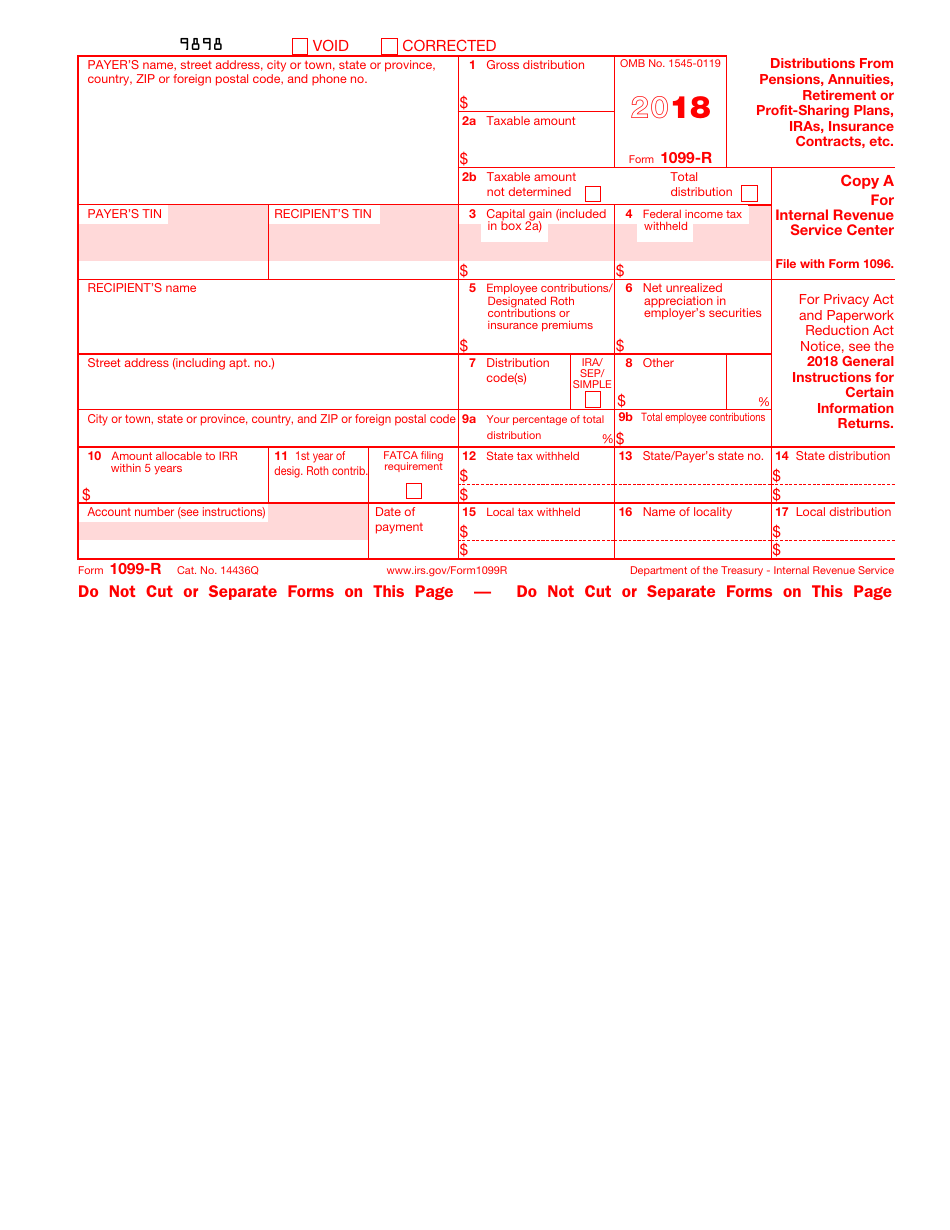

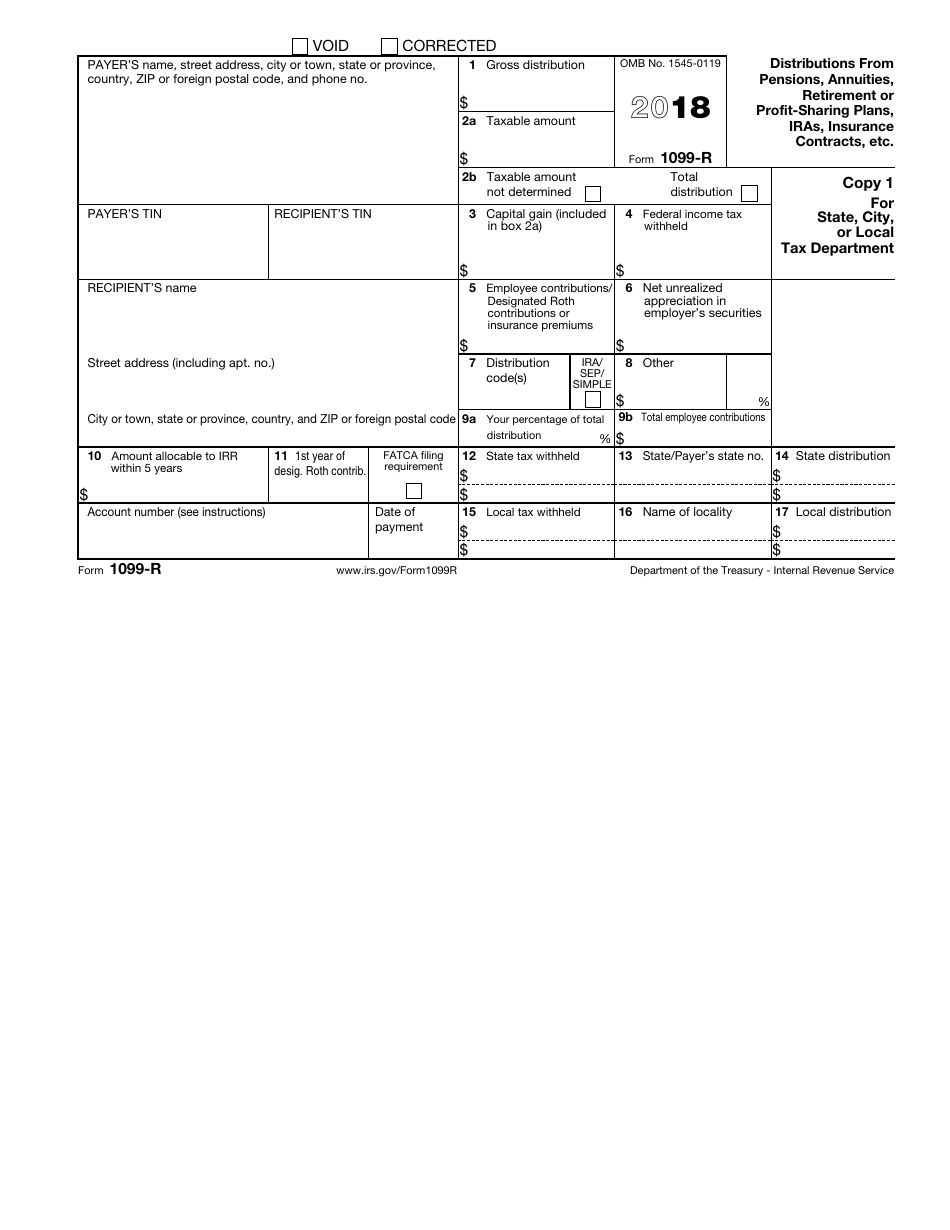

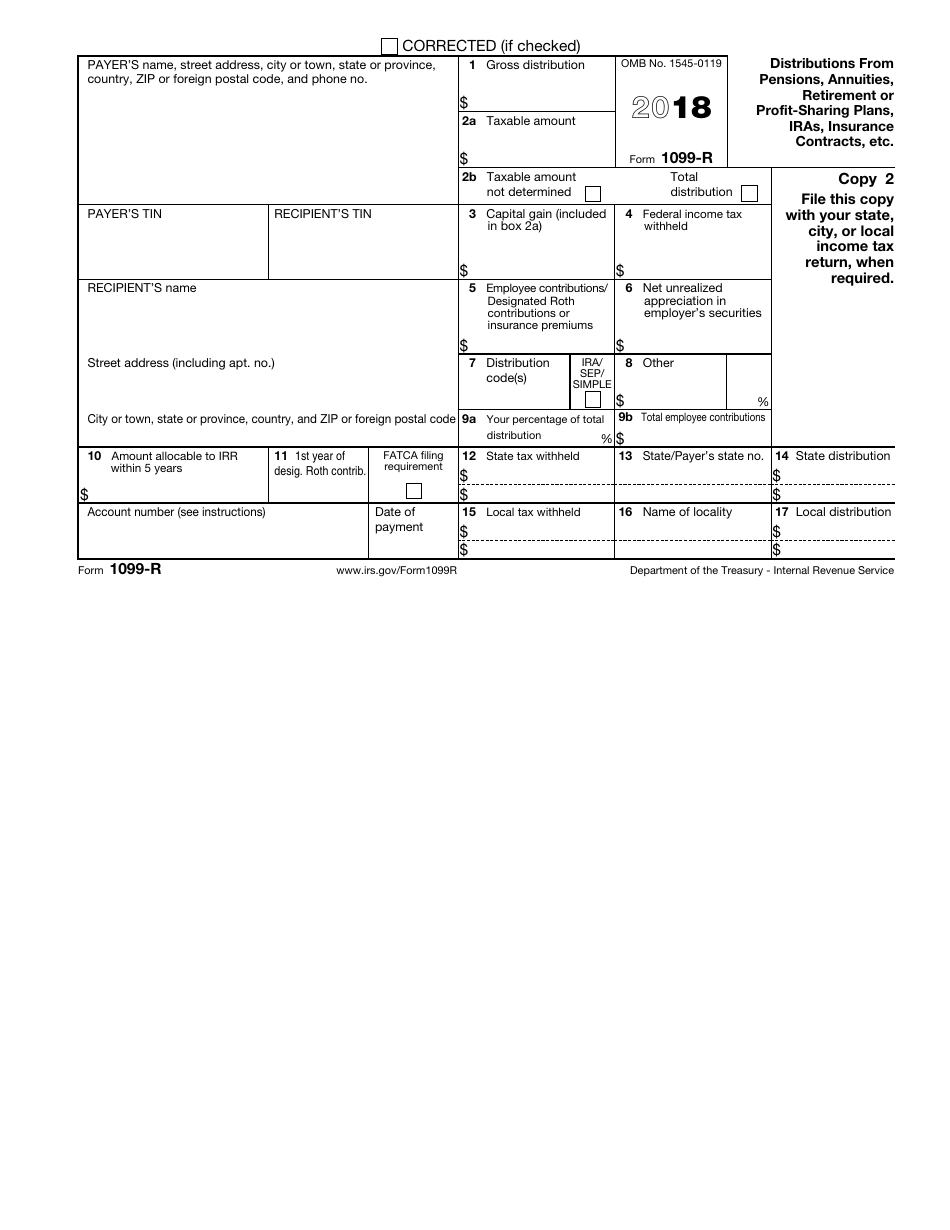

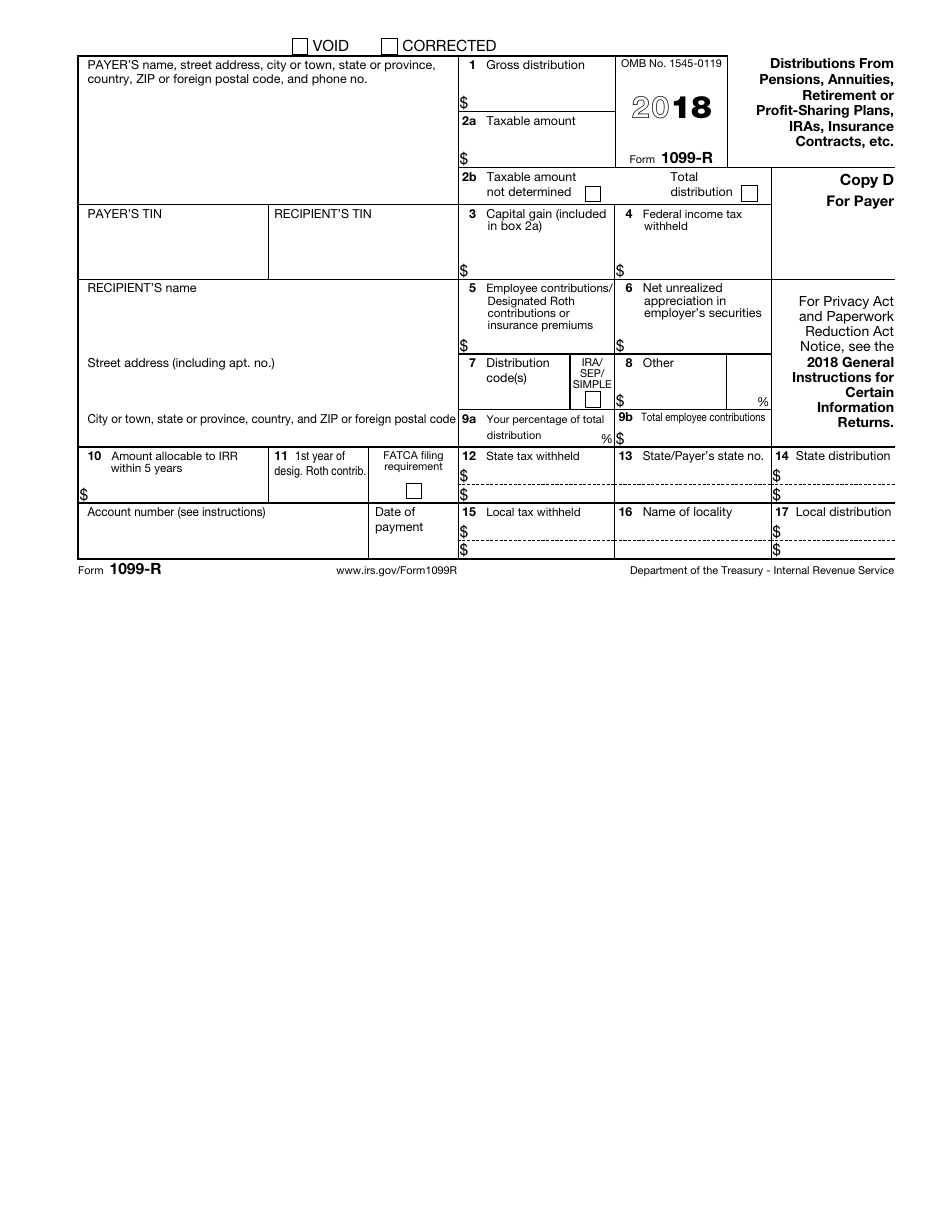

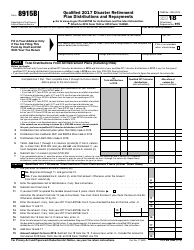

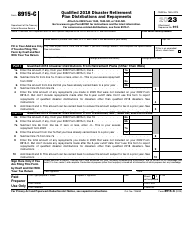

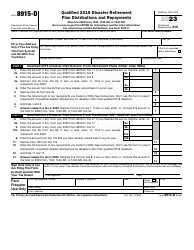

This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 1099-R

for the current year.

IRS Form 1099-R Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, Etc.

What Is IRS Form 1099-R?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 1099-R?

A: IRS Form 1099-R is a tax form used to report distributions from pensions, annuities, retirement or profit-sharing plans, IRAs, insurance contracts, etc.

Q: What types of distributions are reported on IRS Form 1099-R?

A: IRS Form 1099-R reports various types of distributions, such as retirement plan distributions, annuity payments, IRA distributions, and insurance contract payouts.

Q: Who receives IRS Form 1099-R?

A: The recipient of a distribution from a pension, annuity, retirement or profit-sharing plan, IRA, insurance contract, etc. receives IRS Form 1099-R.

Q: Why is IRS Form 1099-R important?

A: IRS Form 1099-R is important for taxpayers to accurately report and pay taxes on distributions received from various retirement and investment accounts.

