This version of the form is not currently in use and is provided for reference only. Download this version of

Form FTB3805V

for the current year.

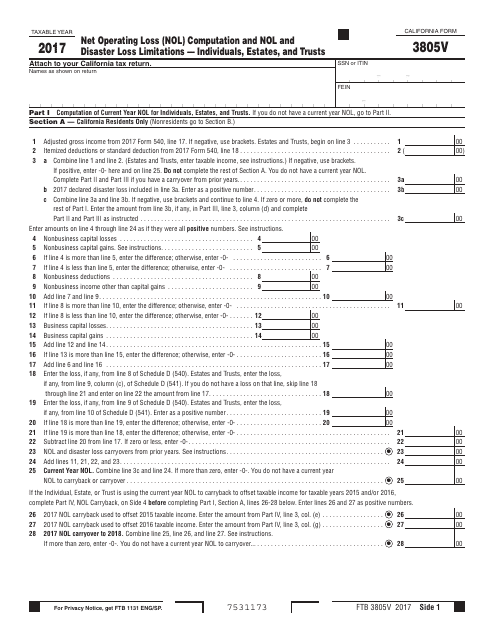

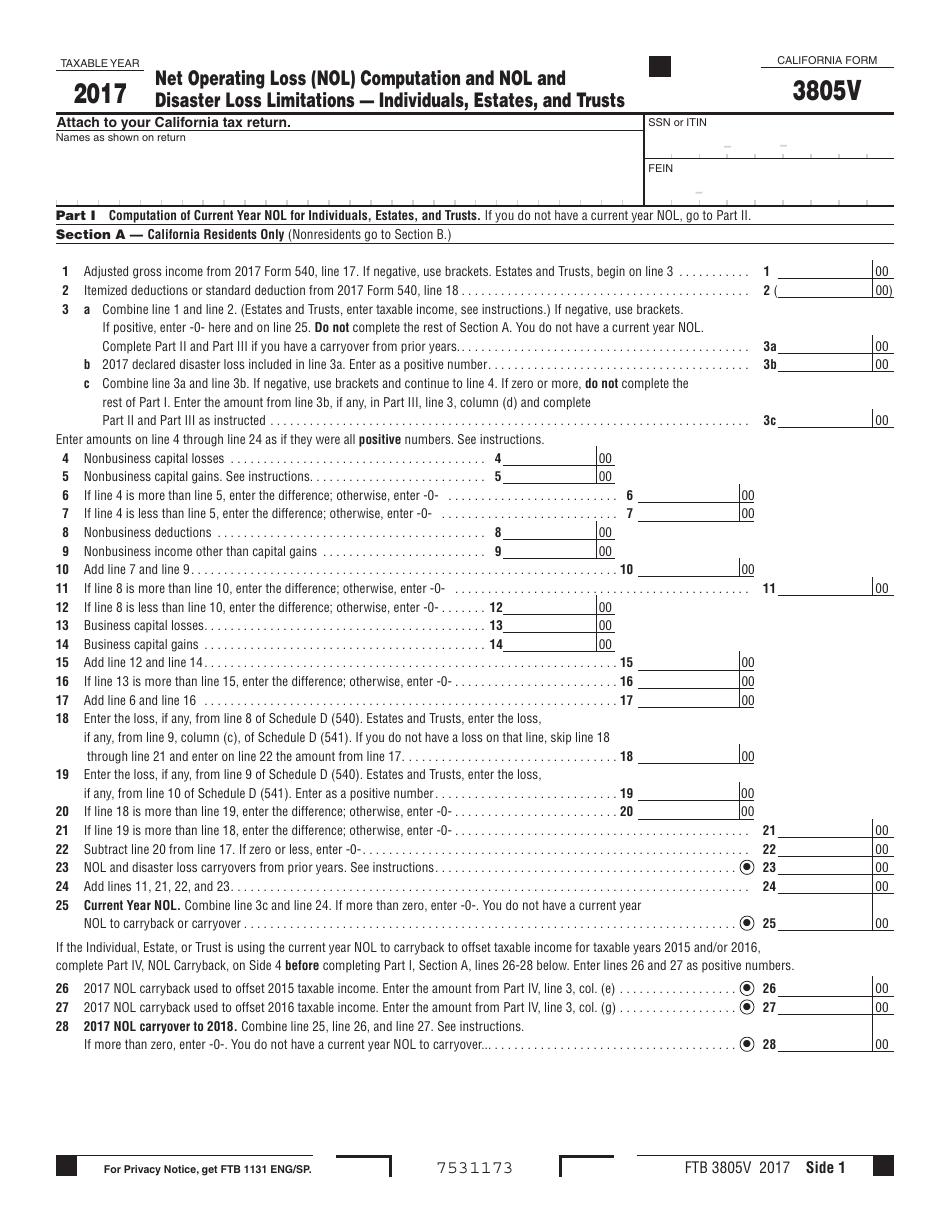

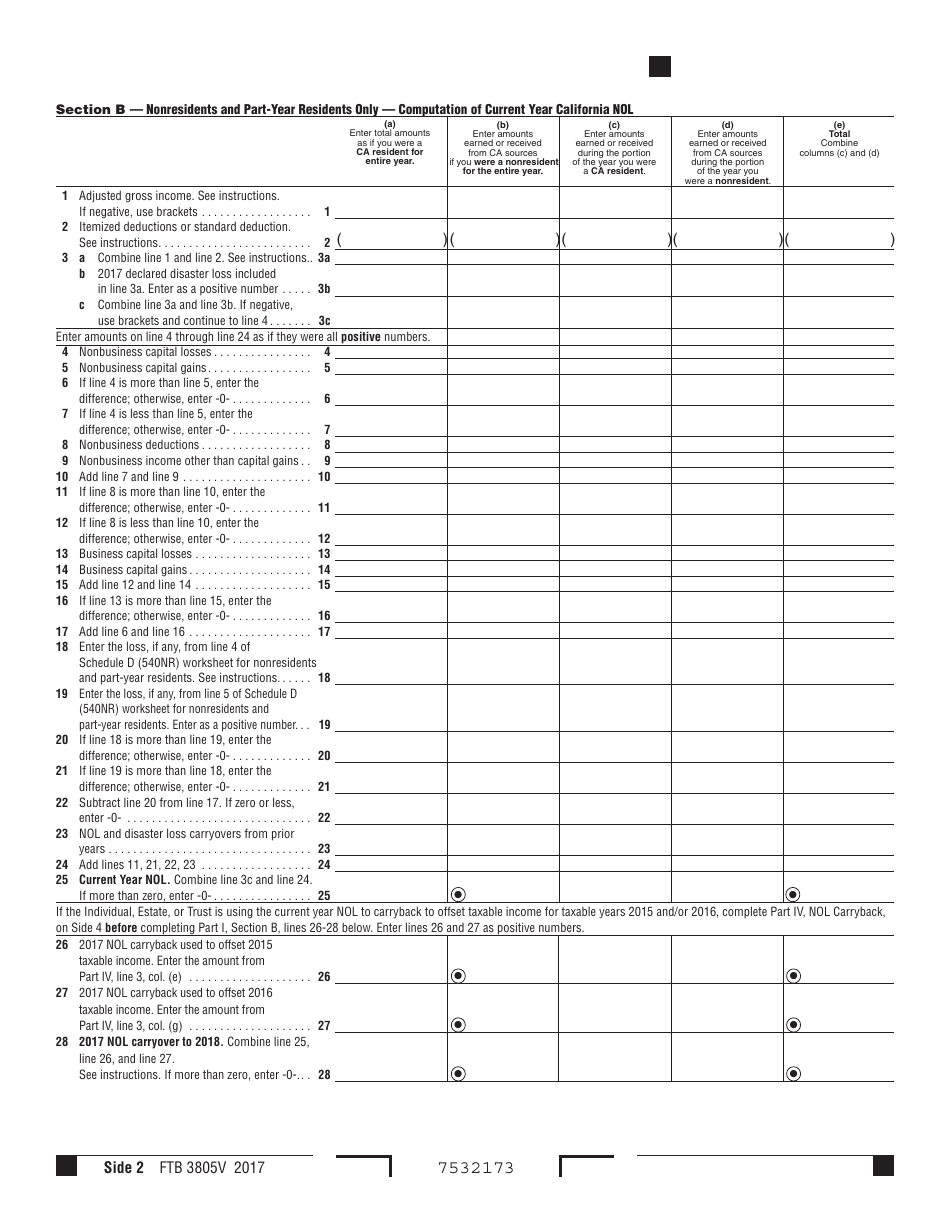

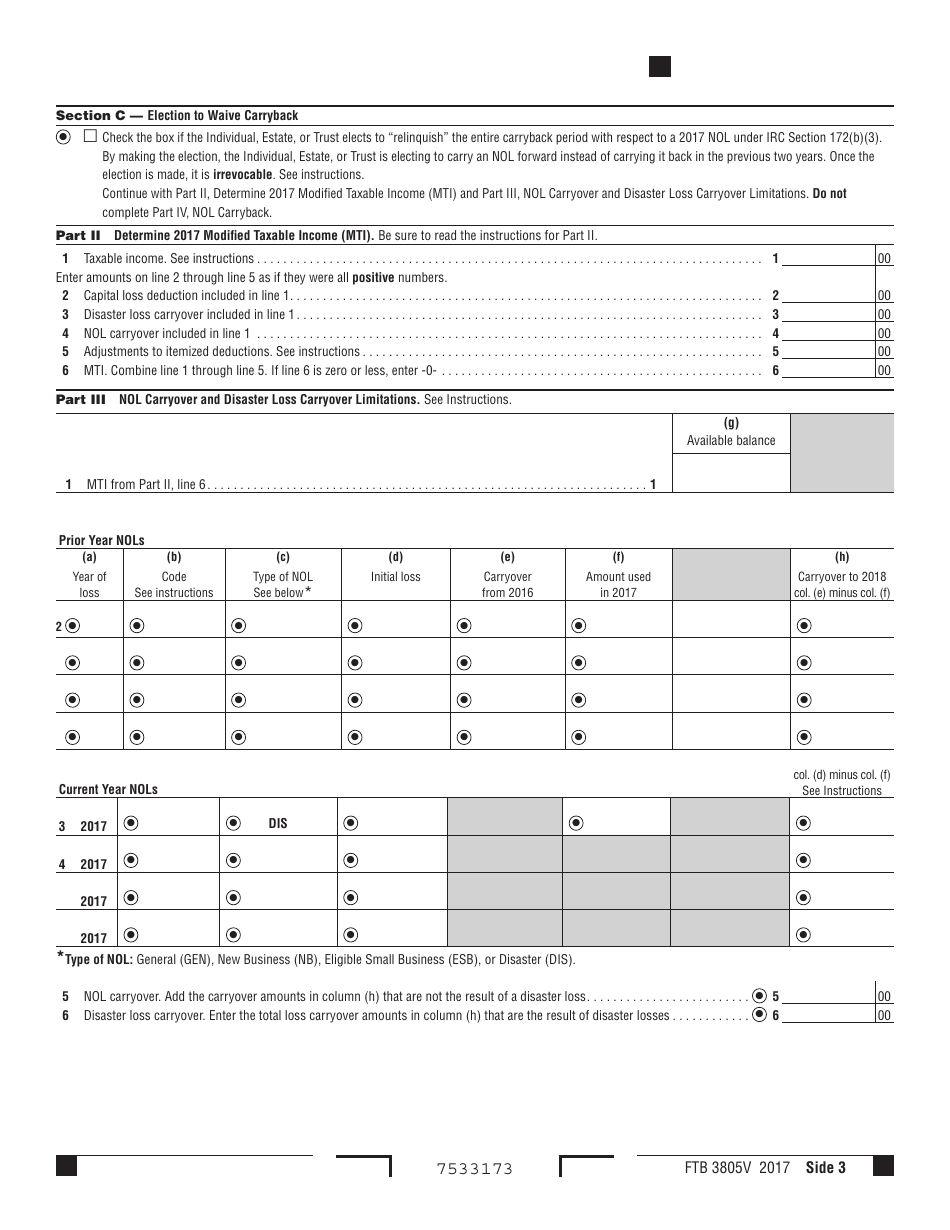

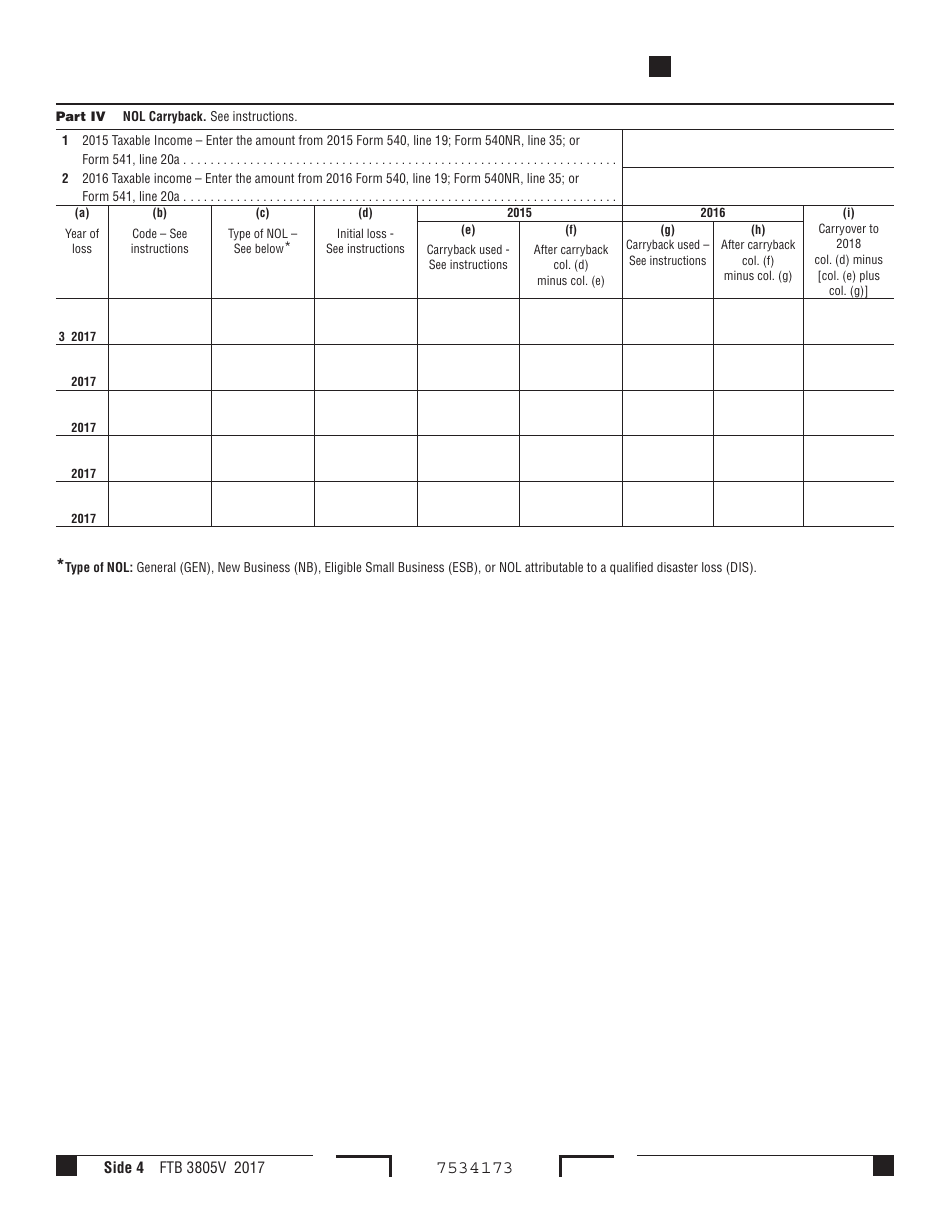

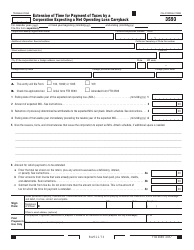

Form FTB3805V Net Operating Loss (Nol) Computation and Nol and Disaster Loss Limitations " Individuals, Estates, and Trusts - California

