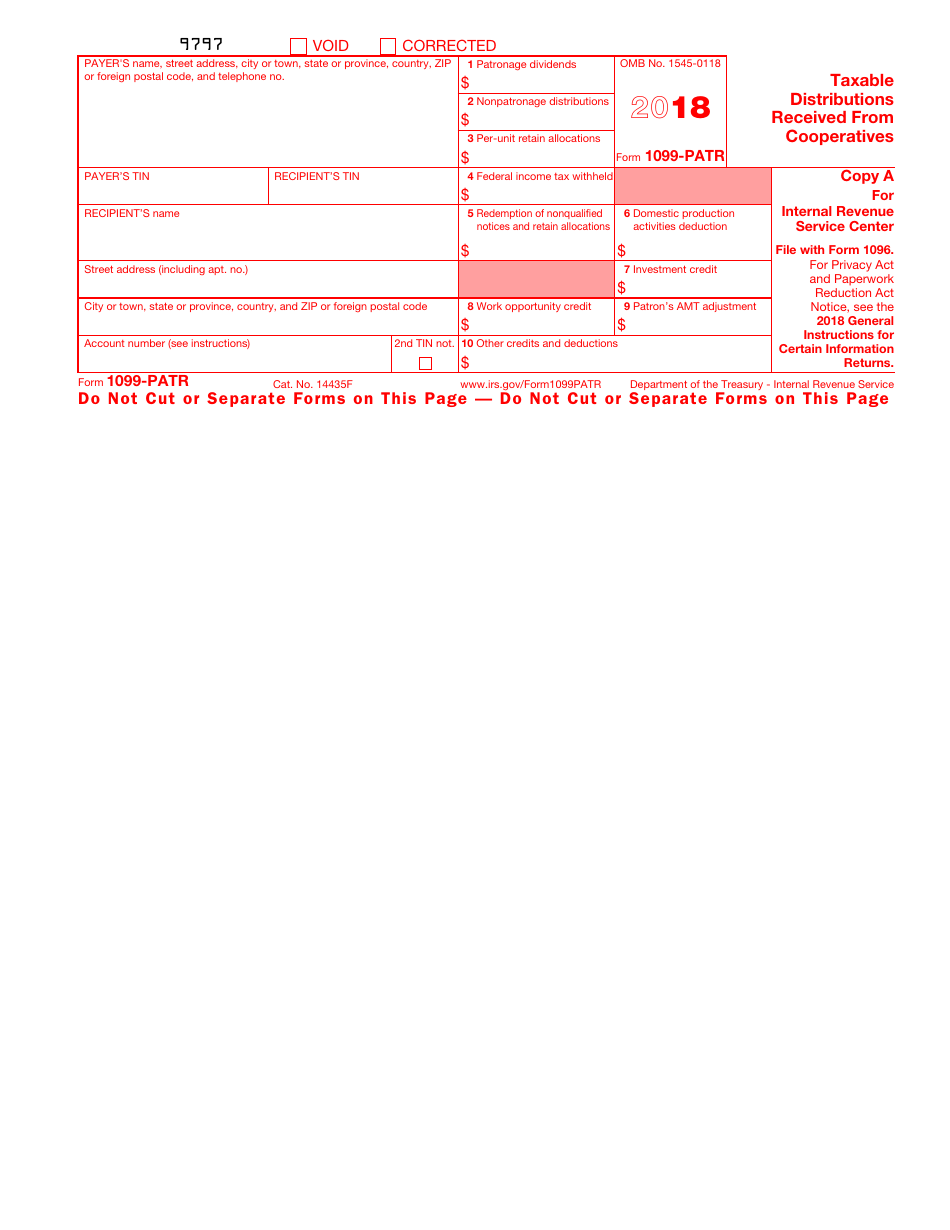

This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 1099-PATR

for the current year.

