This version of the form is not currently in use and is provided for reference only. Download this version of

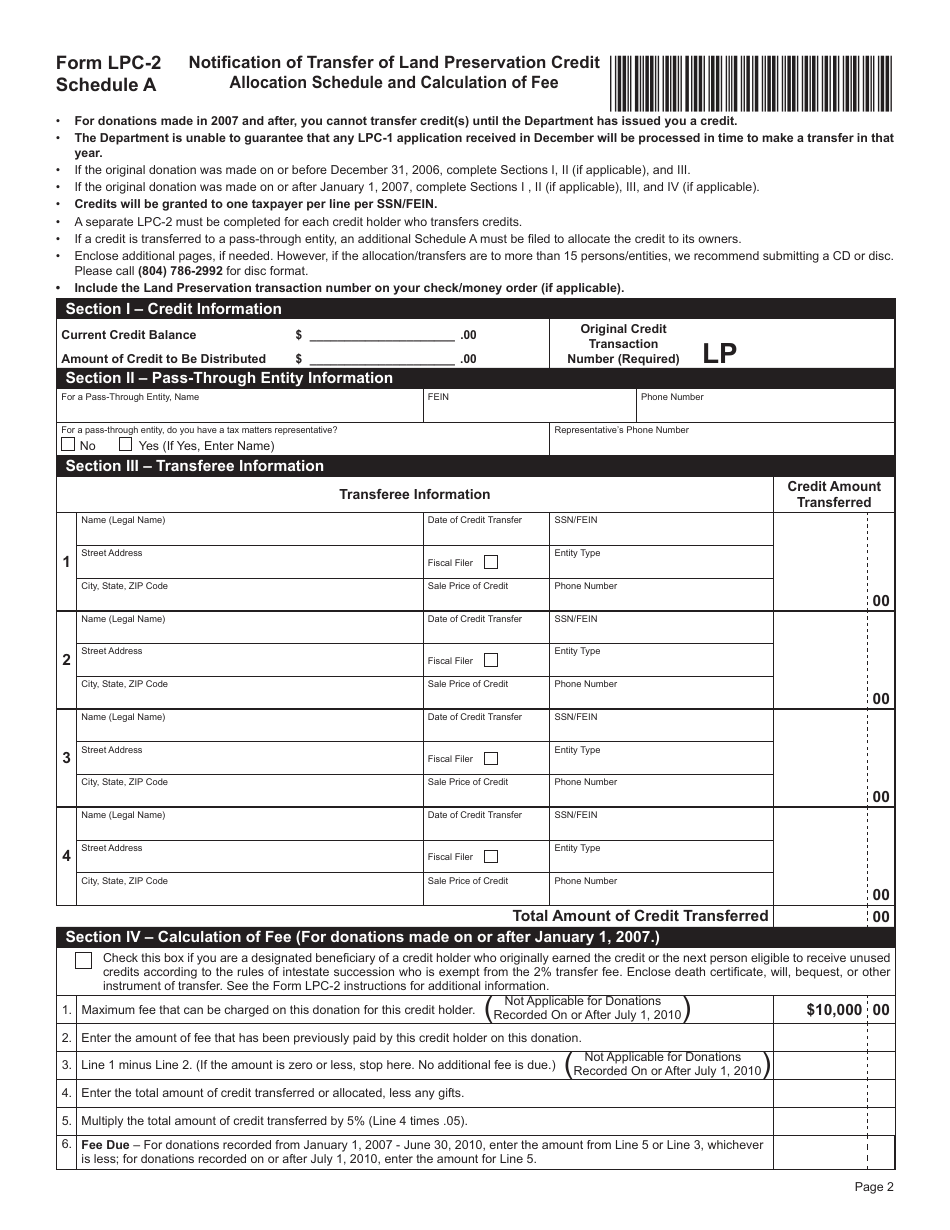

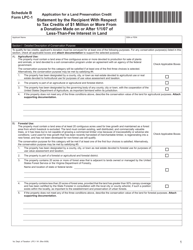

Form LPC-2

for the current year.

