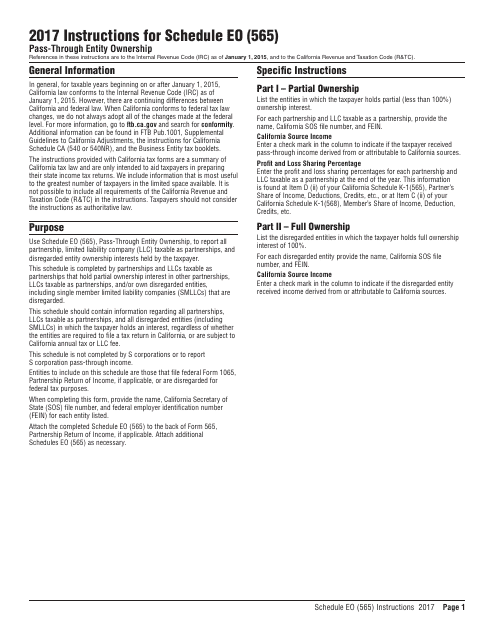

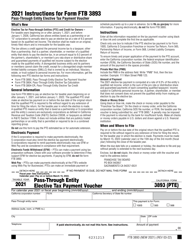

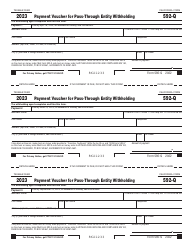

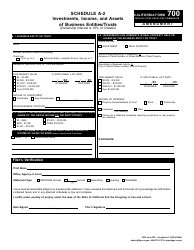

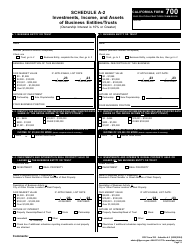

Instructions for Form 565 Schedule EO Pass-Through Entity Ownership - California

This document contains official instructions for Form 565 Schedule EO, Pass-Through Entity Ownership - a form released and collected by the California Franchise Tax Board. An up-to-date fillable Form 565 Schedule EO is available for download through this link.

FAQ

Q: What is Form 565 Schedule EO?

A: Form 565 Schedule EO is a form used to report pass-through entity ownership information in California.

Q: Who needs to file Form 565 Schedule EO?

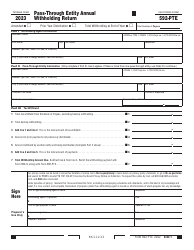

A: Pass-through entities that have any California residents or nonresidents as owners need to file Form 565 Schedule EO.

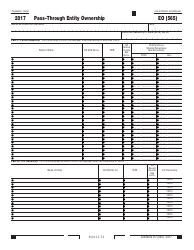

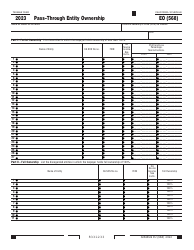

Q: What information needs to be reported on Form 565 Schedule EO?

A: Form 565 Schedule EO requires the reporting of the name, address, percentage of ownership, and tax identification number of each owner.

Q: When is the deadline to file Form 565 Schedule EO?

A: Form 565 Schedule EO is due on or before the 15th day of the 4th month after the close of the taxable year.

Q: Are there any penalties for not filing Form 565 Schedule EO?

A: Yes, failure to file Form 565 Schedule EO or providing false information can result in penalties imposed by the California Franchise Tax Board.

Instruction Details:

- This 1-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the California Franchise Tax Board.