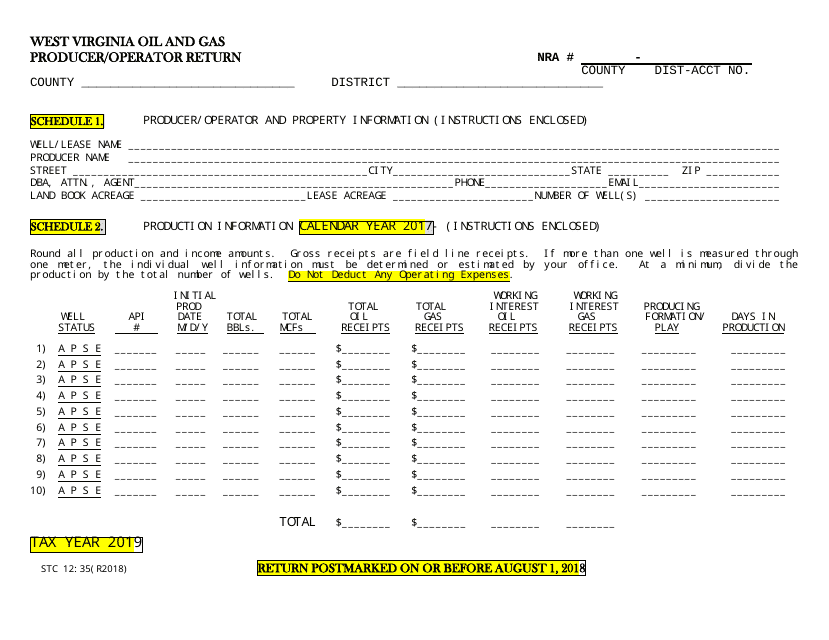

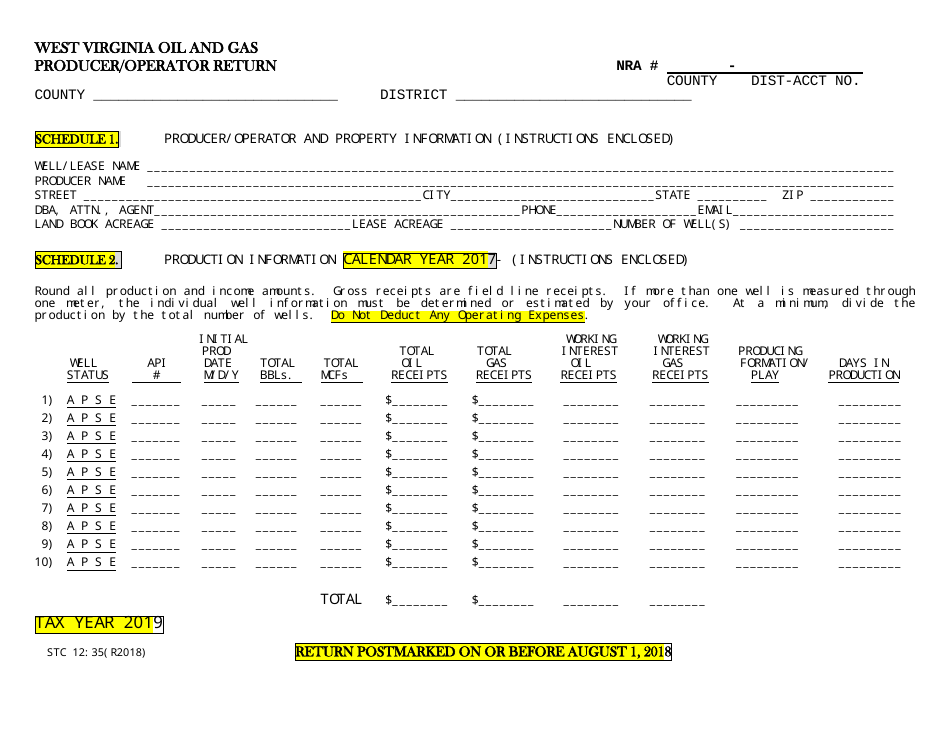

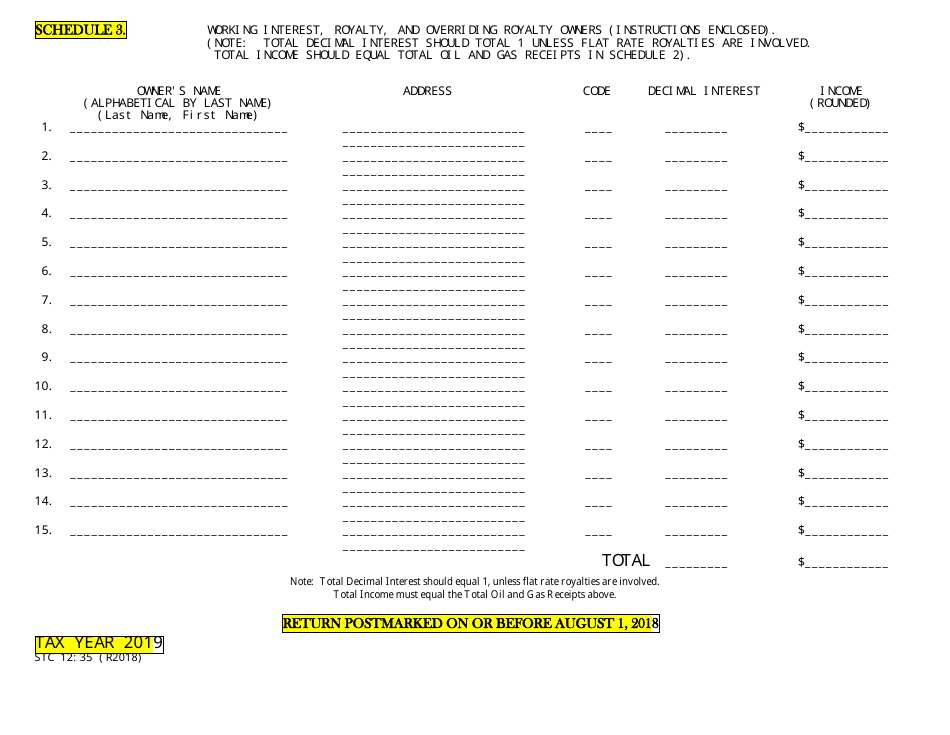

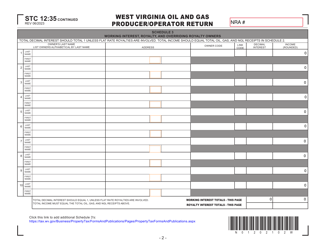

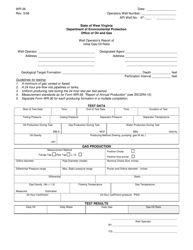

Form STC-1235 West Virginia Oil and Gas Producer / Operator Return - West Virginia

What Is Form STC-1235?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form STC-1235?

A: Form STC-1235 is the West Virginia Oil and Gas Producer/Operator Return.

Q: Who needs to file Form STC-1235?

A: Oil and gas producers and operators in West Virginia need to file Form STC-1235.

Q: What is the purpose of Form STC-1235?

A: The purpose of Form STC-1235 is to report and pay the taxes owed by oil and gas producers/operators in West Virginia.

Q: How often does Form STC-1235 need to be filed?

A: Form STC-1235 needs to be filed annually.

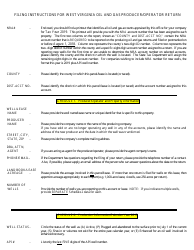

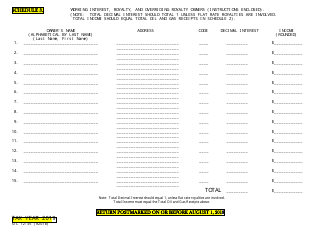

Q: What information is required to complete Form STC-1235?

A: To complete Form STC-1235, you will need to provide information about your oil and gas production and operations, including revenue, expenses, and tax calculations.

Q: Are there any penalties for late filing of Form STC-1235?

A: Yes, there may be penalties for late filing of Form STC-1235. It is important to file on time to avoid penalties.

Q: Can I e-file Form STC-1235?

A: Yes, you can e-file Form STC-1235. E-filing is encouraged and may be faster and more convenient than mailing a paper return.

Q: Is there a deadline for filing Form STC-1235?

A: Yes, Form STC-1235 must be filed by the due date, which is typically on or around March 1st each year.

Q: What should I do if I have questions or need assistance with Form STC-1235?

A: If you have questions or need assistance with Form STC-1235, you can contact the West Virginia State Tax Department for guidance.

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form STC-1235 by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.