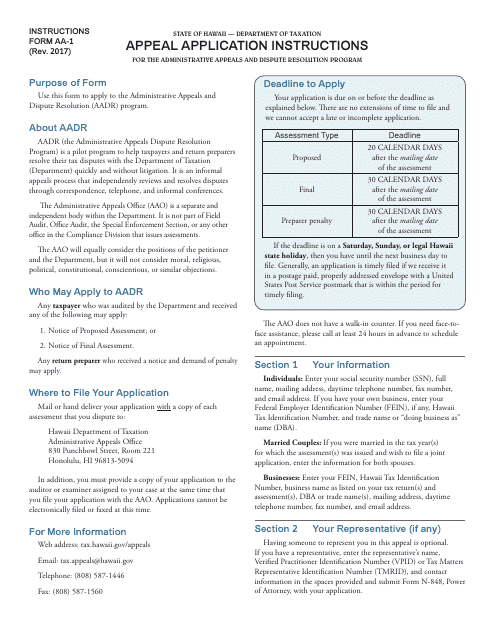

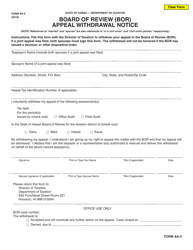

Instructions for Form AA-1 Appeal Application - Hawaii

This document contains official instructions for Form AA-1 , Appeal Application - a form released and collected by the Hawaii Department of Taxation. An up-to-date fillable Form AA-1 is available for download through this link.

FAQ

Q: What is Form AA-1?

A: Form AA-1 is an Appeal Application form in Hawaii.

Q: What is the purpose of Form AA-1?

A: The purpose of Form AA-1 is to appeal a decision made by a Hawaii state agency.

Q: Who needs to file Form AA-1?

A: Anyone who wants to appeal a decision made by a Hawaii state agency needs to file Form AA-1.

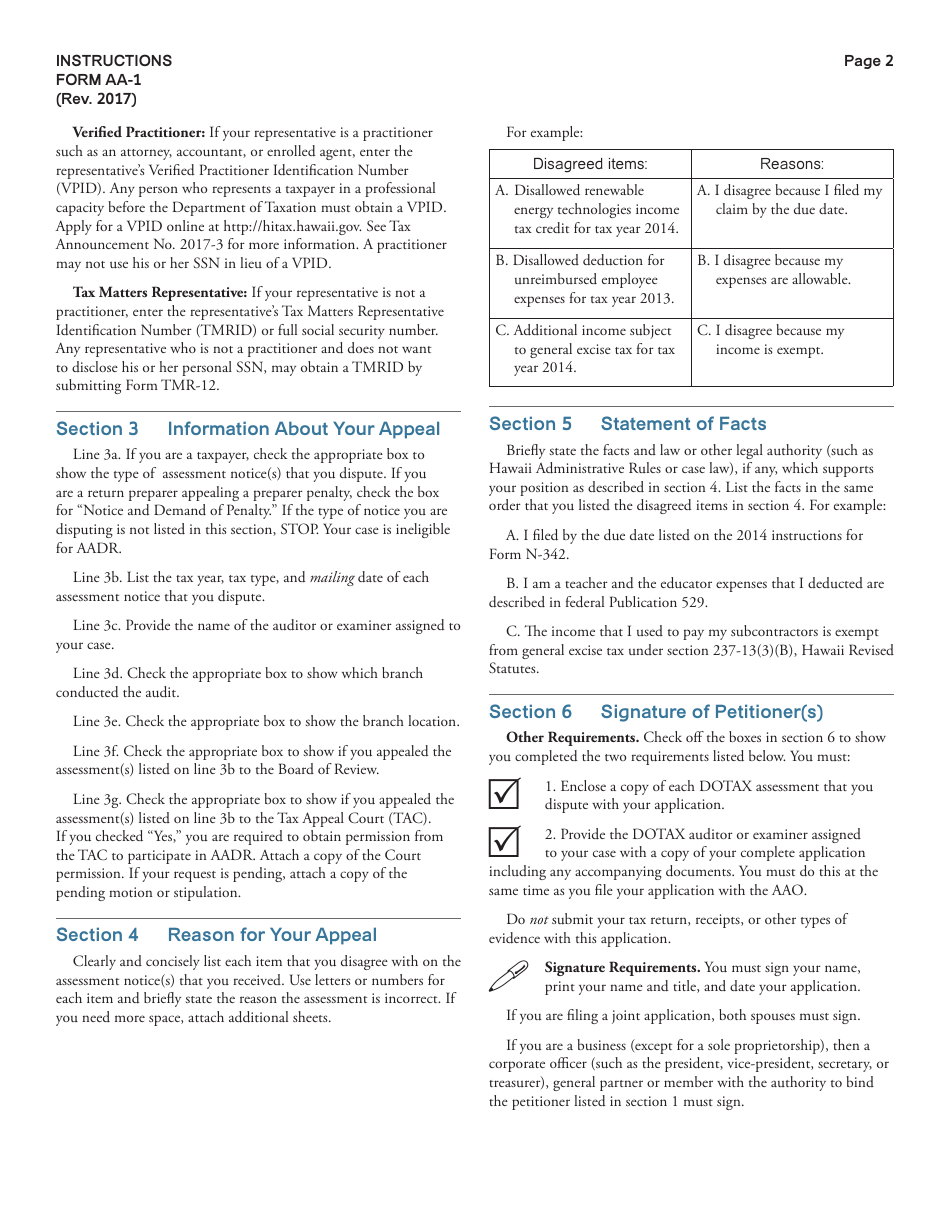

Q: What information is required on Form AA-1?