What Is Form FTB3805V?

This is a legal form that was released by the California Franchise Tax Board - a government authority operating within California. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form FTB3805V?

A: Form FTB3805V is used to compute the Net Operating Loss (NOL) and the NOL and Disaster Loss Limitations for individuals, estates, and trusts in California.

Q: Who needs to file Form FTB3805V?

A: Individuals, estates, and trusts in California who have incurred a Net Operating Loss (NOL) need to file Form FTB3805V to compute the NOL and the NOL and Disaster Loss Limitations.

Q: What is a Net Operating Loss (NOL)?

A: A Net Operating Loss (NOL) occurs when a taxpayer's deductible expenses exceed their taxable income.

Q: What are the NOL Limitations?

A: The NOL Limitations are the rules and regulations that determine how much of a Net Operating Loss (NOL) can be deducted in a given tax year.

Q: What are the Disaster Loss Limitations?

A: The Disaster Loss Limitations are the rules and regulations that determine how much of a disaster loss can be deducted in a given tax year.

Q: Why do I need to file Form FTB3805V?

A: You need to file Form FTB3805V to compute your Net Operating Loss (NOL) and determine the limitations on how much of the NOL and disaster losses can be deducted in a given tax year.

Form Details:

- Released on January 1, 2017;

- The latest edition provided by the California Franchise Tax Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form FTB3805V by clicking the link below or browse more documents and templates provided by the California Franchise Tax Board.