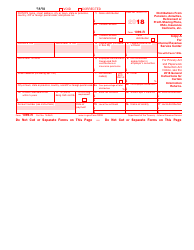

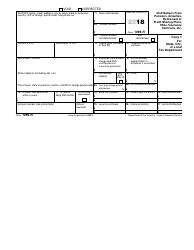

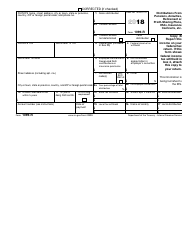

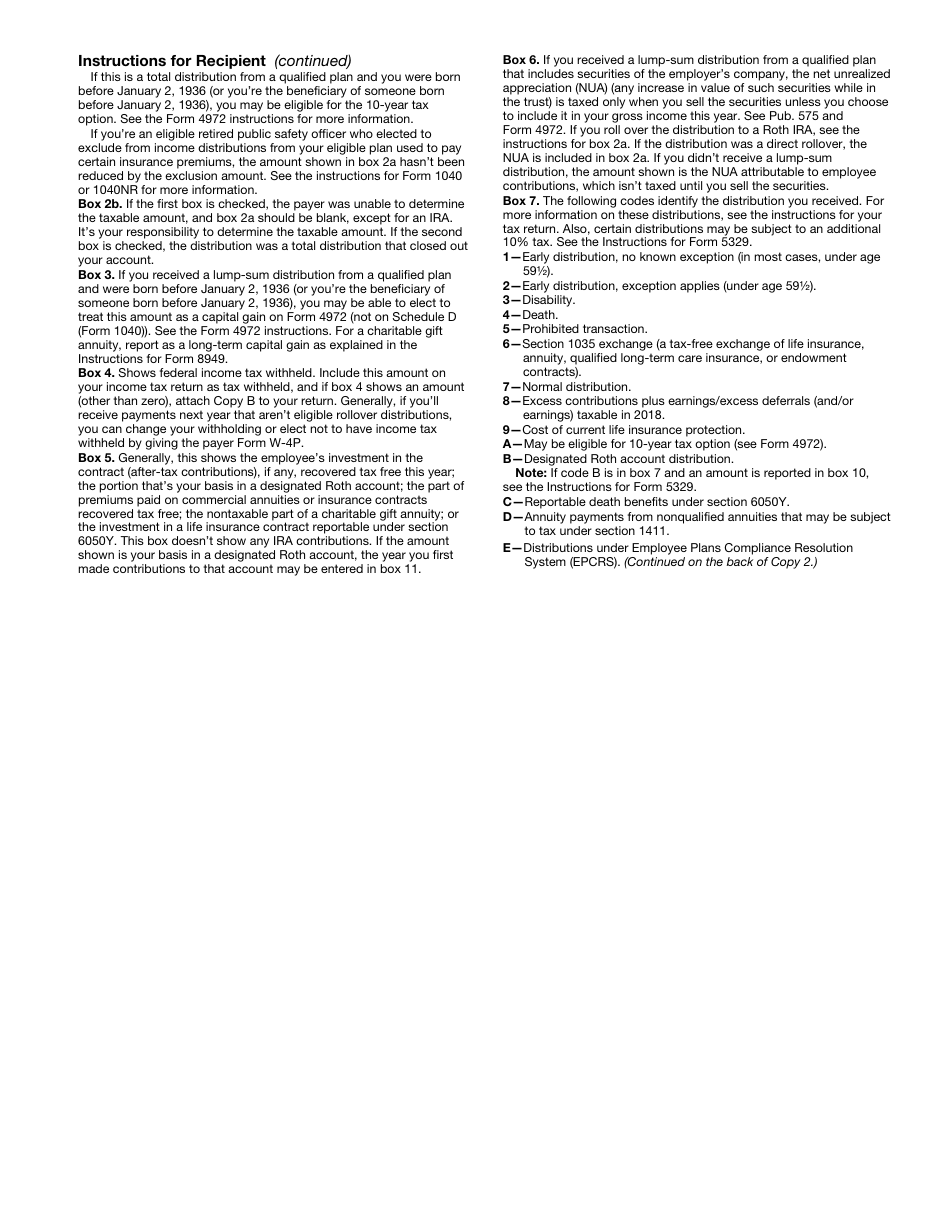

Q: What information is included on IRS Form 1099-R?

A: IRS Form 1099-R includes information such as the recipient's name, address, Social Security number, distribution amount, taxable amount, and any applicable codes or special tax treatment.

Q: When is IRS Form 1099-R due?

A: IRS Form 1099-R must be furnished to the recipient by January 31st of the year following the distribution, and it must be filed with the IRS by the end of February (if filing by paper) or the end of March (if filing electronically).

Q: How do I report IRS Form 1099-R on my tax return?

A: You must report the information from IRS Form 1099-R on your tax return by entering the necessary details on the appropriate sections of your tax form, such as Form 1040 or Form 1040A.

