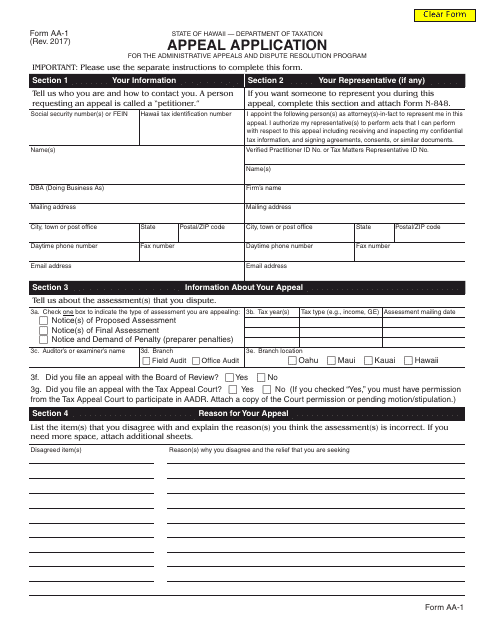

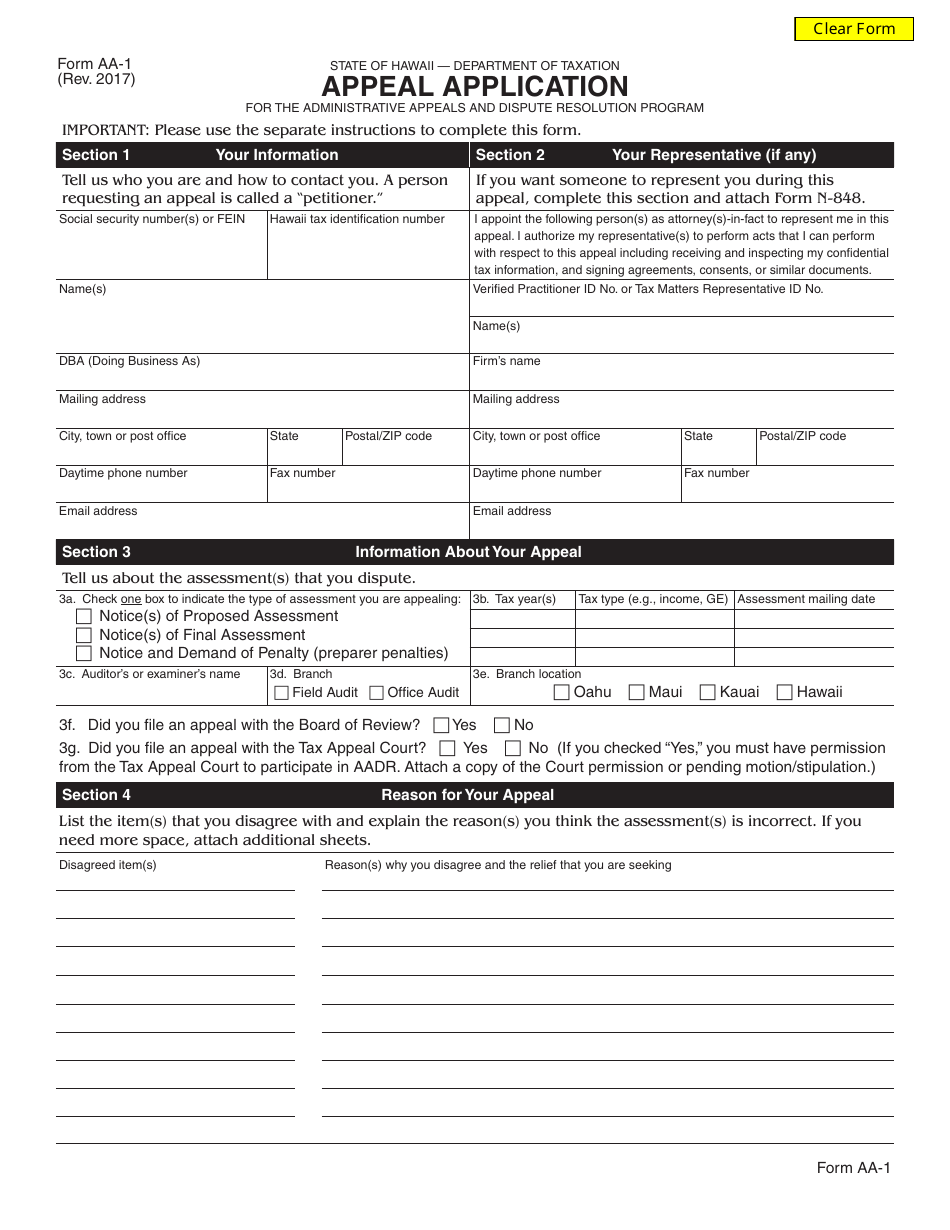

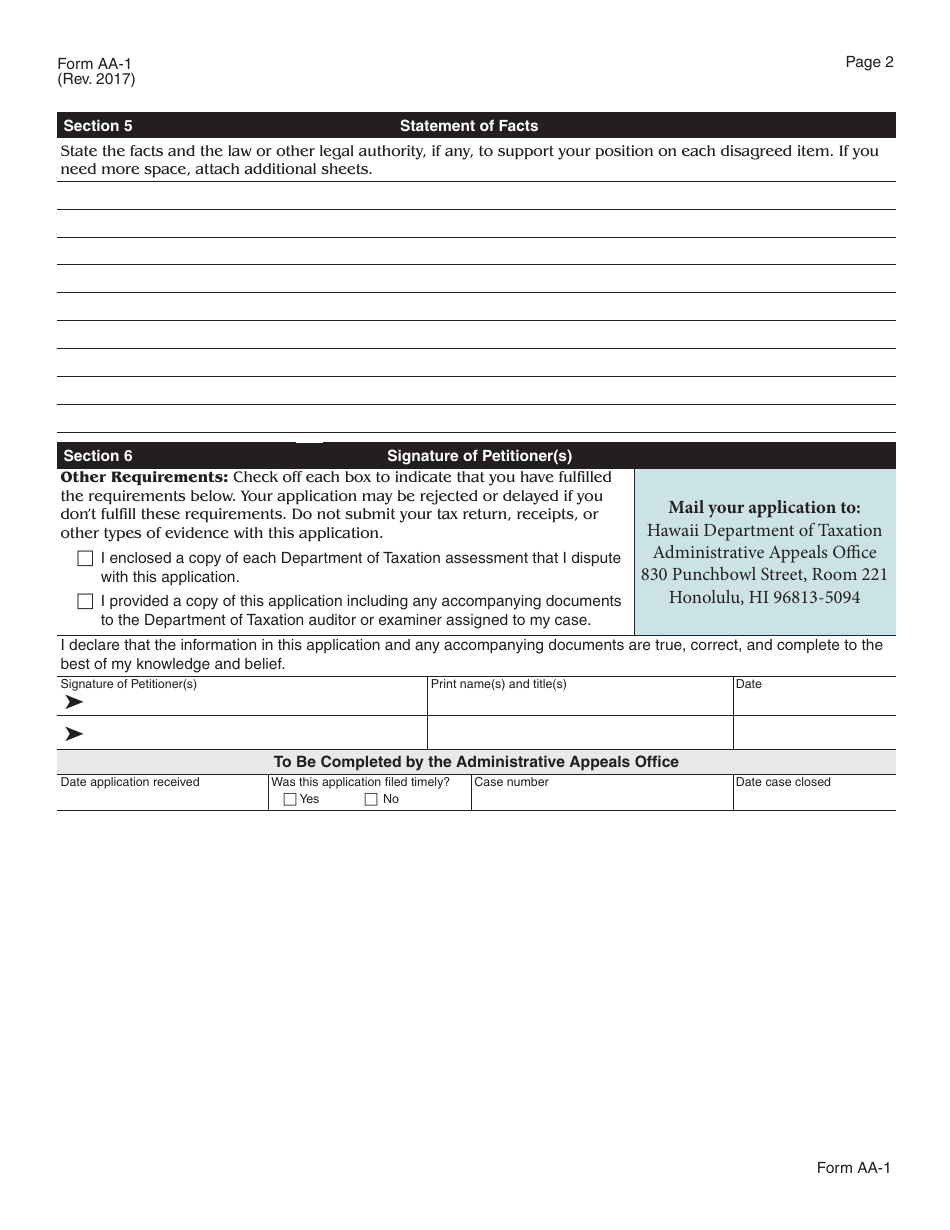

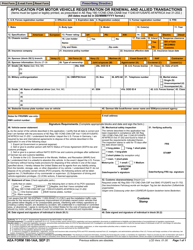

Form AA-1 Appeal Application - Hawaii

What Is Form AA-1?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form AA-1?

A: Form AA-1 is an appeal application in Hawaii.

Q: What is the purpose of Form AA-1?

A: The purpose of Form AA-1 is to appeal a decision in Hawaii.

Q: Is there a fee for filing Form AA-1?

A: There may be a fee associated with filing Form AA-1. Please check the instructions for the most up-to-date information.

Q: What should I include with Form AA-1?

A: You should carefully follow the instructions provided with Form AA-1 and include any required supporting documentation.

Q: Is there a deadline for submitting Form AA-1?

A: Yes, there is typically a deadline for submitting Form AA-1. Please refer to the instructions for the specific deadline.

Q: Can I appeal a decision without using Form AA-1?

A: No, you must use Form AA-1 to appeal a decision in Hawaii.

Q: Can I get assistance with filling out Form AA-1?

A: Yes, you may be able to get assistance with filling out Form AA-1. Contact the relevant Hawaii government office for more information.

Q: Is Form AA-1 specific to Hawaii only?

A: Yes, Form AA-1 is specific to the state of Hawaii and is not applicable in other states.

Form Details:

- Released on January 1, 2017;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form AA-1 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.