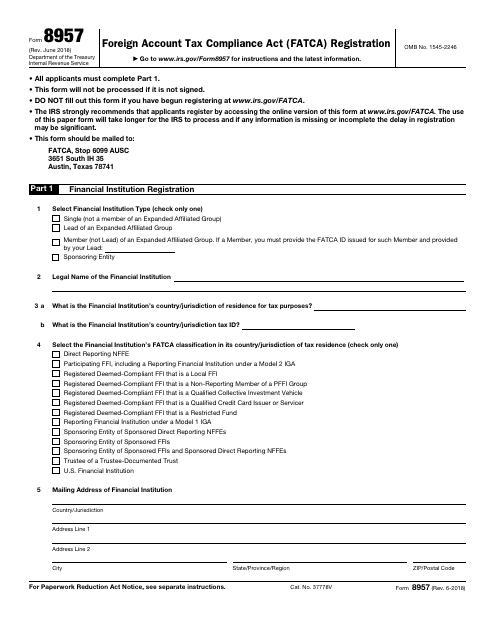

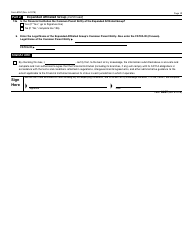

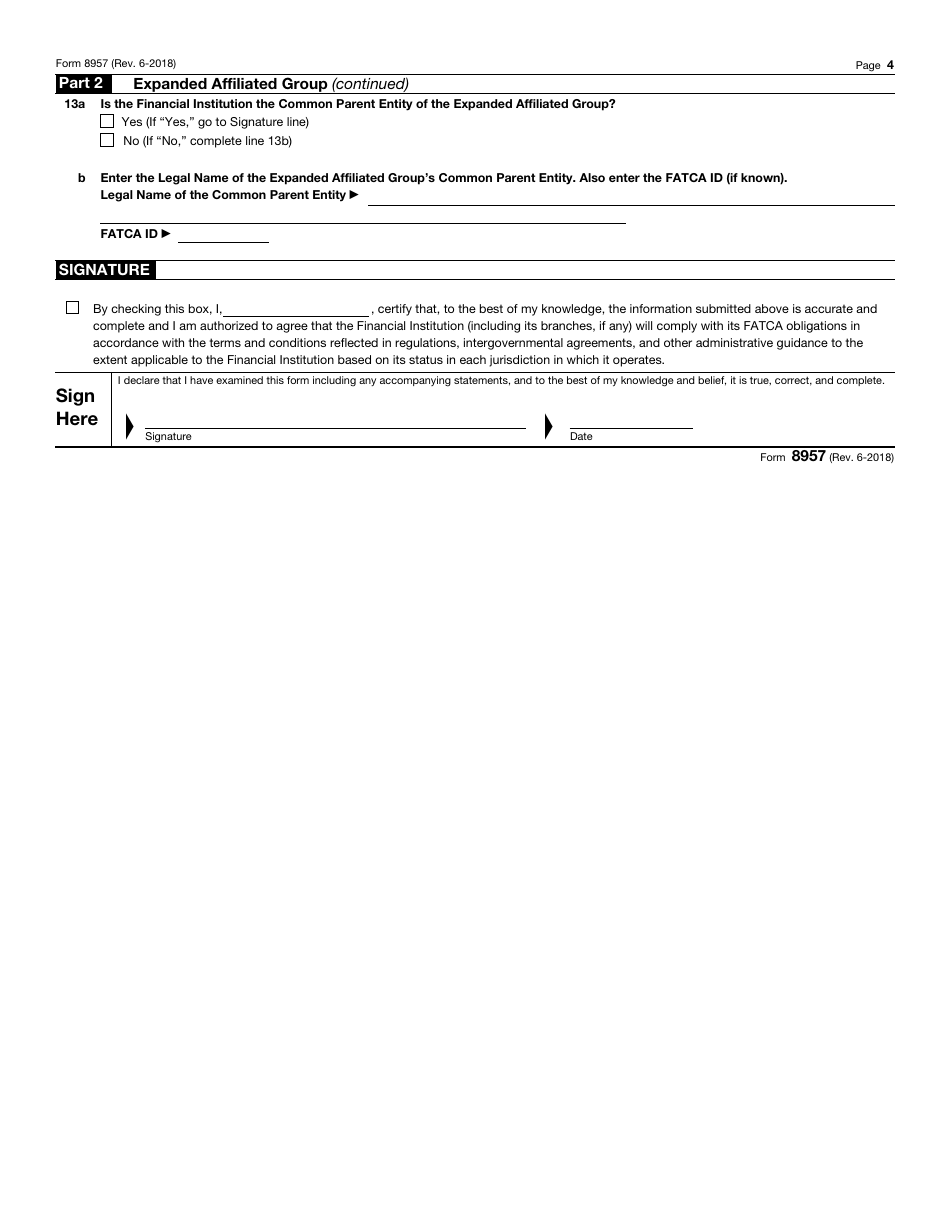

IRS Form 8957 Foreign Account Tax Compliance Act (Fatca) Registration

What Is IRS Form 8957?

