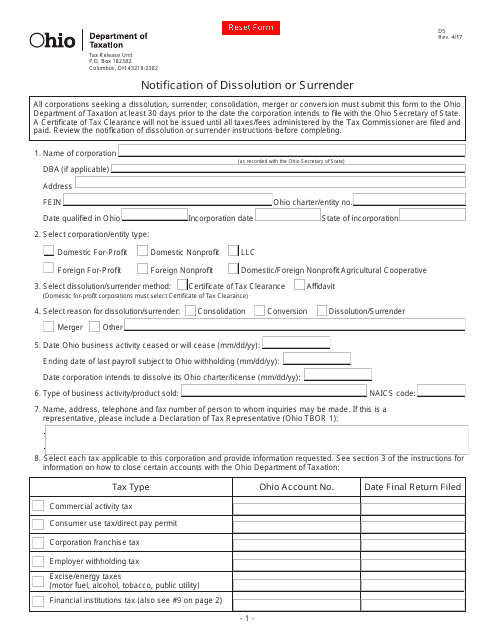

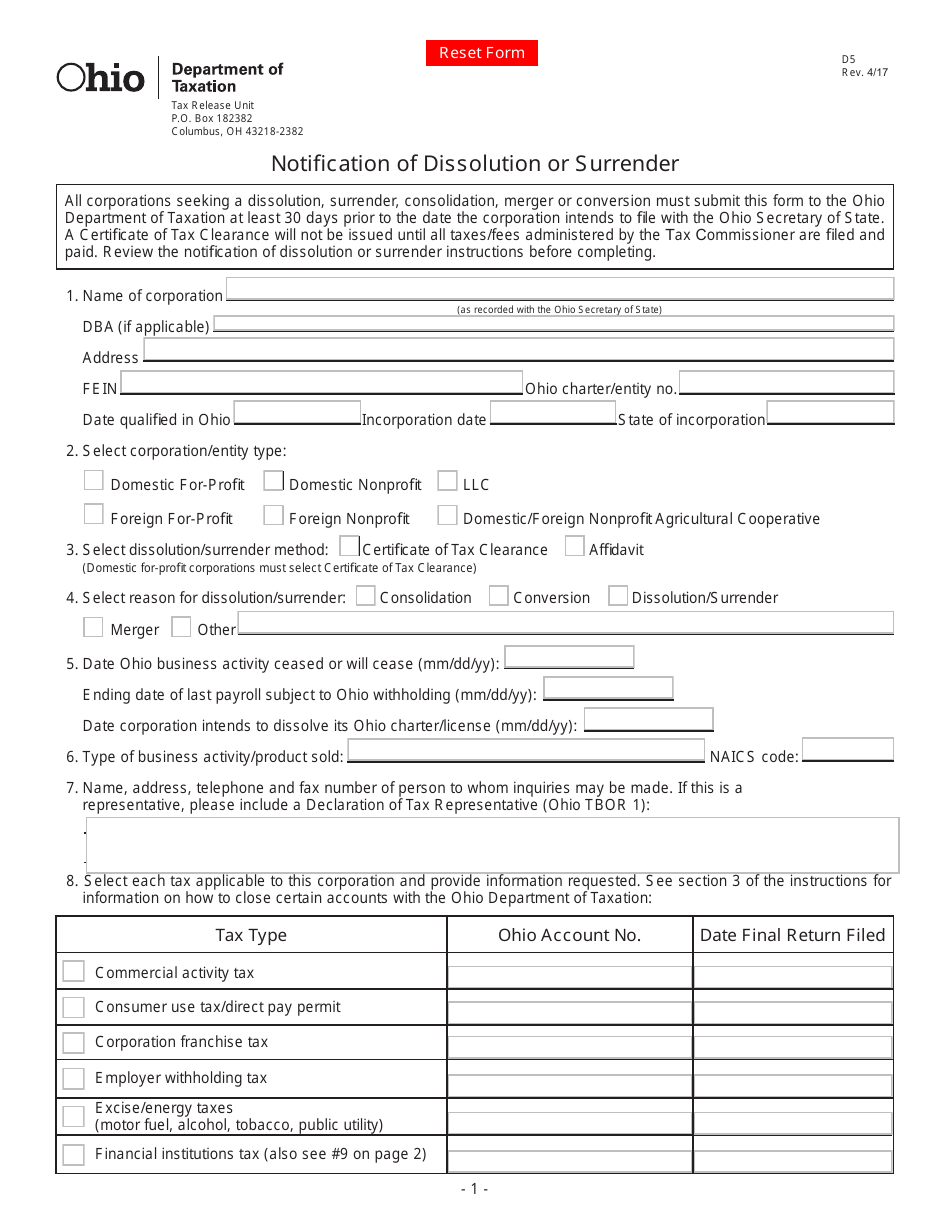

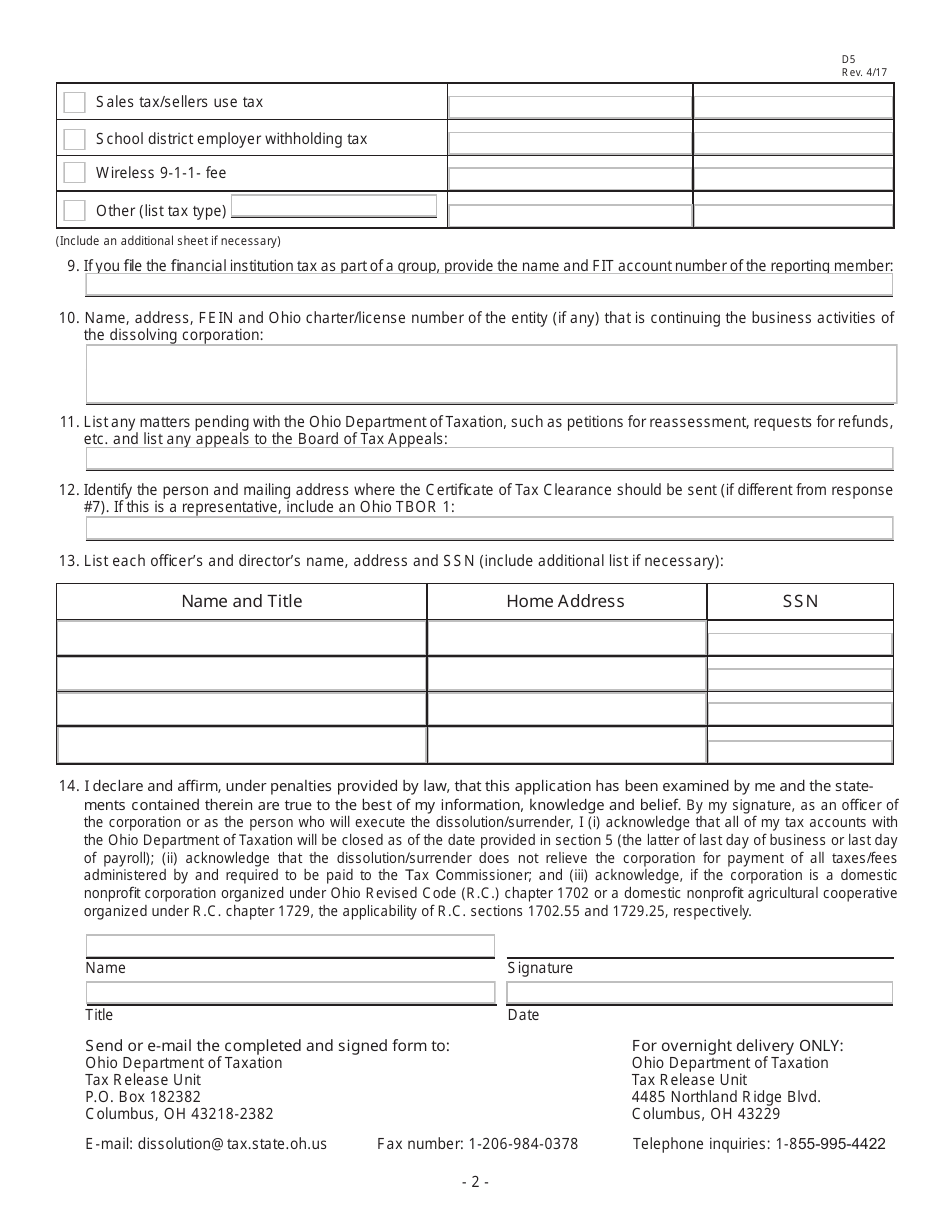

Form D5 Notification of Dissolution or Surrender - Ohio

What Is Form D5?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form D5?

A: Form D5 is a notification form for the dissolution or surrender of a business entity in Ohio.

Q: Who needs to file Form D5?

A: Business entities in Ohio that are seeking to dissolve or surrender their operations need to file Form D5.

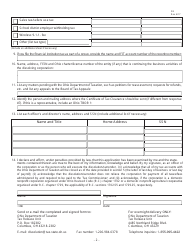

Q: What information is required on Form D5?

A: Form D5 requires information such as the name of the business entity, the reason for dissolution or surrender, and the signature of an authorized representative.

Q: What is the filing fee for Form D5?

A: The filing fee for Form D5 is $50.

Q: What happens after Form D5 is filed?

A: After Form D5 is filed and the filing fee is paid, the business entity will be officially dissolved or surrendered.

Form Details:

- Released on April 1, 2017;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form D5 by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.