This version of the form is not currently in use and is provided for reference only. Download this version of

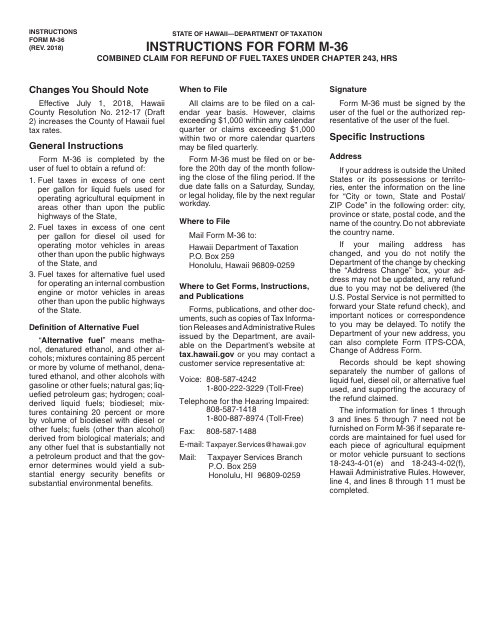

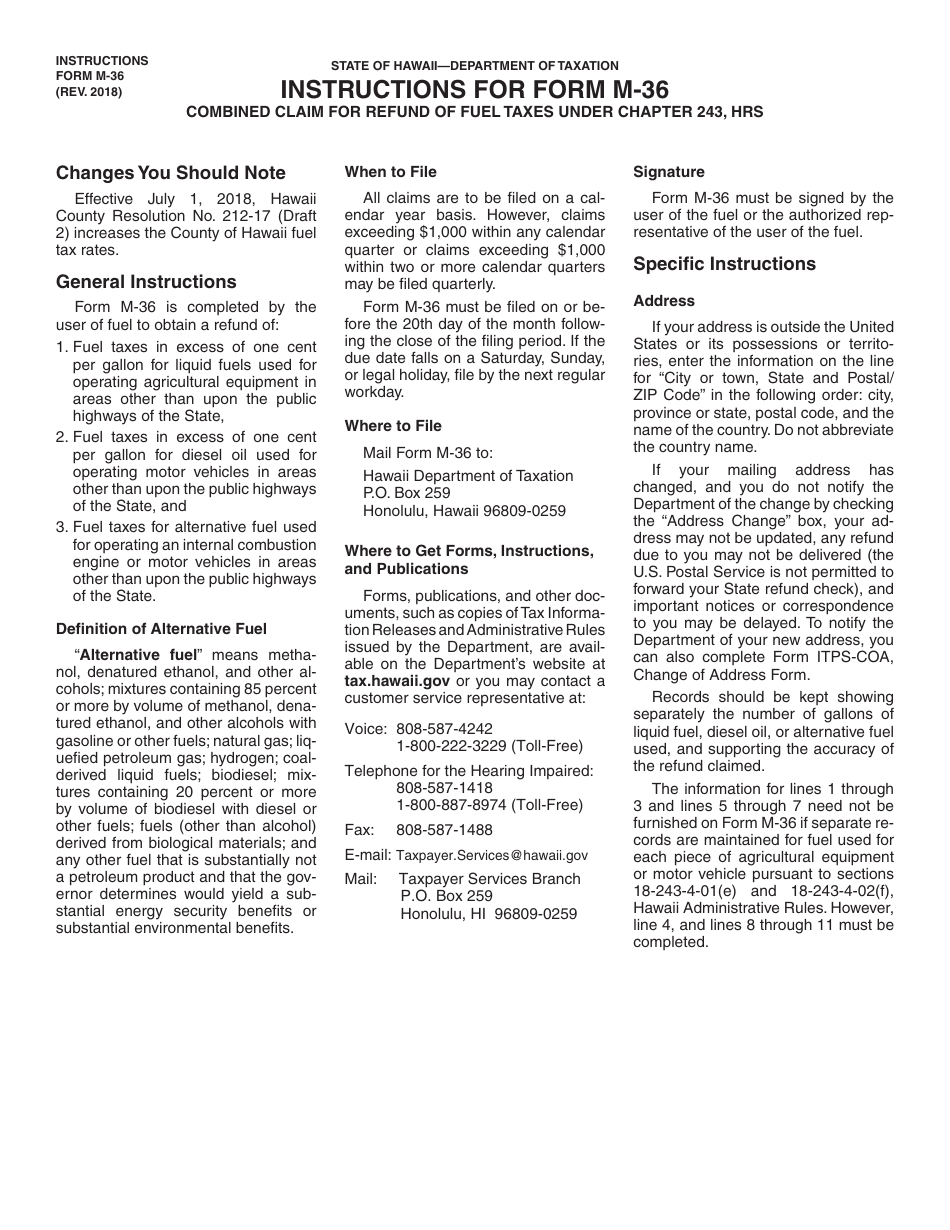

Instructions for Form M-36

for the current year.

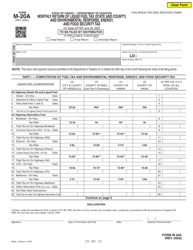

Instructions for Form M-36 Combined Claim for Refund of Fuel Taxes Under Chapter 243, Hrs - Hawaii

This document contains official instructions for Form M-36 , Combined Claim for Refund of Fuel Taxes Under Chapter 243, Hrs - a form released and collected by the Hawaii Department of Taxation. An up-to-date fillable Form M-36 is available for download through this link.

FAQ

Q: What is Form M-36?

A: Form M-36 is a form used for claiming a refund of fuel taxes in Hawaii.

Q: What is Chapter 243, Hrs - Hawaii?

A: Chapter 243, Hrs - Hawaii refers to the specific section of Hawaii Revised Statutes that deals with fuel taxes.

Q: Who can use Form M-36?

A: Form M-36 can be used by individuals or businesses who want to claim a refund of fuel taxes in Hawaii.

Q: What kind of fuel taxes can be refunded with Form M-36?

A: Form M-36 can be used to claim a refund of taxes paid on gasoline, diesel fuel, or other taxable fuels in Hawaii.

Q: What information is required to complete Form M-36?

A: Form M-36 requires information such as the amount of fuel purchased, the amount of fuel used in nontaxable activities, and supporting documentation for the claim.

Q: What is the deadline for filing Form M-36?

A: Form M-36 must be filed within 3 years from the date the fuel taxes were paid or the due date of the return, whichever is later.

Q: How long does it take to process a refund claim with Form M-36?

A: Processing time for refund claims with Form M-36 can vary, but it typically takes several weeks to several months.

Q: Are there any penalties for filing an incorrect or fraudulent Form M-36?

A: Yes, penalties may apply for filing an incorrect or fraudulent Form M-36, including fines and potential criminal charges.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Hawaii Department of Taxation.