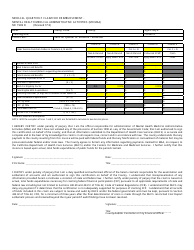

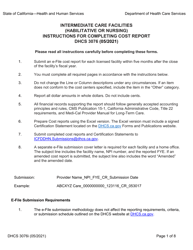

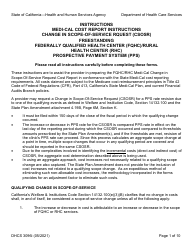

Instructions for Form DHS3095 Medi-Cal Home Office Cost Report - California

This document contains official instructions for Form DHS3095 , Medi-Cal Home Office Cost Report - a form released and collected by the California Department of Health Care Services.

FAQ

Q: What is Form DHS3095?

A: Form DHS3095 is the Medi-Cal Home Office Cost Report for California.

Q: Who is required to file Form DHS3095?

A: Providers of home health care services in California who participate in the Medi-Cal program are required to file Form DHS3095.

Q: What is the purpose of Form DHS3095?

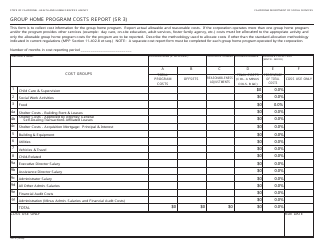

A: The purpose of Form DHS3095 is to report the home office costs incurred by providers of home health care services in California.

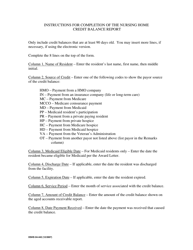

Q: What information is required on Form DHS3095?

A: Form DHS3095 requires providers to report various expenses related to their home office, such as rent, utilities, and administrative costs.

Q: When is Form DHS3095 due?

A: Form DHS3095 is due within 120 days after the close of the provider's fiscal year.

Q: Are there any penalties for late filing of Form DHS3095?

A: Yes, providers may be subject to penalties for late filing of Form DHS3095, including the potential loss of reimbursement for the home office costs.

Q: Can I request an extension to file Form DHS3095?

A: Yes, providers can request an extension to file Form DHS3095, but it must be submitted in writing to the DHCS.

Q: Who should I contact for assistance with Form DHS3095?

A: For assistance with Form DHS3095, providers can contact the DHCS directly or consult with a certified public accountant (CPA) experienced in Medi-Cal reporting requirements.

Instruction Details:

- This 8-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the California Department of Health Care Services.