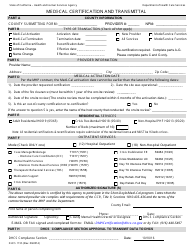

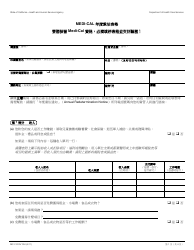

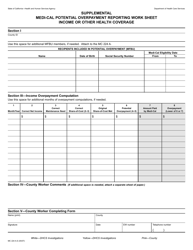

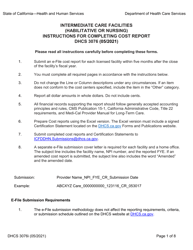

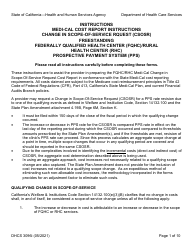

Instructions for Form DHS3092 Medi-Cal Supplemental Cost Report - California

This document contains official instructions for Form DHS3092 , Medi-Cal Supplemental Cost Report - a form released and collected by the California Department of Health Care Services.

FAQ

Q: What is Form DHS3092?

A: Form DHS3092 is the Medi-Cal Supplemental Cost Report for California.

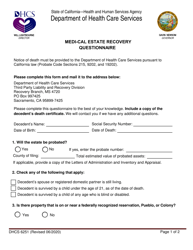

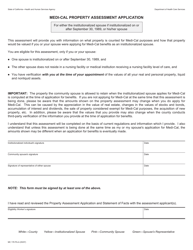

Q: Who should use Form DHS3092?

A: This form should be used by medical providers in California who provide services under the Medi-Cal program.

Q: What is the purpose of Form DHS3092?

A: The purpose of Form DHS3092 is to document the costs incurred by medical providers and submit them to the California Department of Health Care Services.

Q: When should Form DHS3092 be filed?

A: Form DHS3092 should be filed annually, within 120 days after the close of the provider's fiscal year.

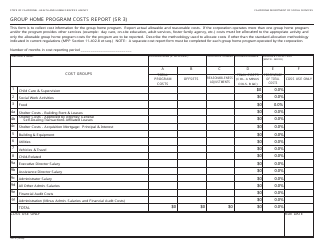

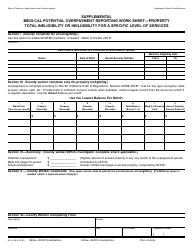

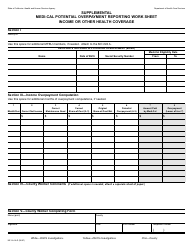

Q: What information is required on Form DHS3092?

A: Form DHS3092 requires information about the provider's financial statements, costs, revenues, and other relevant financial data.

Q: Is there a deadline for filing Form DHS3092?

A: Yes, Form DHS3092 must be filed within 120 days after the close of the provider's fiscal year.

Q: What happens if Form DHS3092 is not filed on time?

A: Failure to file Form DHS3092 on time may result in penalties or the loss of reimbursement for Medi-Cal services.

Instruction Details:

- This 7-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the California Department of Health Care Services.