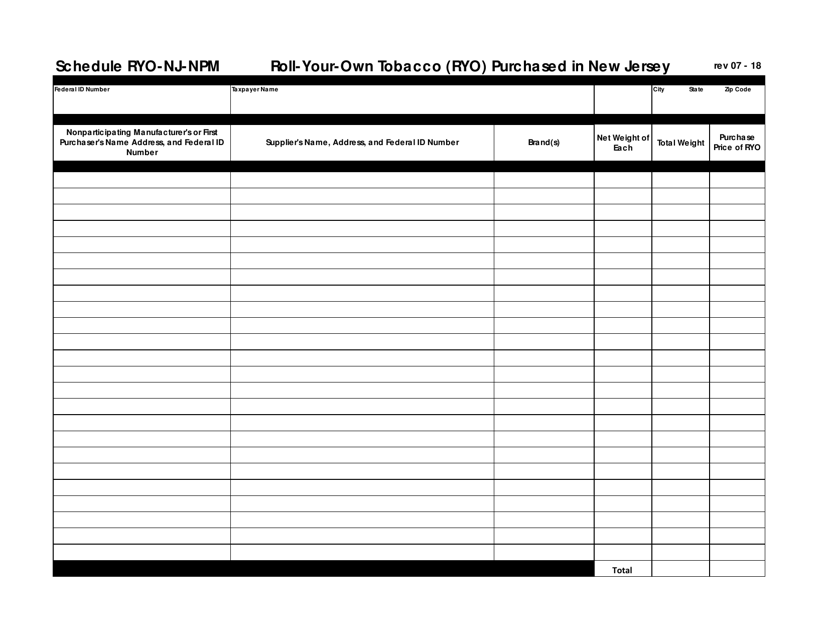

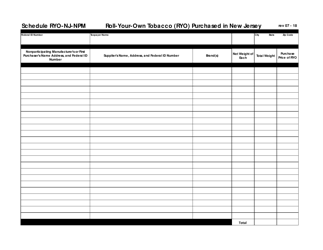

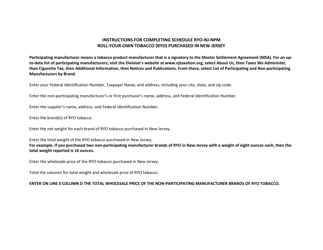

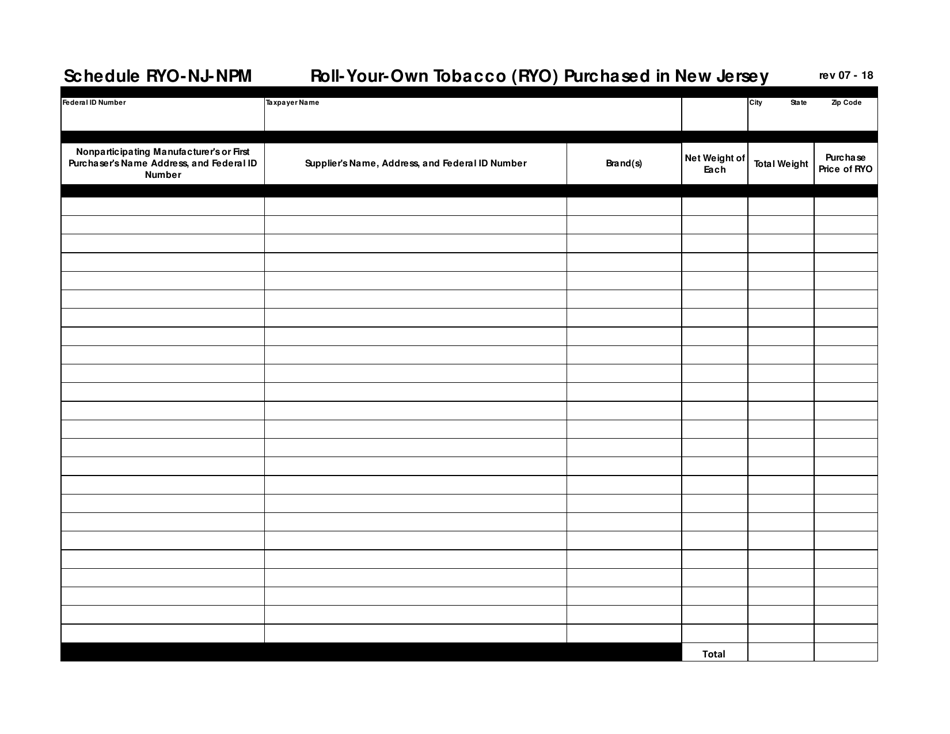

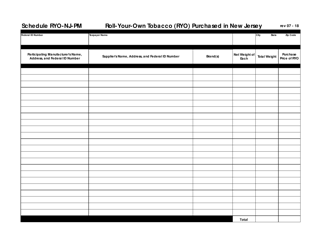

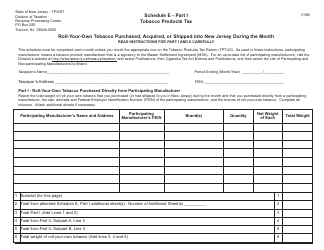

Schedule RYO-NJ-NPM Roll-Your-Own Tobacco (Ryo) Purchased in New Jersey - Non Participating Manufacturer - New Jersey

What Is Schedule RYO-NJ-NPM?

