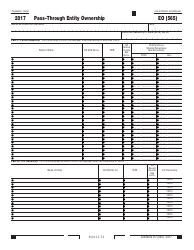

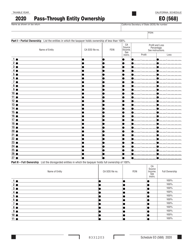

Instructions for Form 568 Schedule EO Pass-Through Entity Ownership - California

This document contains official instructions for Form 568 Schedule EO, Pass-Through Entity Ownership - a form released and collected by the California Franchise Tax Board.

FAQ

Q: What is Form 568 Schedule EO?

A: Form 568 Schedule EO is a document used in California to report pass-through entity ownership.

Q: Who needs to file Form 568 Schedule EO?

A: Pass-through entities in California need to file Form 568 Schedule EO if they have ownership in another pass-through entity.

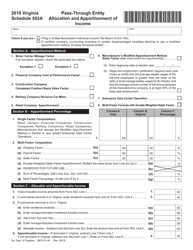

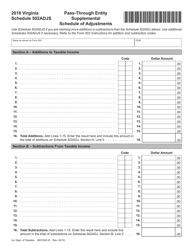

Q: What information is required on Form 568 Schedule EO?

A: Form 568 Schedule EO requires information about the ownership percentage, federal identification numbers, and business activities of the pass-through entities involved.

Q: When is Form 568 Schedule EO due?

A: Form 568 Schedule EO is due by the 15th day of the 4th month after the close of the taxable year.

Instruction Details:

- This 1-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the California Franchise Tax Board.