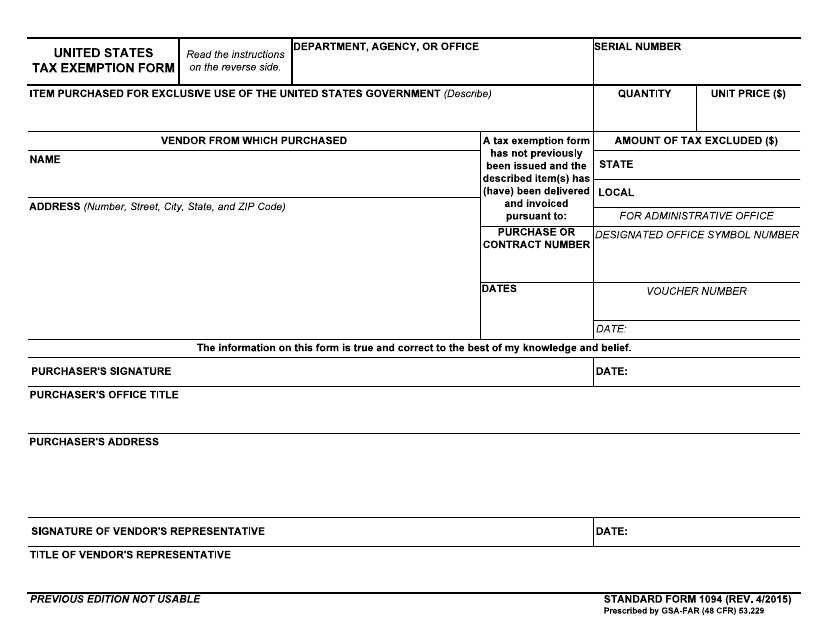

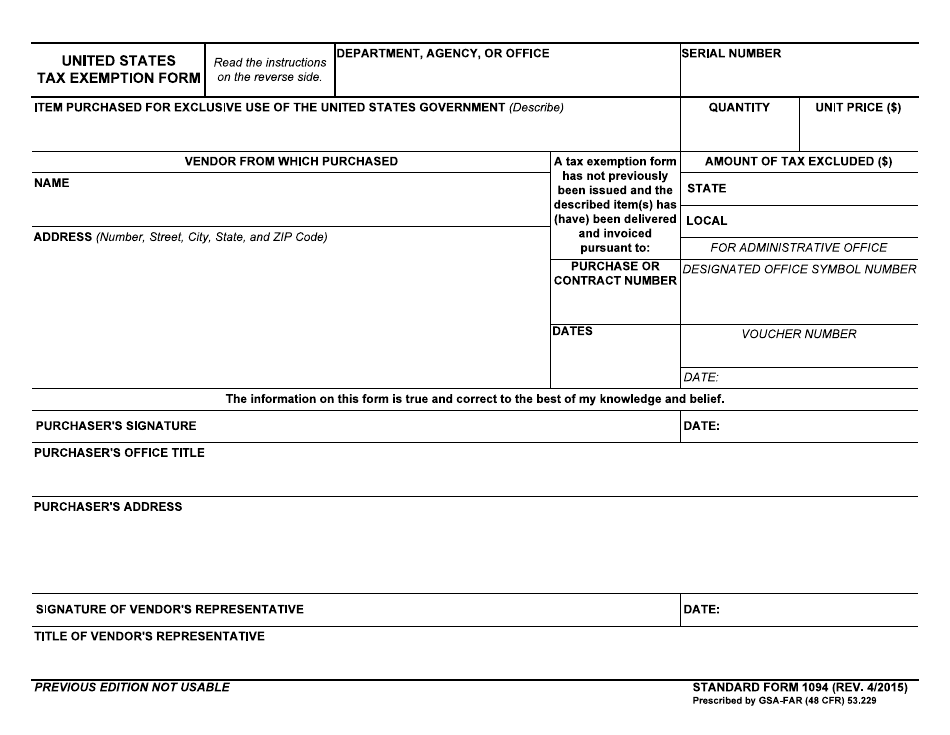

Form SF-1094 United States Tax Exemption Form

What Is Form SF-1094?

