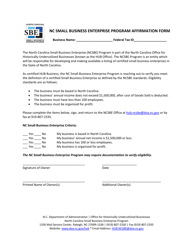

Form D-403 NC-NPA Nonresident Partner Affirmation - North Carolina

What Is Form D-403 NC-NPA?

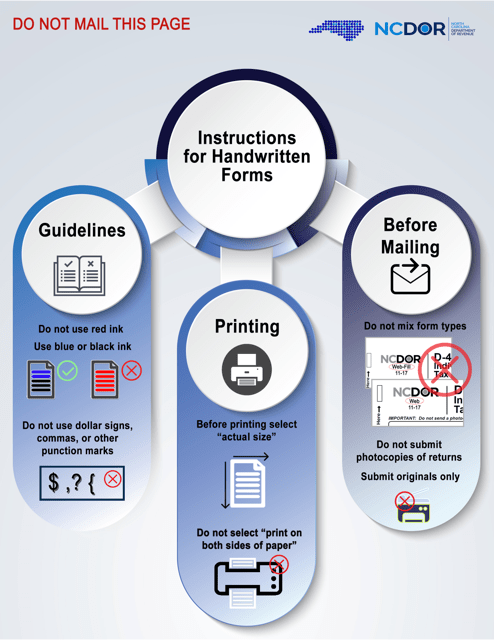

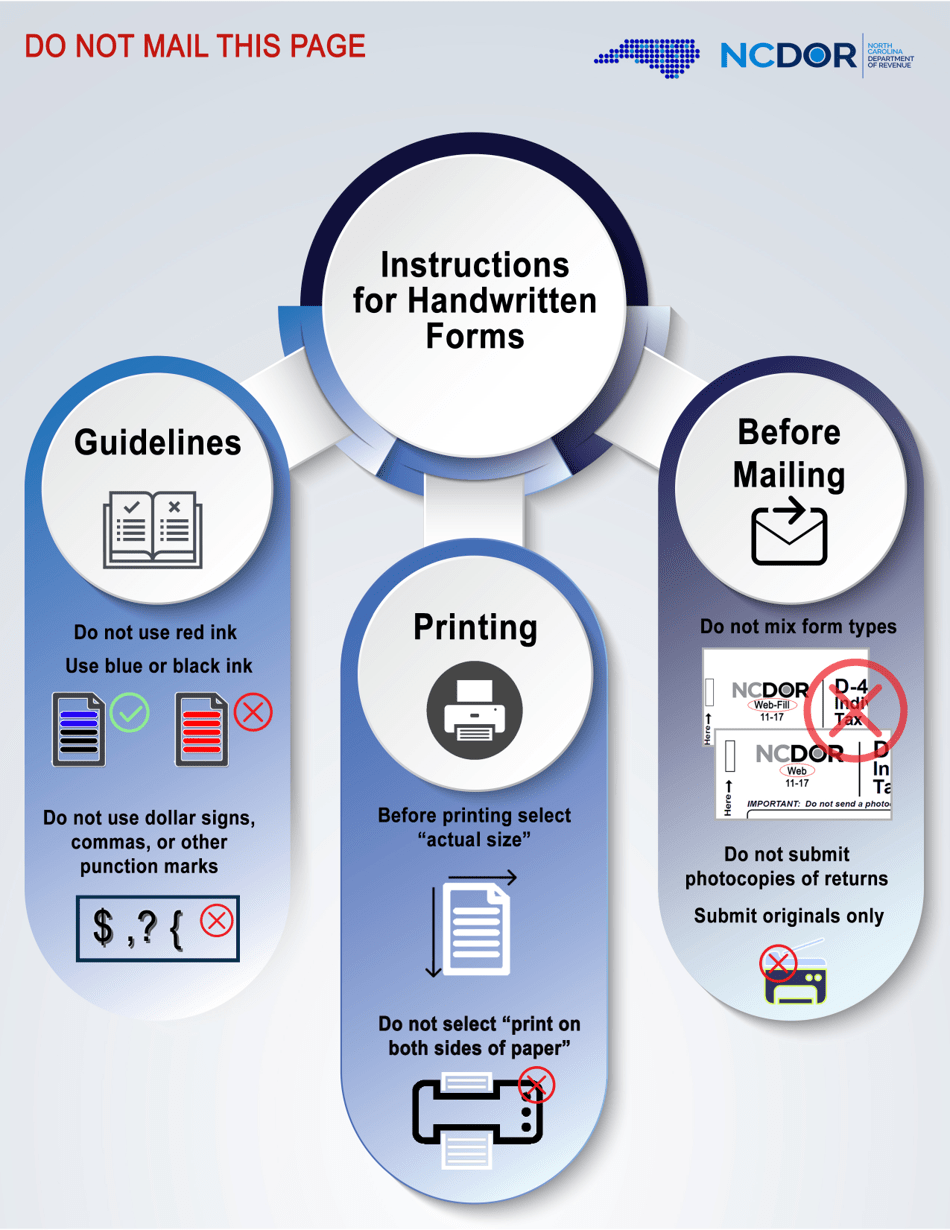

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

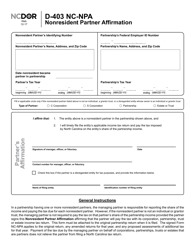

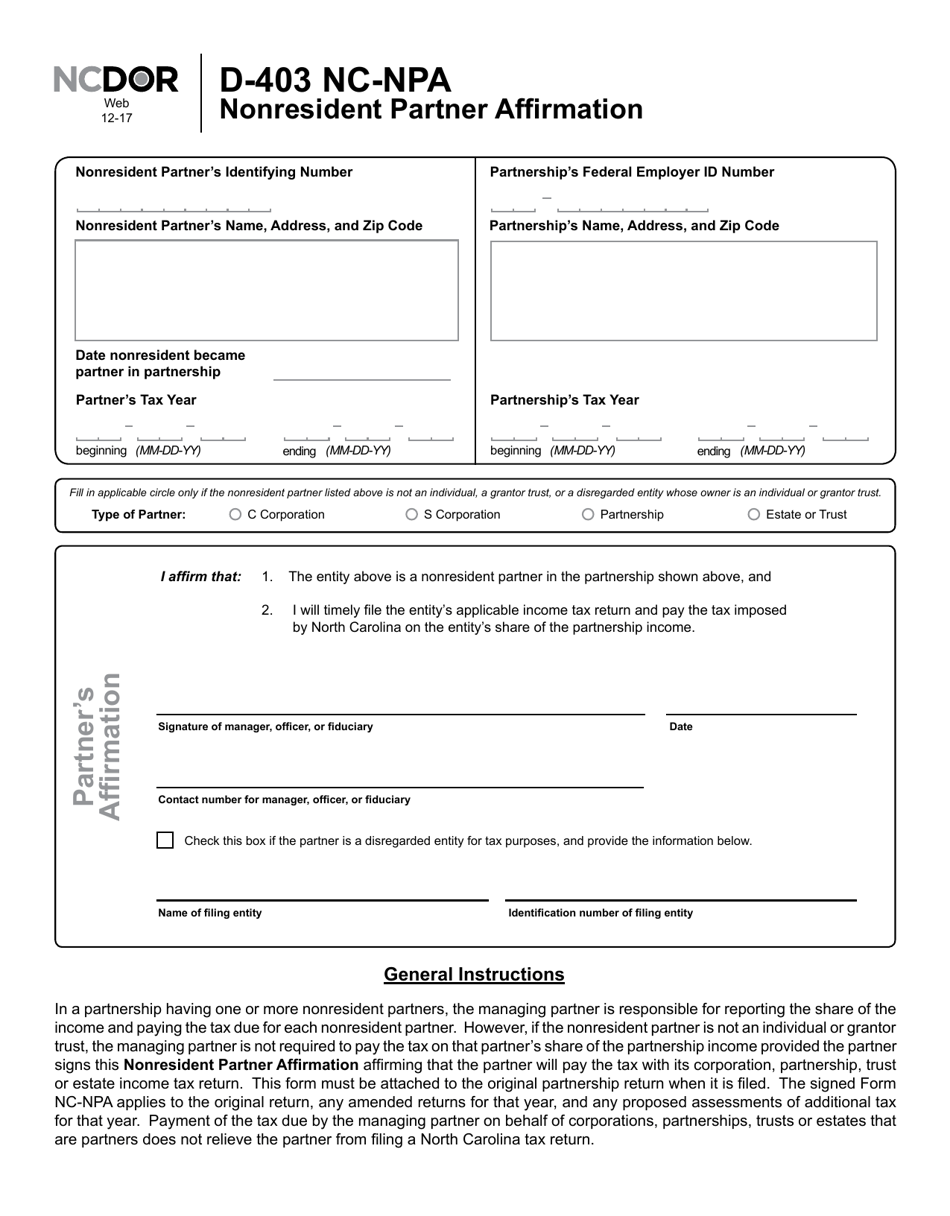

Q: What is Form D-403 NC-NPA?

A: Form D-403 NC-NPA is a tax form used by nonresident partners to affirm their status in North Carolina.

Q: Who needs to file Form D-403 NC-NPA?

A: Nonresident partners who want to affirm their status in North Carolina need to file Form D-403 NC-NPA.

Q: What information is required on Form D-403 NC-NPA?

A: Form D-403 NC-NPA requires information such as the partner's name, address, and identification number.

Q: When is the deadline to file Form D-403 NC-NPA?

A: The deadline to file Form D-403 NC-NPA is generally the same as the deadline for filing your North Carolina partnership tax return.

Q: Are there any penalties for not filing Form D-403 NC-NPA?

A: Yes, there may be penalties for not filing Form D-403 NC-NPA, such as the denial of certain deductions or exemptions.

Form Details:

- Released on December 1, 2017;

- The latest edition provided by the North Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form D-403 NC-NPA by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.