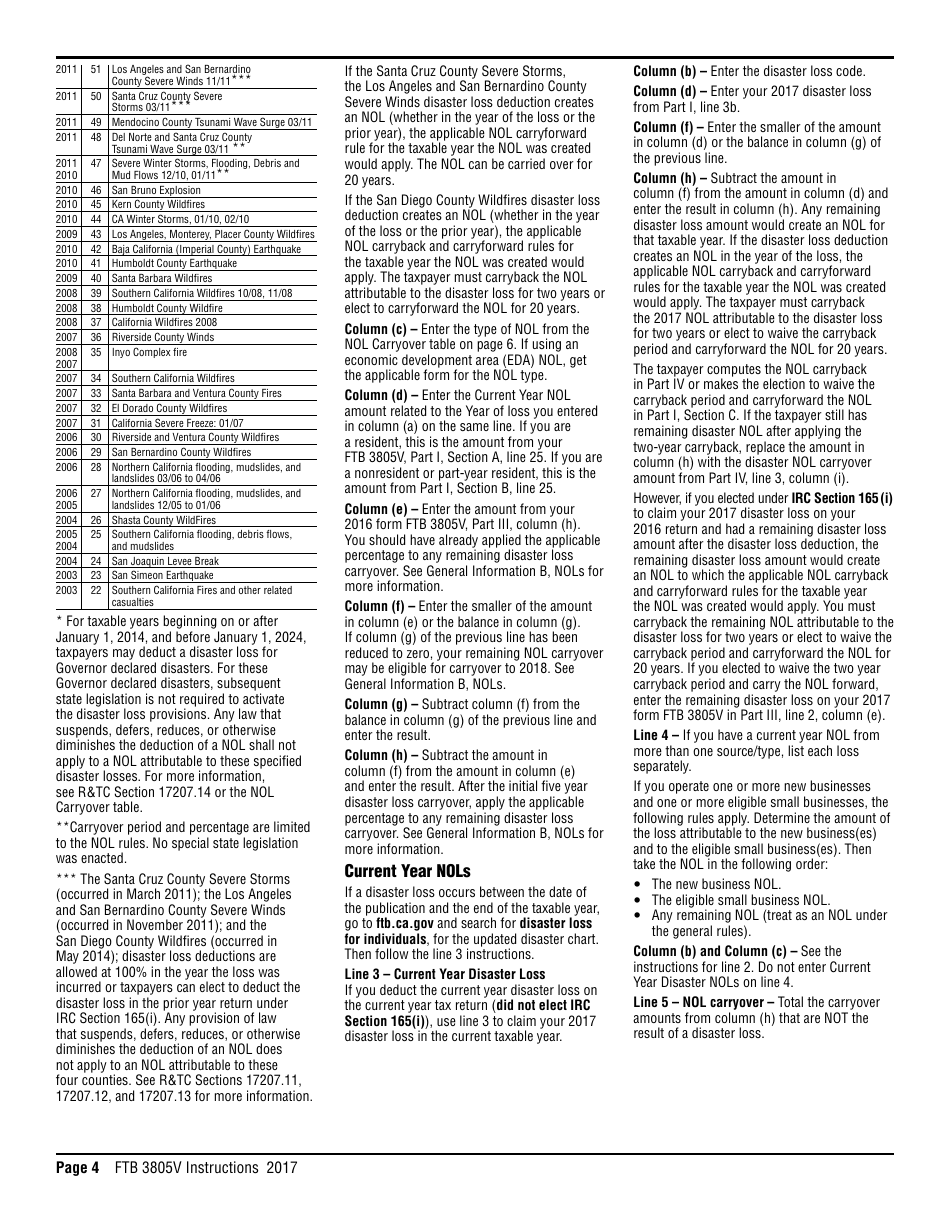

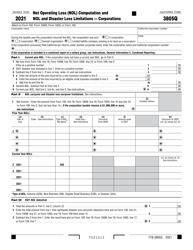

Instructions for Form FTB3805V Net Operating Loss (Nol) Computation and Nol and Disaster Loss Limitations " Individuals, Estates, and Trusts - California

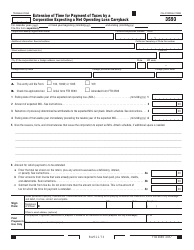

This document contains official instructions for Form FTB3805V , Net Loss Limitations '" Individuals, Estates, and Trusts - a form released and collected by the California Franchise Tax Board. An up-to-date fillable Form FTB3805V is available for download through Form FTB3805V Net Operating Loss (Nol) Computation and Nol and Disaster Loss Limitations.

