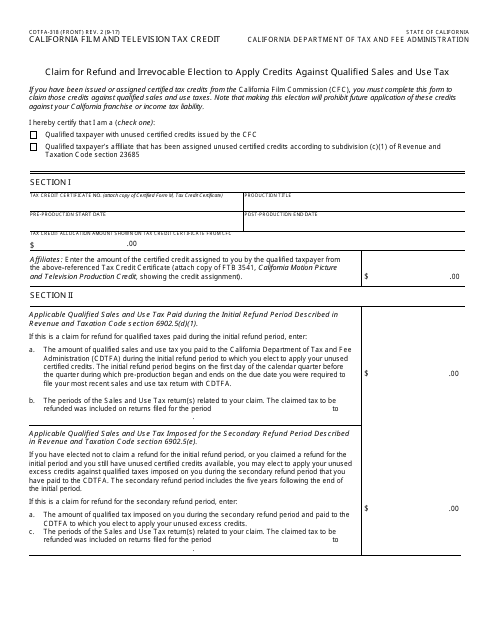

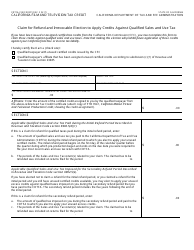

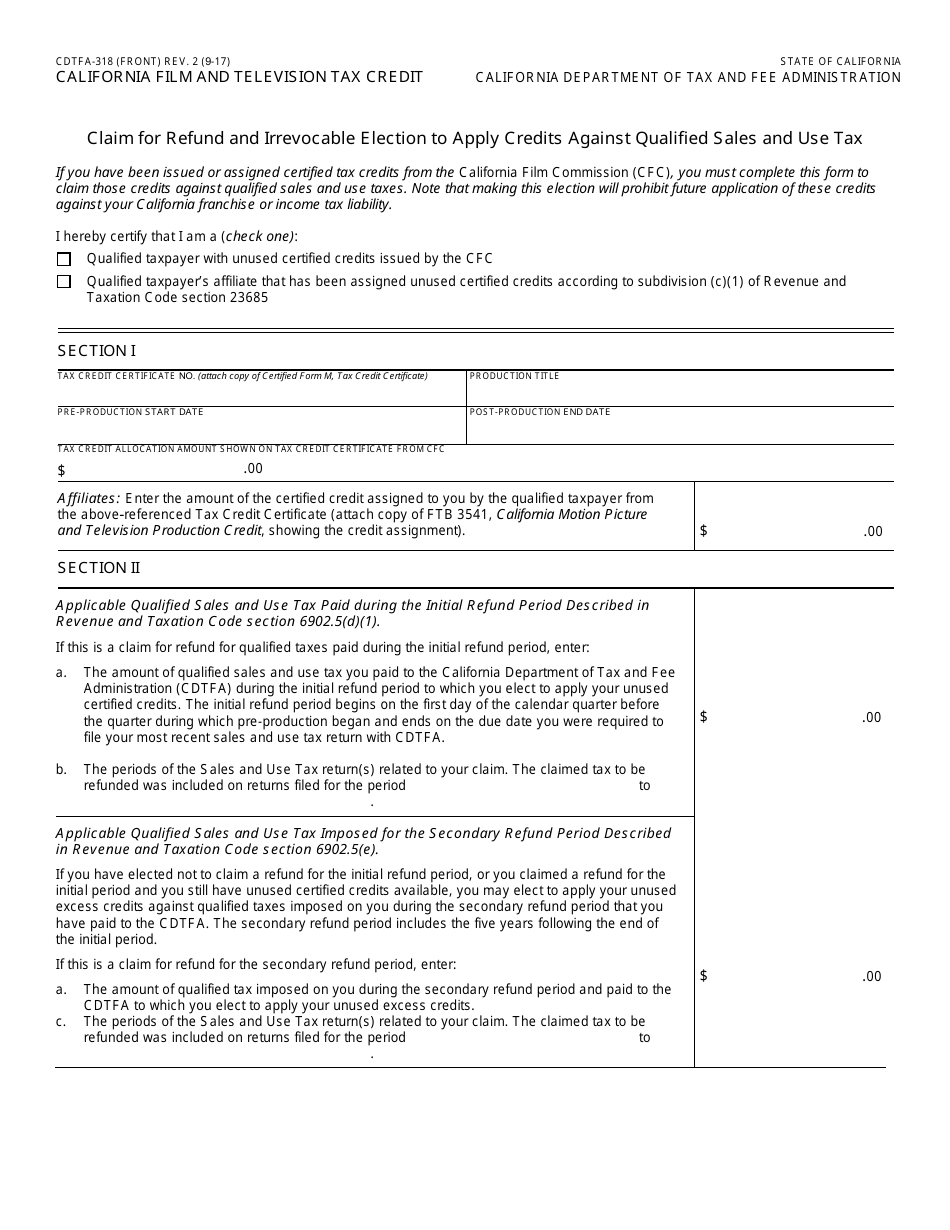

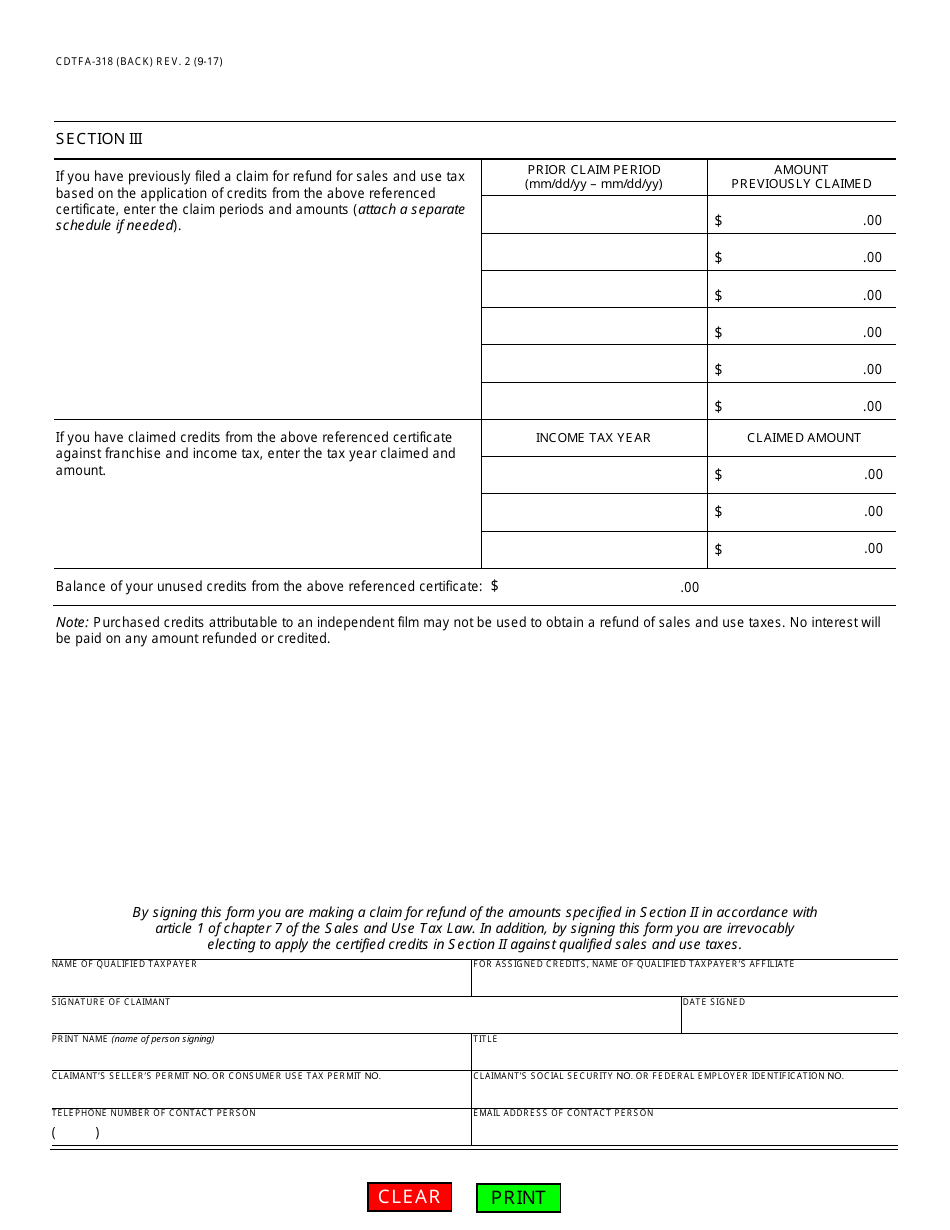

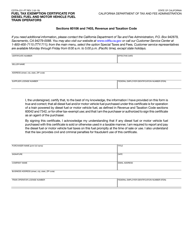

Form CDTFA-318 California Film and Television Tax Credit - California

What Is Form CDTFA-318?

This is a legal form that was released by the California Department of Tax and Fee Administration - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CDTFA-318?

A: Form CDTFA-318 is the California Film and Television Tax Credit form.

Q: What is the purpose of Form CDTFA-318?

A: Form CDTFA-318 is used to claim the California Film and Television Tax Credit.

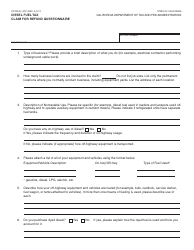

Q: Who needs to fill out Form CDTFA-318?

A: Film and television production companies that are eligible for the California Film and Television Tax Credit need to fill out Form CDTFA-318.

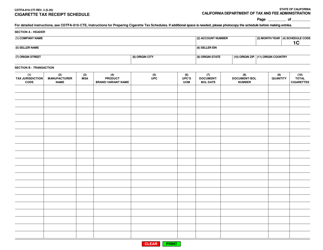

Q: What information is required on Form CDTFA-318?

A: Form CDTFA-318 requires information about the production company, the project, the estimated qualified expenditures, and other supporting documentation.

Q: Are there any deadlines to file Form CDTFA-318?

A: Yes, Form CDTFA-318 must be filed with the CDTFA by the due date specified in the tax credit agreement.

Q: What happens after I file Form CDTFA-318?

A: After filing Form CDTFA-318, the CDTFA will review the form and supporting documentation, and if approved, the production company may be eligible for the California Film and Television Tax Credit.

Q: Is the California Film and Television Tax Credit refundable?

A: No, the California Film and Television Tax Credit is not refundable. It can only be used to offset California state tax liabilities.

Q: Can I claim the California Film and Television Tax Credit for a project that has already been completed?

A: No, the California Film and Television Tax Credit can only be claimed for qualified expenditures that occur during the taxable year in which the credit is authorized.

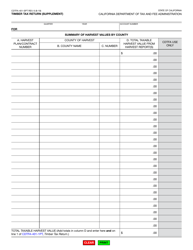

Q: How is the amount of the California Film and Television Tax Credit determined?

A: The amount of the California Film and Television Tax Credit is determined based on a percentage of the qualified expenditures made by the production company for the eligible project.

Form Details:

- Released on September 1, 2017;

- The latest edition provided by the California Department of Tax and Fee Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CDTFA-318 by clicking the link below or browse more documents and templates provided by the California Department of Tax and Fee Administration.