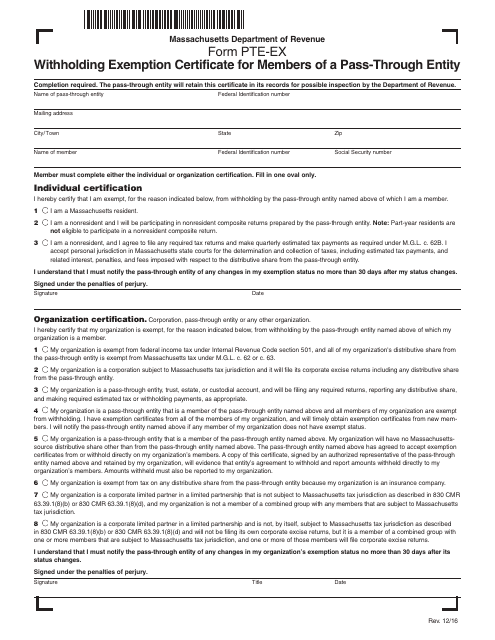

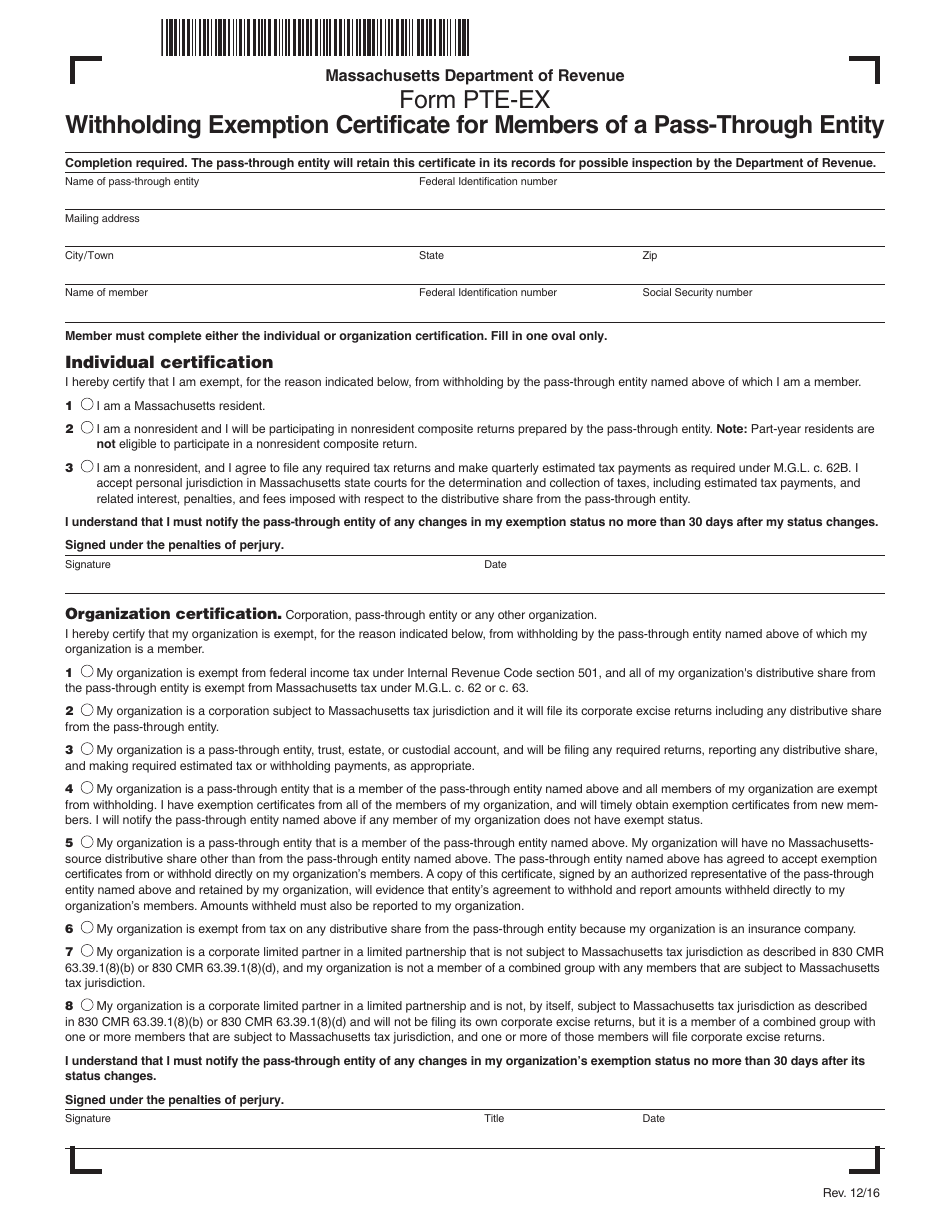

Form PTE-EX Withholding Exemption Certificate for Members of a Pass-Through Entity - Massachusetts

What Is Form PTE-EX?

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PTE-EX?

A: Form PTE-EX is a Withholding Exemption Certificate specifically for Members of a Pass-Through Entity in Massachusetts.

Q: Who needs to file Form PTE-EX?

A: Members of a Pass-Through Entity in Massachusetts who meet certain exemption requirements need to file Form PTE-EX.

Q: What is a Pass-Through Entity?

A: A Pass-Through Entity is a business entity that does not pay taxes itself, but passes through its income, losses, deductions, and credits to its owners.

Q: What is the purpose of Form PTE-EX?

A: The purpose of Form PTE-EX is to claim an exemption from income tax withholding on income distributed by a Pass-Through Entity.

Q: What information is required on Form PTE-EX?

A: Form PTE-EX requires the member's name, social security number, and the pass-through entity's name and identification number.

Form Details:

- Released on December 1, 2016;

- The latest edition provided by the Massachusetts Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form PTE-EX by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.