales requires reporting of various information, including sales volume, brand information, and the payment of the required excise tax.

Q: When is Schedule NPM Cigarette Sales due?

A: Schedule NPM Cigarette Sales is due on a monthly basis, with a deadline of the 20th day of the following month.

Form Details:

- The latest edition provided by the Delaware Department of Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Schedule NPM by clicking the link below or browse more documents and templates provided by the Delaware Department of Finance.