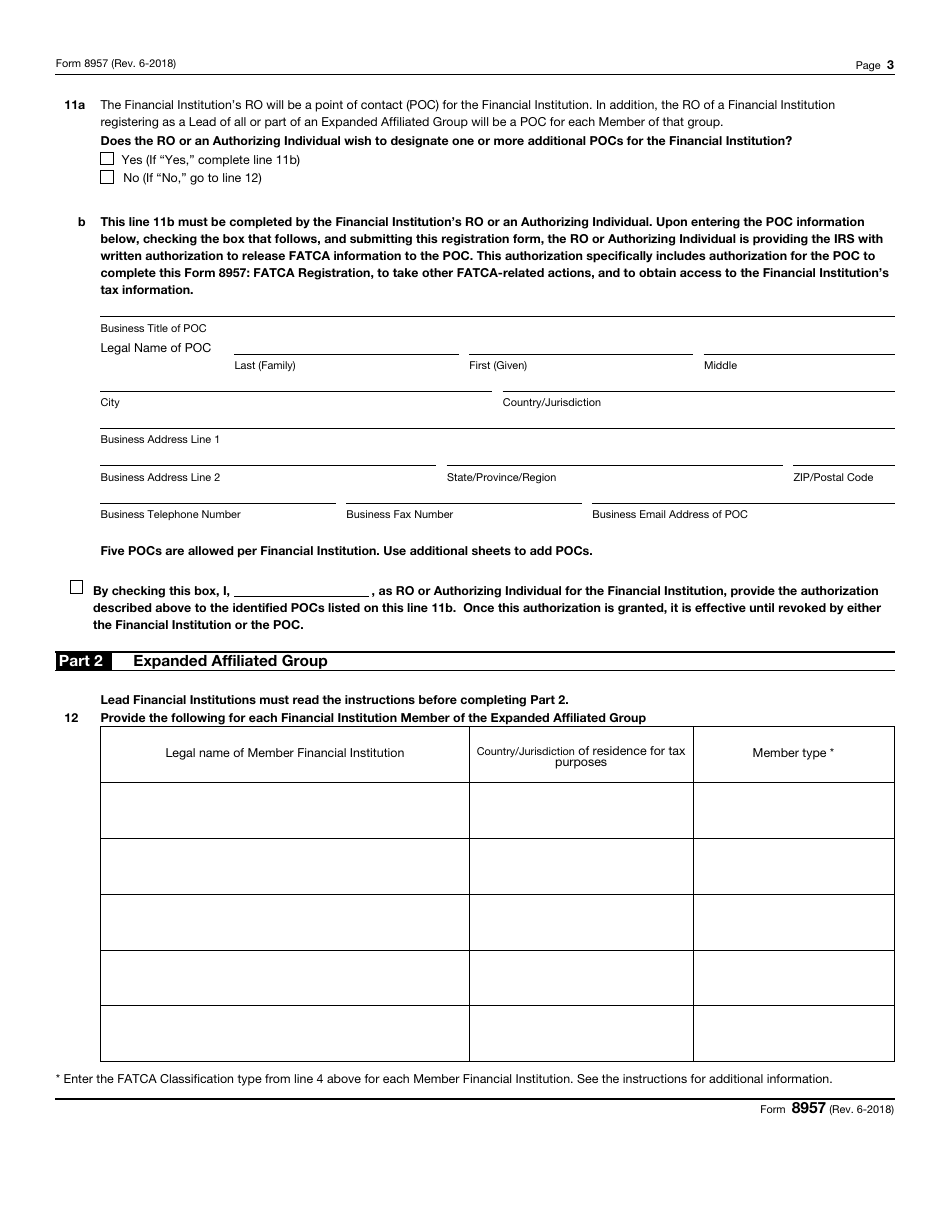

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on June 1, 2018. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 8957?

A: IRS Form 8957 is the form used for the Foreign Account Tax Compliance Act (FATCA) registration.

Q: What is the Foreign Account Tax Compliance Act (FATCA)?

A: The Foreign Account Tax Compliance Act (FATCA) is a U.S. law that requires foreign financial institutions to report information about U.S. account holders to the IRS.

Q: Who is required to file IRS Form 8957?

