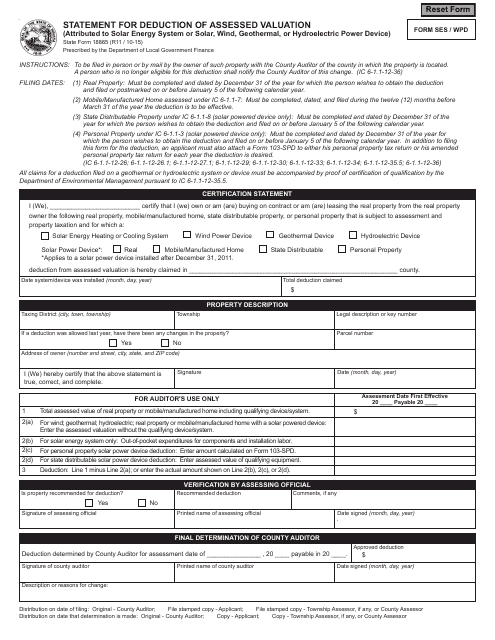

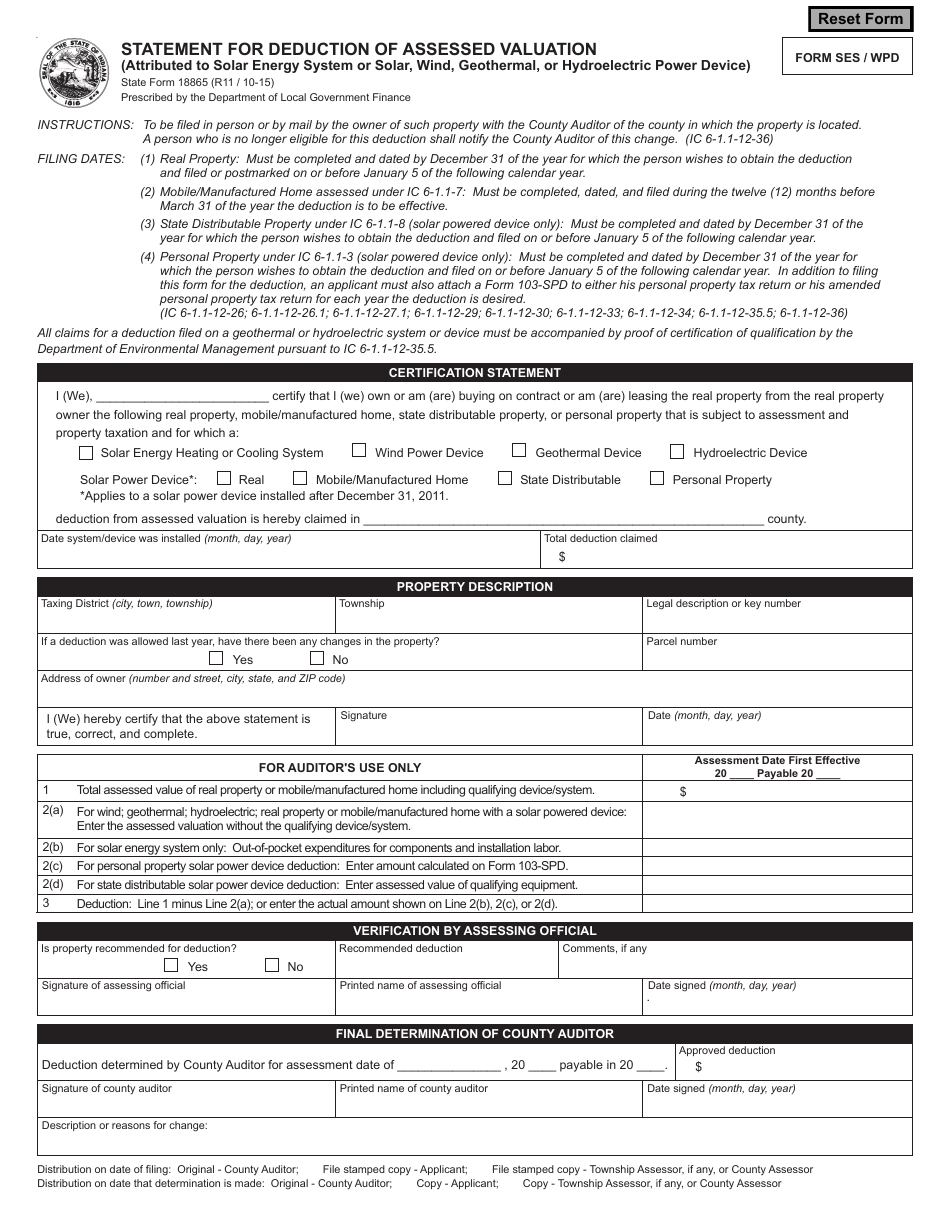

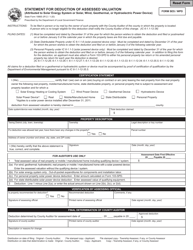

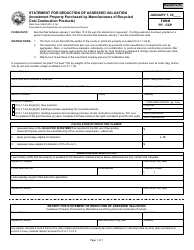

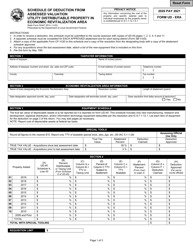

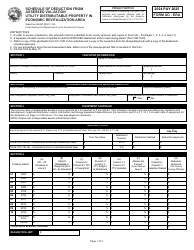

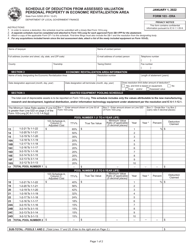

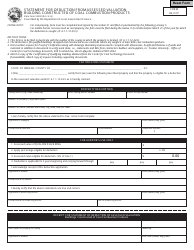

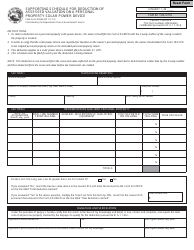

Form SES / WPD (State Form 18865) Statement for Deduction of Assessed Valuation (Attributed to Solar Energy System / Wind, Geothermal or Hydroelectric Power Device) - Indiana

What Is Form SES/WPD (State Form 18865)?

This is a legal form that was released by the Indiana Department of Local Government Finance - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

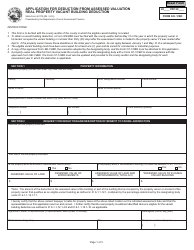

Q: What is the SES/WPD Statement for Deduction of Assessed Valuation?

A: It is a form (State Form 18865) used in Indiana to claim a deduction on the assessed valuation of a Solar Energy System/Wind, Geothermal or Hydroelectric Power Device.

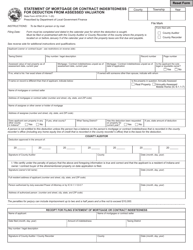

Q: What is the purpose of the SES/WPD deduction?

A: The deduction is meant to encourage the installation and use of renewable energy systems by reducing the property taxes on these systems.

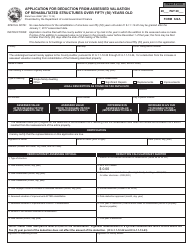

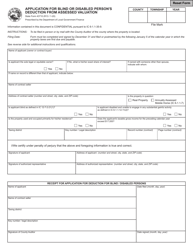

Q: Who can claim the SES/WPD deduction?

A: Any property owner in Indiana who has installed a qualified Solar Energy System/Wind, Geothermal or Hydroelectric Power Device can claim the deduction.

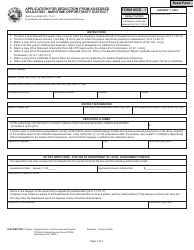

Q: How do I claim the SES/WPD deduction?