FAQ

Q: What is Form FTB3805V?

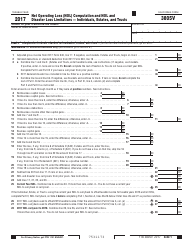

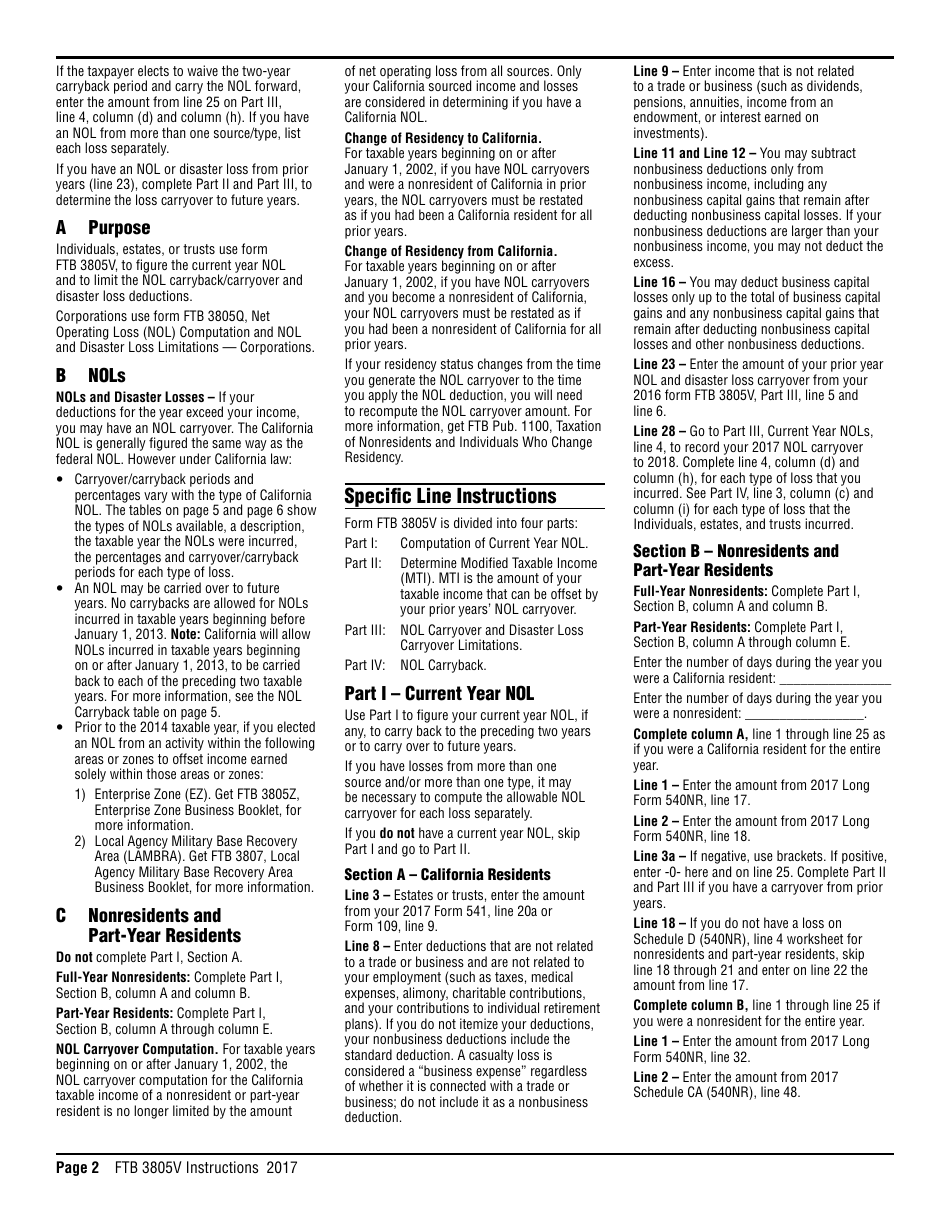

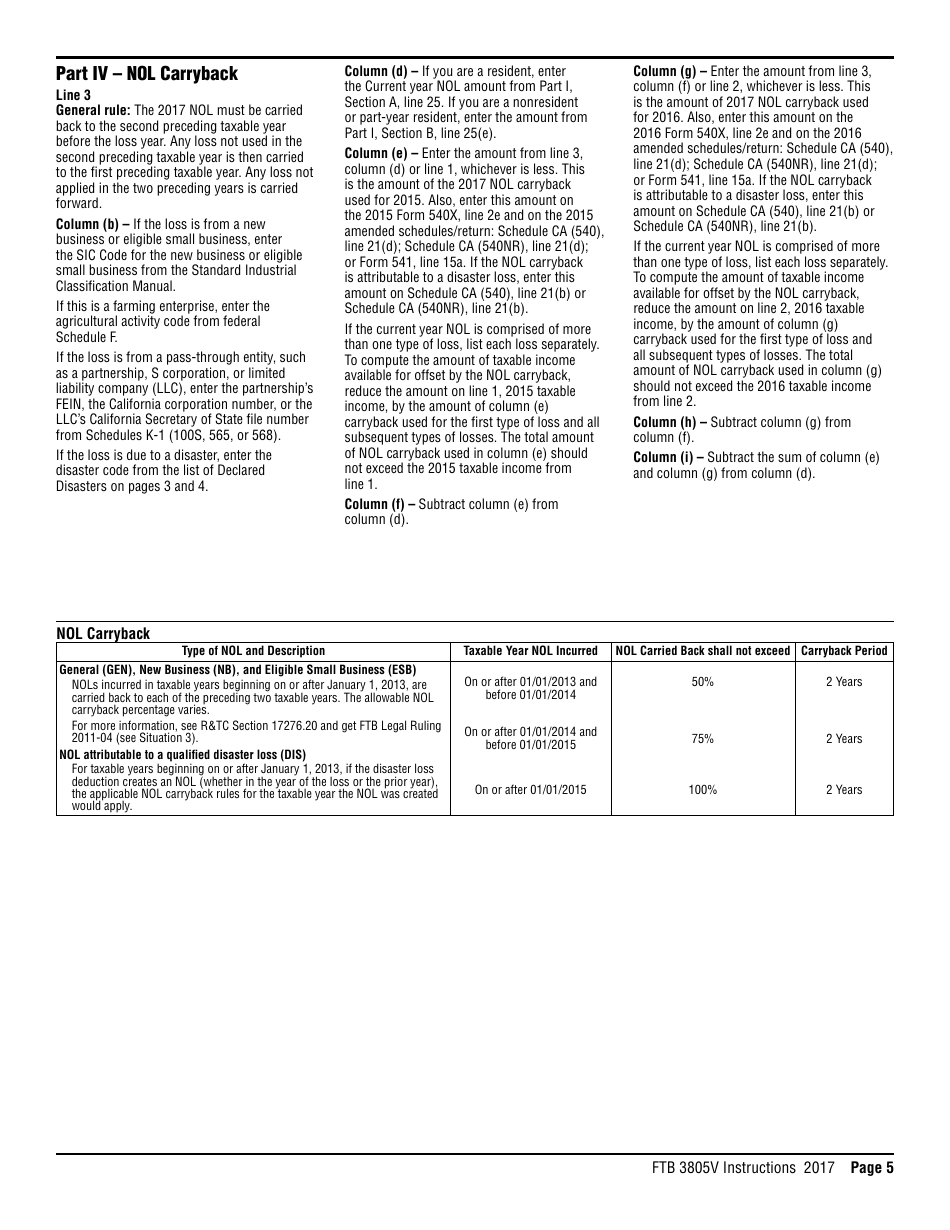

A: Form FTB3805V is used to calculate the Net Operating Loss (NOL) and NOL and Disaster Loss Limitations for individuals, estates, and trusts in California.

Q: Who needs to file Form FTB3805V?

A: Individuals, estates, and trusts in California who have a net operating loss or a disaster loss may need to file Form FTB3805V.

Q: What is a Net Operating Loss (NOL)?

A: A Net Operating Loss (NOL) occurs when a taxpayer's allowable deductions exceed their taxable income for a particular year.

Q: What are the NOL and Disaster Loss Limitations?