A: Some of the information required on Form AA-1 includes your name, contact information, a description of the decision being appealed, and the reasons for the appeal.

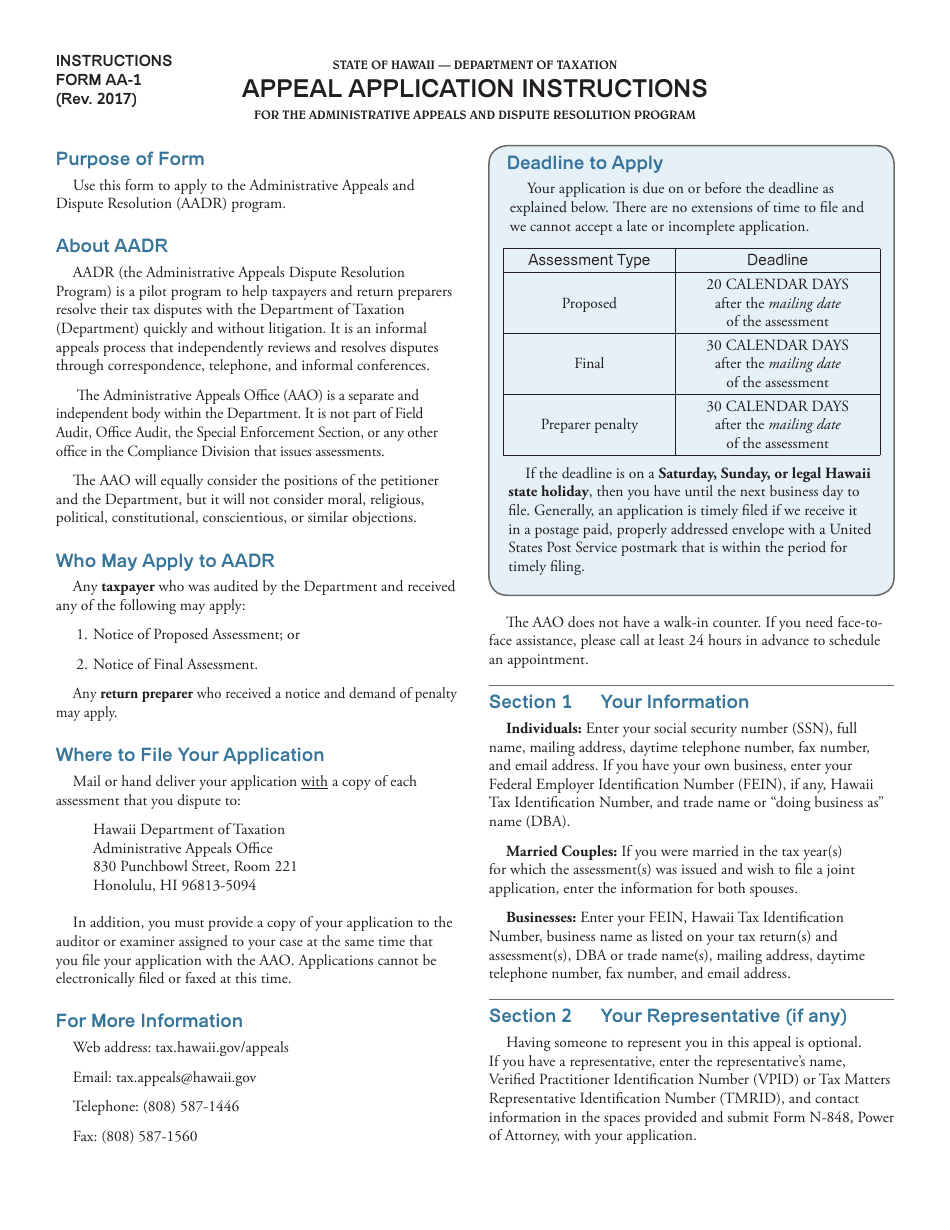

Q: What is the deadline for filing Form AA-1?

A: The deadline for filing Form AA-1 is typically stated in the decision being appealed. It is important to submit the form within the given timeframe.

Q: Can I file Form AA-1 electronically?

A: It depends on the specific Hawaii state agency. Some agencies may allow electronic filing, while others may require physical submission of the form.

Q: What should I do after filing Form AA-1?

A: After filing Form AA-1, you should wait for further instructions from the Hawaii state agency regarding the appeal process.

Q: Who can I contact for more information about Form AA-1?

A: For more information about Form AA-1, you can contact the Hawaii state agency that made the decision you are appealing.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Hawaii Department of Taxation.