This version of the form is not currently in use and is provided for reference only. Download this version of

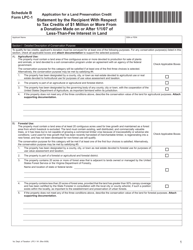

Instructions for Form LPC-2

for the current year.

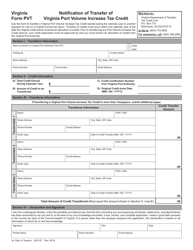

Instructions for Form LPC-2 Notification of Transfer of Land Preservation Credit - Virginia

This document contains official instructions for Form LPC-2 , Notification of Transfer of Land Preservation Credit - a form released and collected by the Virginia Department of Taxation. An up-to-date fillable Form LPC-2 is available for download through this link.

FAQ

Q: What is Form LPC-2?

A: Form LPC-2 is a document used for the notification of transfer of Land Preservation Credit in Virginia.

Q: What is Land Preservation Credit?

A: Land Preservation Credit is a program that provides tax credits to landowners who participate in land preservation programs in Virginia.

Q: Who needs to file Form LPC-2?

A: Form LPC-2 must be filed by the transferor and transferee involved in the transfer of Land Preservation Credit.

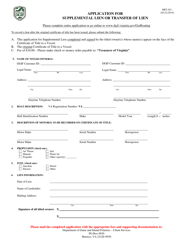

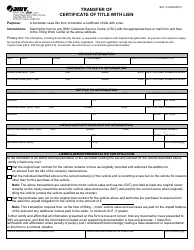

Q: What information is required on Form LPC-2?

A: Form LPC-2 requires details about the transferor, transferee, the transferred credit, and a legal description of the property.

Q: Are there any filing fees for Form LPC-2?

A: No, there are no filing fees associated with Form LPC-2.

Q: When should Form LPC-2 be filed?

A: Form LPC-2 must be filed within 90 days of the transfer of the Land Preservation Credit.

Q: What happens after Form LPC-2 is filed?

A: After Form LPC-2 is filed, the Virginia Department of Taxation will review the form and process the transfer of the Land Preservation Credit.

Q: Can Form LPC-2 be filed electronically?

A: No, Form LPC-2 must be filed by mail or in person to the Virginia Department of Taxation.

Instruction Details:

- This 3-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Virginia Department of Taxation.