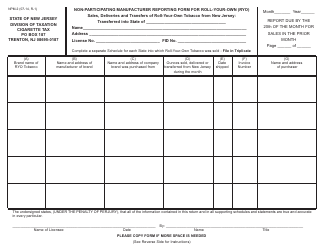

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule RYO-NJ-NPM?

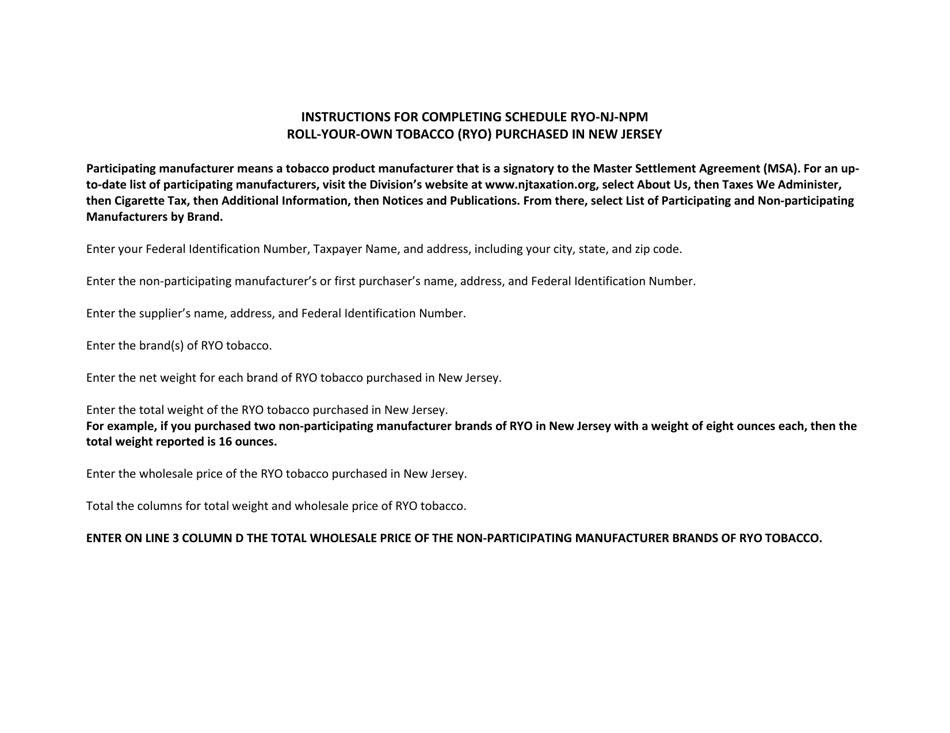

A: Schedule RYO-NJ-NPM refers to the requirements for reporting and paying the tobacco tax on roll-your-own tobacco (RYO) purchased in New Jersey from a non-participating manufacturer (NPM).

Q: What is roll-your-own tobacco?

A: Roll-your-own tobacco refers to loose tobacco that is used to make cigarettes by hand, typically using rolling papers.

Q: What is a non-participating manufacturer?

A: A non-participating manufacturer (NPM) is a tobacco manufacturer that has not entered into the Master Settlement Agreement (MSA) with various U.S. states.

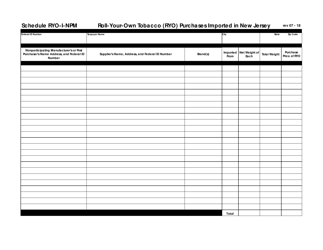

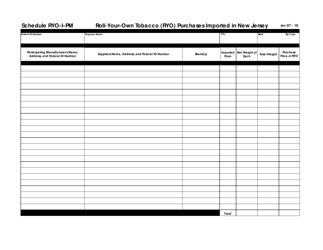

Q: What are the requirements for reporting and paying the tobacco tax on RYO-NJ-NPM?

A: The requirements include reporting the quantity of RYO purchased, the name and address of the retailer, and paying the appropriate tobacco tax to the state of New Jersey.

Q: Why is reporting and paying the tobacco tax on RYO-NJ-NPM important?

A: Reporting and paying the tobacco tax on RYO-NJ-NPM is important to ensure compliance with state laws and regulations, and to contribute to the funding of public health programs and tobacco control initiatives.

Q: Who is responsible for reporting and paying the tobacco tax on RYO-NJ-NPM?

A: The responsibility typically falls on the individual or retailer that purchases roll-your-own tobacco from a non-participating manufacturer in New Jersey.

Q: Are there any penalties for non-compliance with RYO-NJ-NPM requirements?

A: Yes, failure to comply with the reporting and payment requirements may result in penalties, fines, and potential legal consequences.

Form Details:

- Released on July 1, 2018;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule RYO-NJ-NPM by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.