A: Foreign financial institutions that are subject to FATCA reporting requirements must file IRS Form 8957.

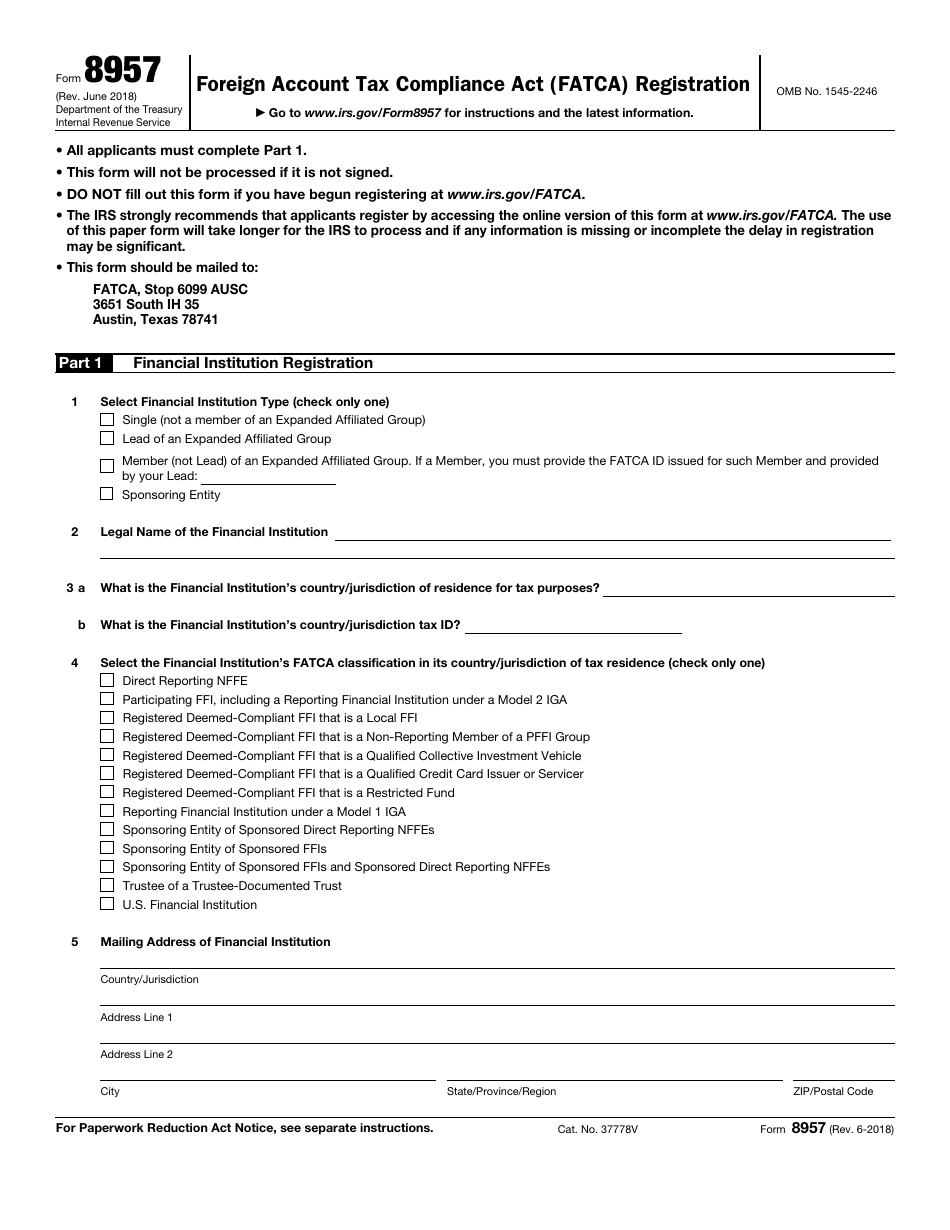

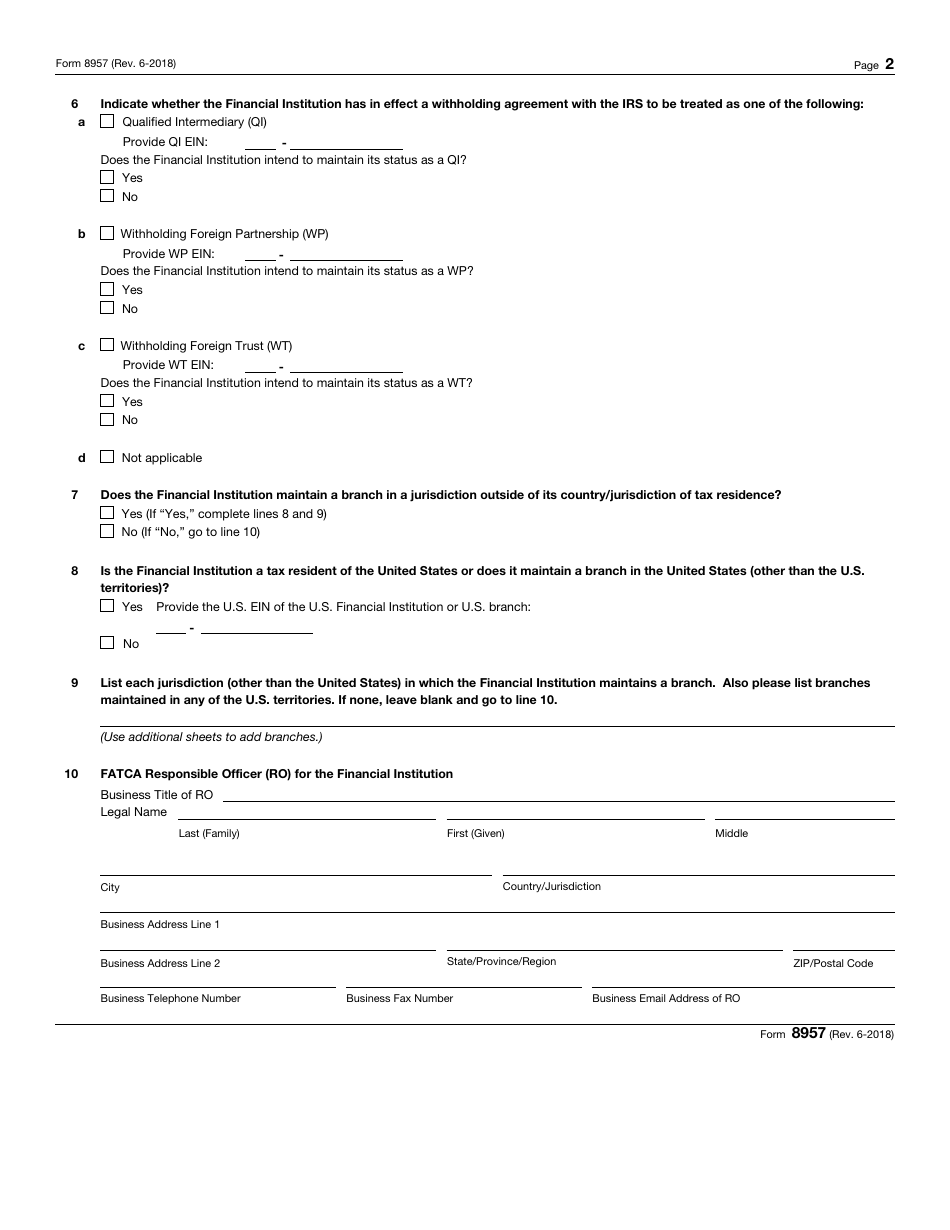

Q: What information is required to be reported on IRS Form 8957?

A: IRS Form 8957 requires foreign financial institutions to report information such as the name, address, and taxpayer identification number of U.S. account holders.

Q: Are there any penalties for not filing IRS Form 8957?

A: Yes, there are penalties for not filing IRS Form 8957, including potential withholding of U.S. source income and imposition of additional tax liabilities.

Q: Can individuals file IRS Form 8957?

A: No, IRS Form 8957 is specifically for foreign financial institutions and not for individuals.

Q: Is the information reported on IRS Form 8957 confidential?

A: Yes, the information reported on IRS Form 8957 is subject to confidentiality provisions.

Q: Are there any exceptions to FATCA reporting requirements?

A: Yes, there are certain exceptions to FATCA reporting requirements, including certain types of retirement plans and non-financial entities.

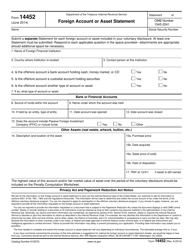

Q: Is IRS Form 8957 the only form related to FATCA?

A: No, there are other forms and requirements related to FATCA, such as IRS Form 8938 for individual taxpayers.

Form Details:

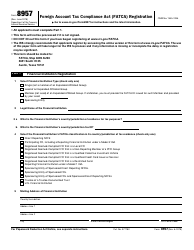

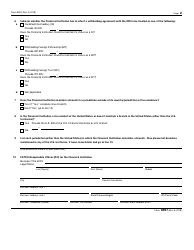

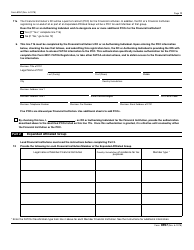

- A 4-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8957 through the link below or browse more documents in our library of IRS Forms.