Q: What if I don't receive IRS Form 1099-R?

A: If you don't receive IRS Form 1099-R, you should still report the distribution on your tax return based on your own records and documentation.

Q: Are all distributions reported on IRS Form 1099-R taxable?

A: Not all distributions reported on IRS Form 1099-R are taxable. Some distributions may be partially or fully tax-exempt, depending on the nature of the distribution and the recipient's individual circumstances.

Form Details:

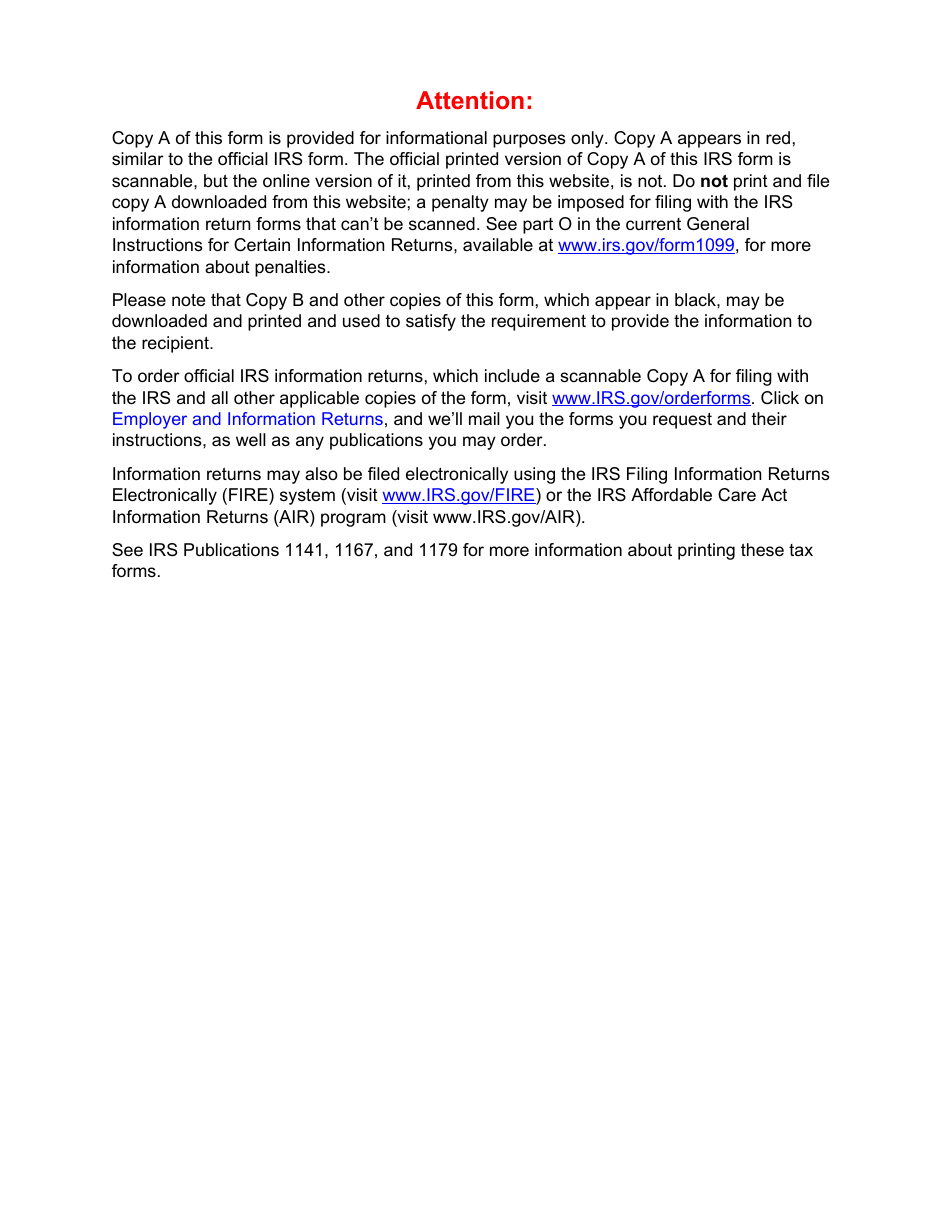

- A 11-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1099-R through the link below or browse more documents in our library of IRS Forms.