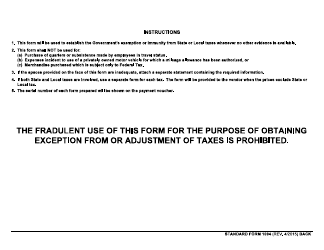

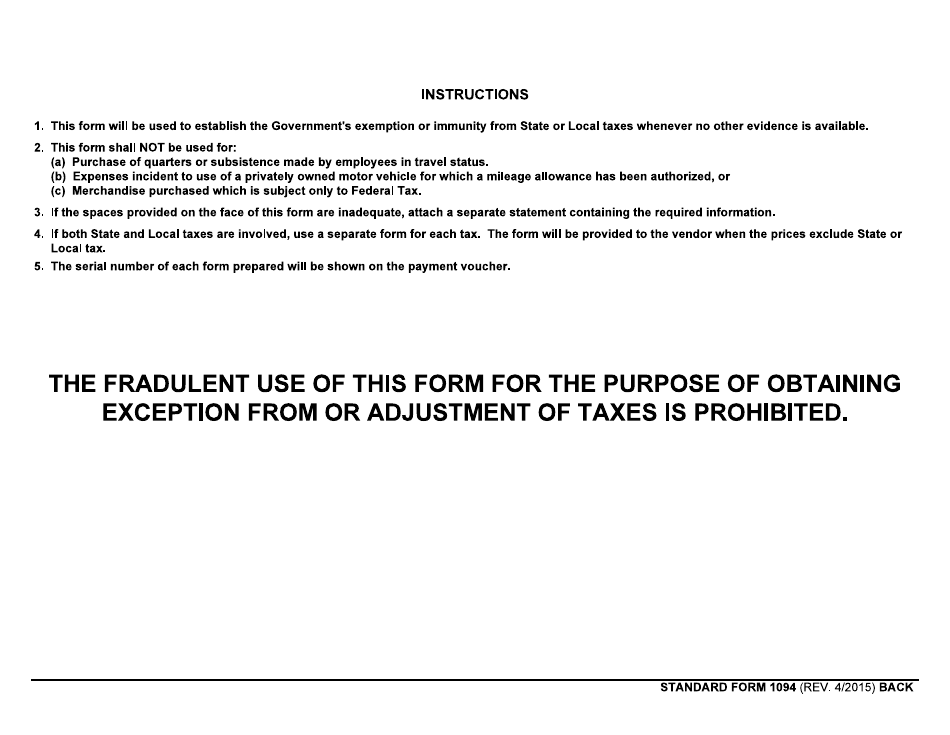

This is a legal form that was released by the U.S. General Services Administration on April 1, 2015 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form SF-1094?

A: Form SF-1094 is the United States Tax Exemption Form.

Q: Who needs to fill out Form SF-1094?

A: Form SF-1094 needs to be filled out by individuals or organizations seeking tax exemption in the United States.

Q: What is the purpose of Form SF-1094?

A: The purpose of Form SF-1094 is to apply for tax exemption status.

Q: What information is required on Form SF-1094?

A: Form SF-1094 requires information such as the applicant's name, contact information, tax identification number, and a detailed explanation of the basis for seeking tax exemption.

Q: Is there a deadline for submitting Form SF-1094?

A: The deadline for submitting Form SF-1094 varies depending on the type of tax exemption being sought. It is advisable to check the instructions provided with the form or consult with a tax professional.

Q: Are there any fees associated with filing Form SF-1094?

A: There are no fees associated with filing Form SF-1094.

Q: What should I do after submitting Form SF-1094?

A: After submitting Form SF-1094, you should keep a copy for your records and wait for a response from the IRS regarding your tax exemption status.

Q: Can I submit Form SF-1094 electronically?

A: No, Form SF-1094 cannot be submitted electronically. It must be filled out manually and sent by mail to the designated IRS address.

Form Details:

- Released on April 1, 2015;

- The latest available edition released by the U.S. General Services Administration;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SF-1094 by clicking the link below or browse more documents and templates provided by the U.S. General Services Administration.