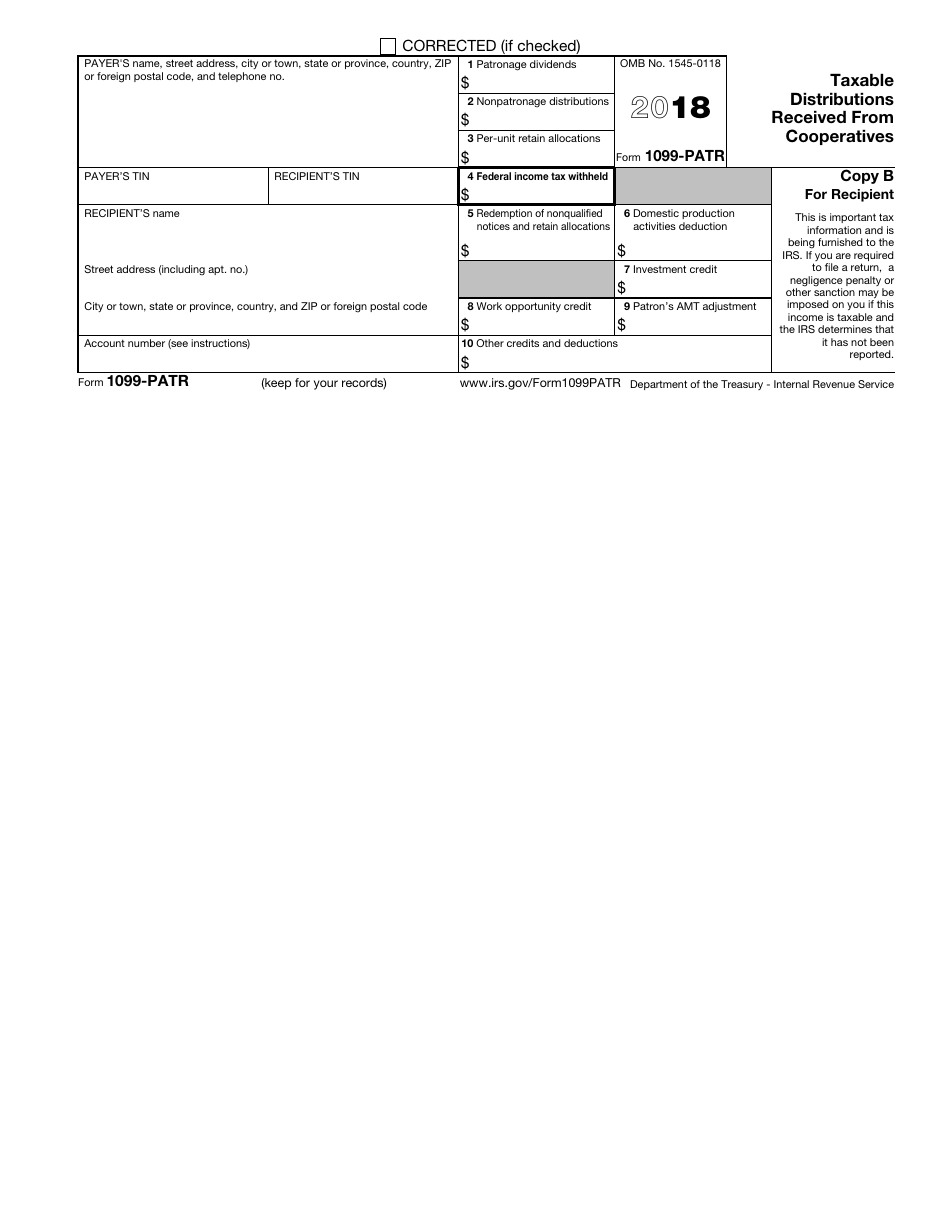

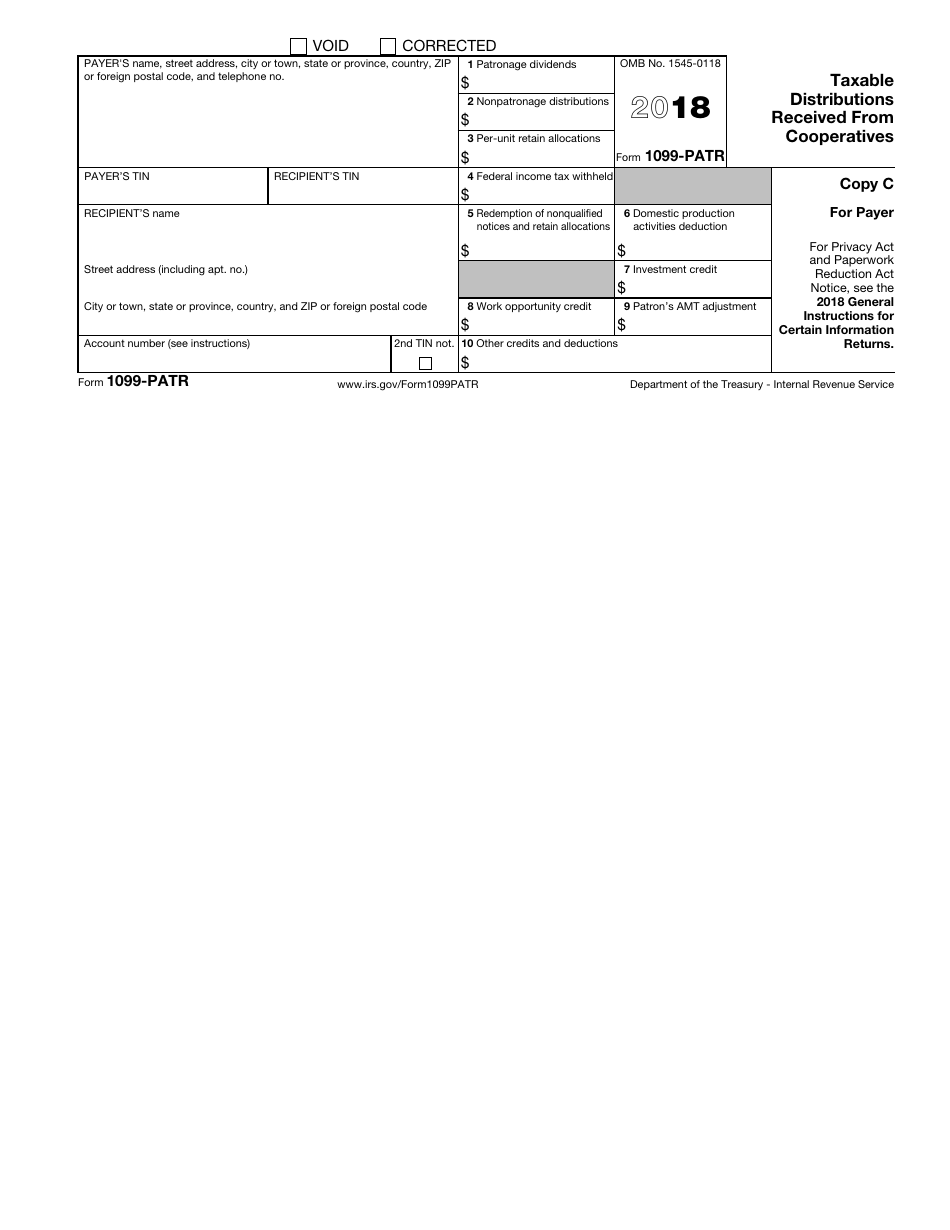

IRS Form 1099-PATR Taxable Distributions Received From Cooperatives

What Is IRS Form 1099-PATR?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 1099-PATR?

A: IRS Form 1099-PATR is used to report taxable distributions received from cooperatives.

Q: What are taxable distributions?

A: Taxable distributions are payments from cooperatives that are subject to federal income tax.

Q: Who receives Form 1099-PATR?

A: Individuals who have received $10 or more in taxable distributions from cooperatives.

Q: What information is reported on Form 1099-PATR?

A: Form 1099-PATR reports the amount of taxable distributions received from cooperatives.

Q: Do I need to include Form 1099-PATR when filing my taxes?

A: Yes, you need to include Form 1099-PATR when filing your taxes to report the taxable distributions received.

Q: What is the deadline to file Form 1099-PATR?

A: Form 1099-PATR must be filed with the IRS by January 31st.

Q: Is there a penalty for not filing Form 1099-PATR?

A: Yes, there may be penalties for not filing Form 1099-PATR, so it is important to meet the deadline.

Q: Can I file Form 1099-PATR electronically?

A: Yes, you can file Form 1099-PATR electronically using the IRS's FIRE (Filing Information Returns Electronically) system.

Q: Are there any exceptions to filing Form 1099-PATR?

A: There are certain exceptions to filing Form 1099-PATR, so it is best to consult the IRS instructions or a tax professional for specific guidance.

Form Details:

- A 6-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1099-PATR through the link below or browse more documents in our library of IRS Forms.