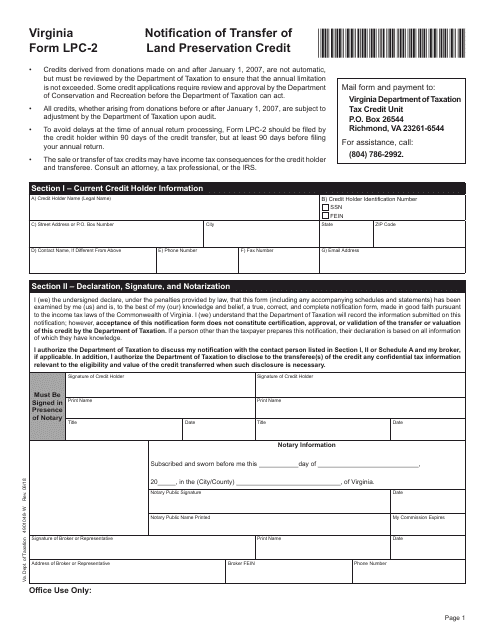

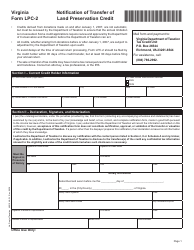

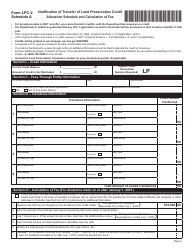

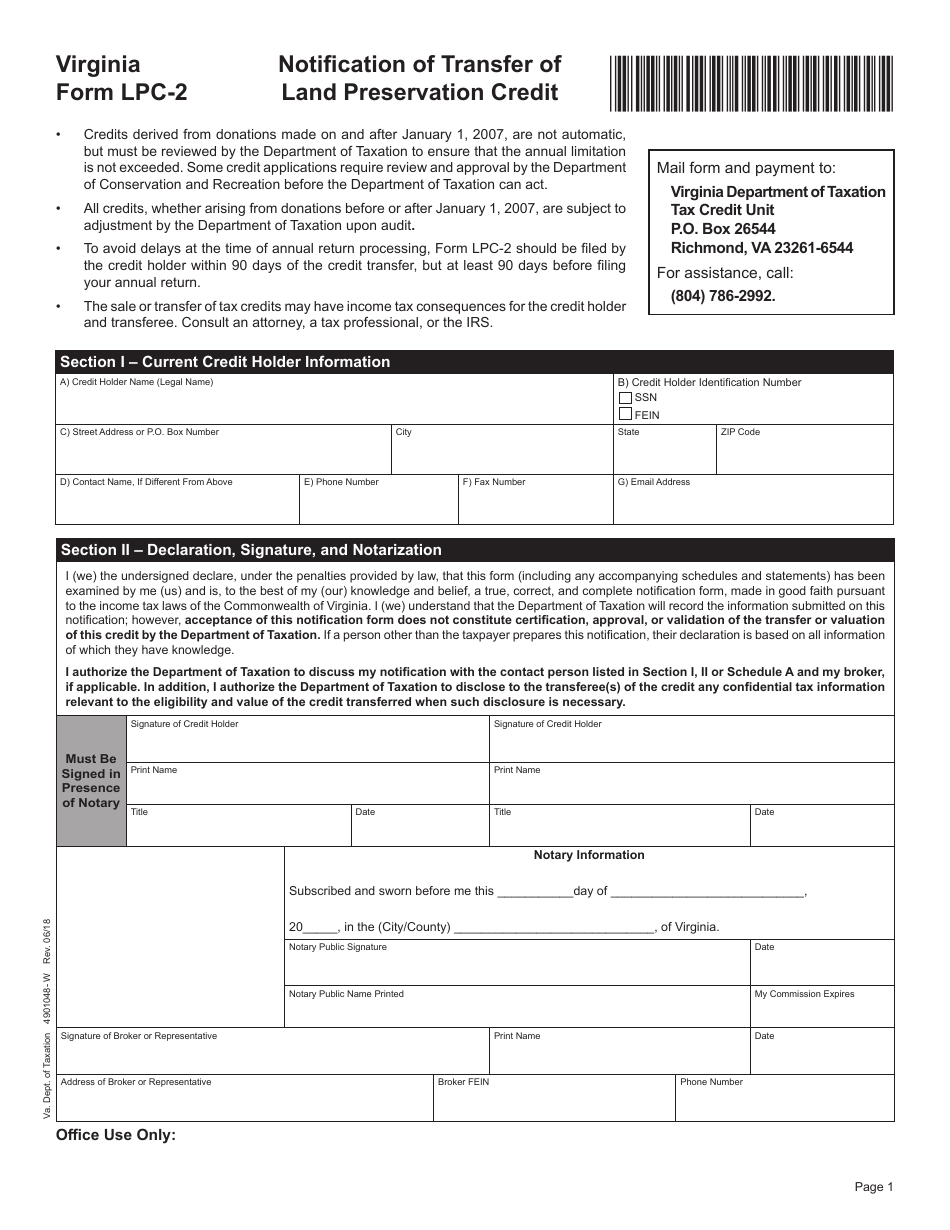

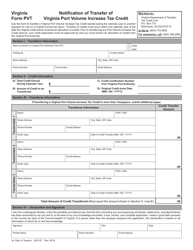

Form LPC-2 Notification of Transfer of Land Preservation Credit - Virginia

What Is Form LPC-2?

This is a legal form that was released by the Virginia Department of Taxation - a government authority operating within Virginia. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form LPC-2?

A: Form LPC-2 is the Notification of Transfer of Land Preservation Credit in Virginia.

Q: What is a Land Preservation Credit?

A: A Land Preservation Credit is a credit that can be used to offset a portion of the taxes due on real property in Virginia.

Q: Why would I need to file Form LPC-2?

A: You would need to file Form LPC-2 if you have transferred a Land Preservation Credit to another individual or entity.

Q: Who needs to file Form LPC-2?

A: The transferor of the Land Preservation Credit needs to file Form LPC-2.

Q: When is the deadline to file Form LPC-2?

A: Form LPC-2 must be filed within 30 days of the transfer of the Land Preservation Credit.

Q: Are there any fees associated with filing Form LPC-2?

A: There are no fees associated with filing Form LPC-2.

Q: What information do I need to provide on Form LPC-2?

A: You will need to provide information about the transferor and transferee of the Land Preservation Credit, as well as details about the transfer.

Q: What happens after I file Form LPC-2?

A: After you file Form LPC-2, the Virginia Department of Taxation will review the form and process the transfer of the Land Preservation Credit.

Form Details:

- Released on June 1, 2018;

- The latest edition provided by the Virginia Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form LPC-2 by clicking the link below or browse more documents and templates provided by the Virginia Department of Taxation.