A: You need to complete the SES/WPD Statement for Deduction of Assessed Valuation form (State Form 18865) and submit it to your county assessor's office.

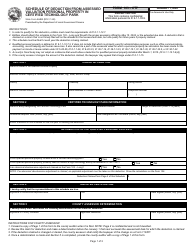

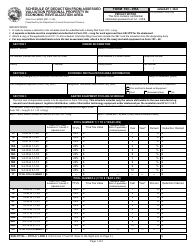

Q: What information is required on the SES/WPD statement?

A: The form requires information about the property, the renewable energy system, and the installer of the system.

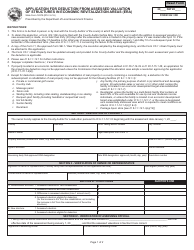

Q: How much is the deduction for the SES/WPD statement?

A: The deduction amount varies depending on the type and capacity of the renewable energy system. It is calculated based on a percentage of the assessed valuation of the system.

Q: Is there a deadline for filing the SES/WPD statement?

A: Yes, the form must be filed with the county assessor's office by May 10th of the assessment year for the deduction to apply for that year.

Q: Can I claim the SES/WPD deduction for multiple properties?

A: Yes, if you have qualified renewable energy systems installed on multiple properties, you can claim the deduction for each eligible property.

Q: Are there any restrictions on claiming the SES/WPD deduction?

A: Yes, there are certain eligibility requirements and guidelines outlined in Indiana's tax laws and regulations. It is advisable to consult with a tax professional or the county assessor's office for specific details.

Form Details:

- Released on October 1, 2015;

- The latest edition provided by the Indiana Department of Local Government Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SES/WPD (State Form 18865) by clicking the link below or browse more documents and templates provided by the Indiana Department of Local Government Finance.