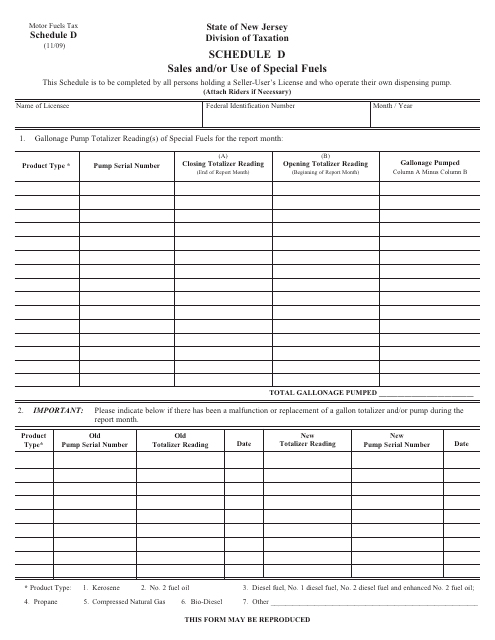

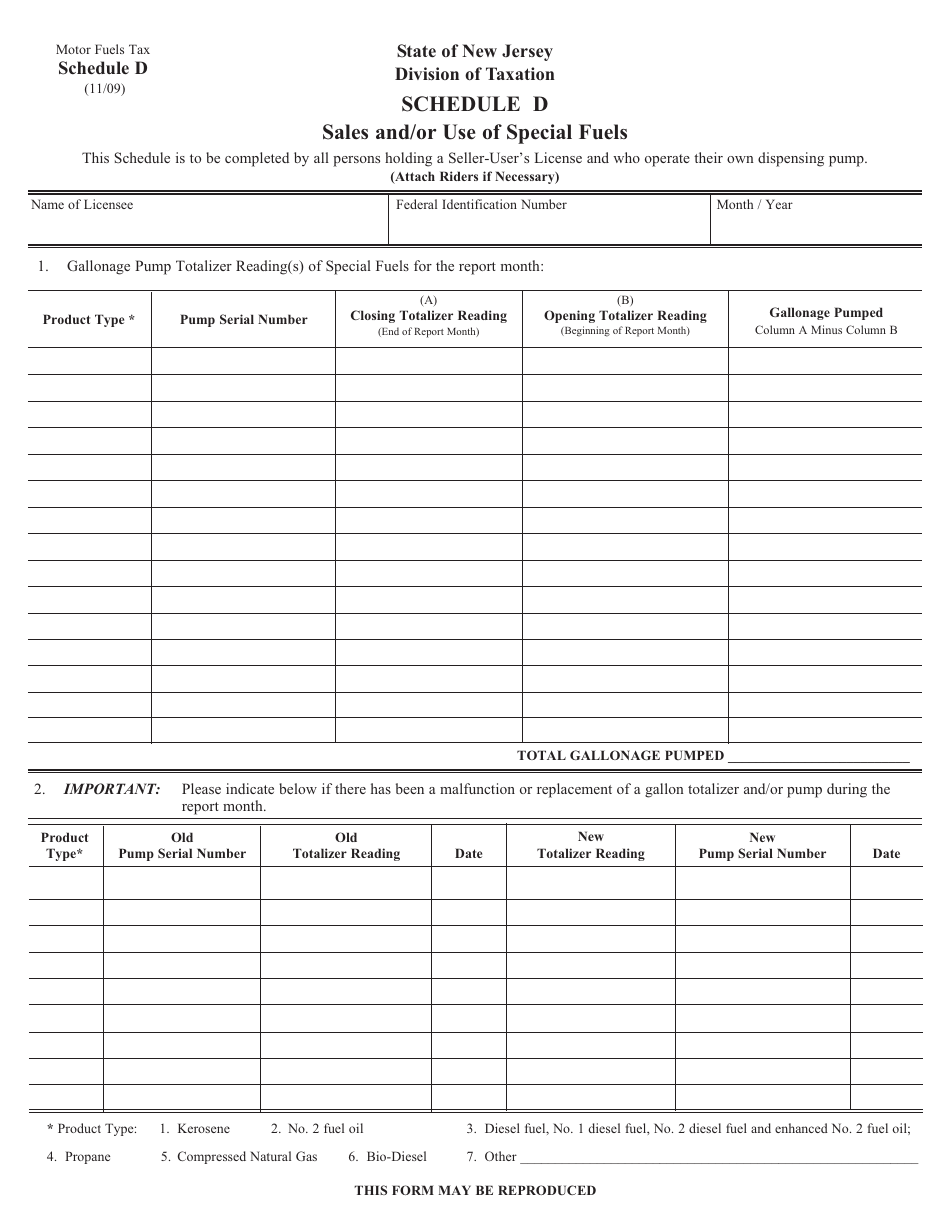

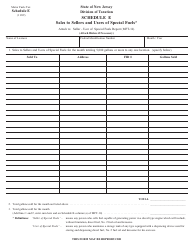

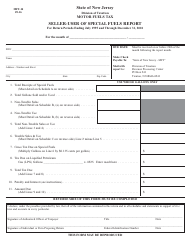

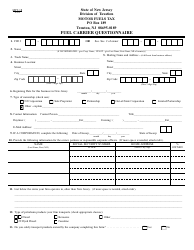

Form MFT-10 Schedule D Sales and / or Use of Special Fuels - New Jersey

What Is Form MFT-10 Schedule D?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey.The document is a supplement to Form MFT-10, Seller-User of Special Fuels Report. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form MFT-10?

A: Form MFT-10 is a schedule used for reporting sales and/or use of special fuels in New Jersey.

Q: What is Schedule D of Form MFT-10?

A: Schedule D is a section of Form MFT-10 specifically dedicated to reporting sales and/or use of special fuels in New Jersey.

Q: What are special fuels?

A: Special fuels include diesel fuel, kerosene, and other fuels commonly used in motor vehicles and equipment.

Q: Who needs to file Form MFT-10 Schedule D?

A: Anyone engaged in the sale or use of special fuels in New Jersey needs to file Form MFT-10 Schedule D.

Q: How often do I need to file Form MFT-10 Schedule D?

A: Form MFT-10 Schedule D needs to be filed quarterly.

Form Details:

- Released on November 1, 2009;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form MFT-10 Schedule D by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.