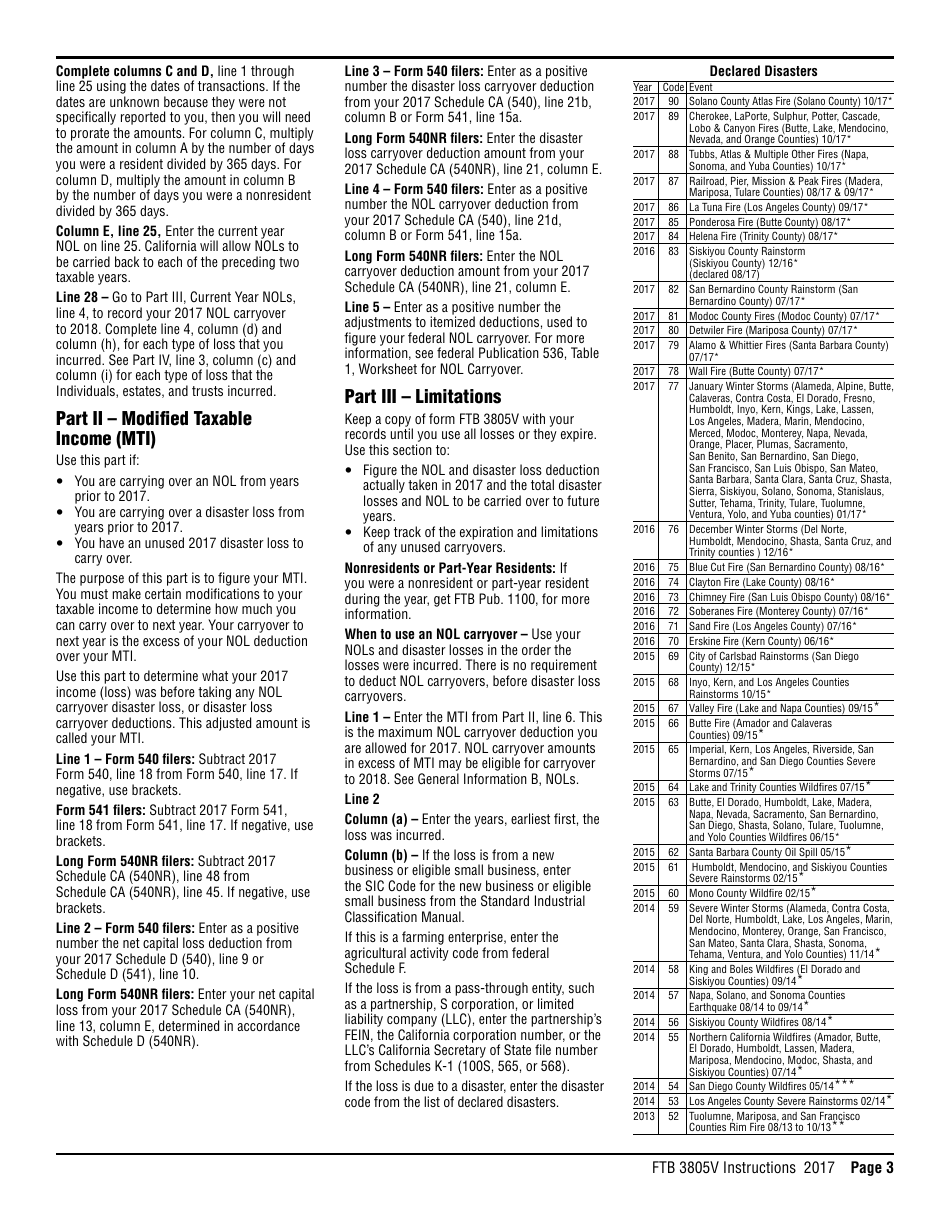

A: The NOL and Disaster Loss Limitations are rules that limit the amount of NOL or disaster loss that can be deducted in a given year.

Q: How do I fill out Form FTB3805V?

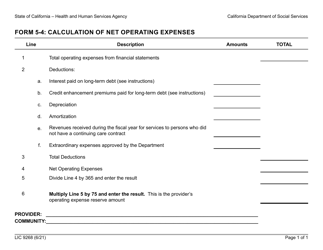

A: Form FTB3805V provides instructions on how to calculate the NOL and NOL and Disaster Loss Limitations. It also includes worksheets and tables to help you determine the amounts to enter on the form.

Instruction Details:

- This 6-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the California Franchise Tax Board.