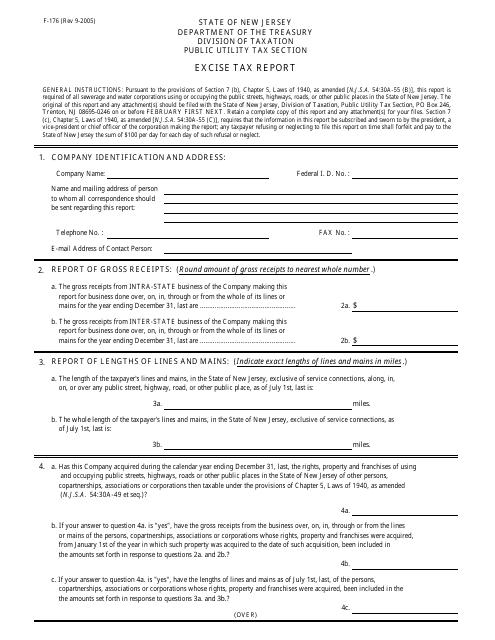

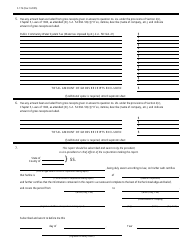

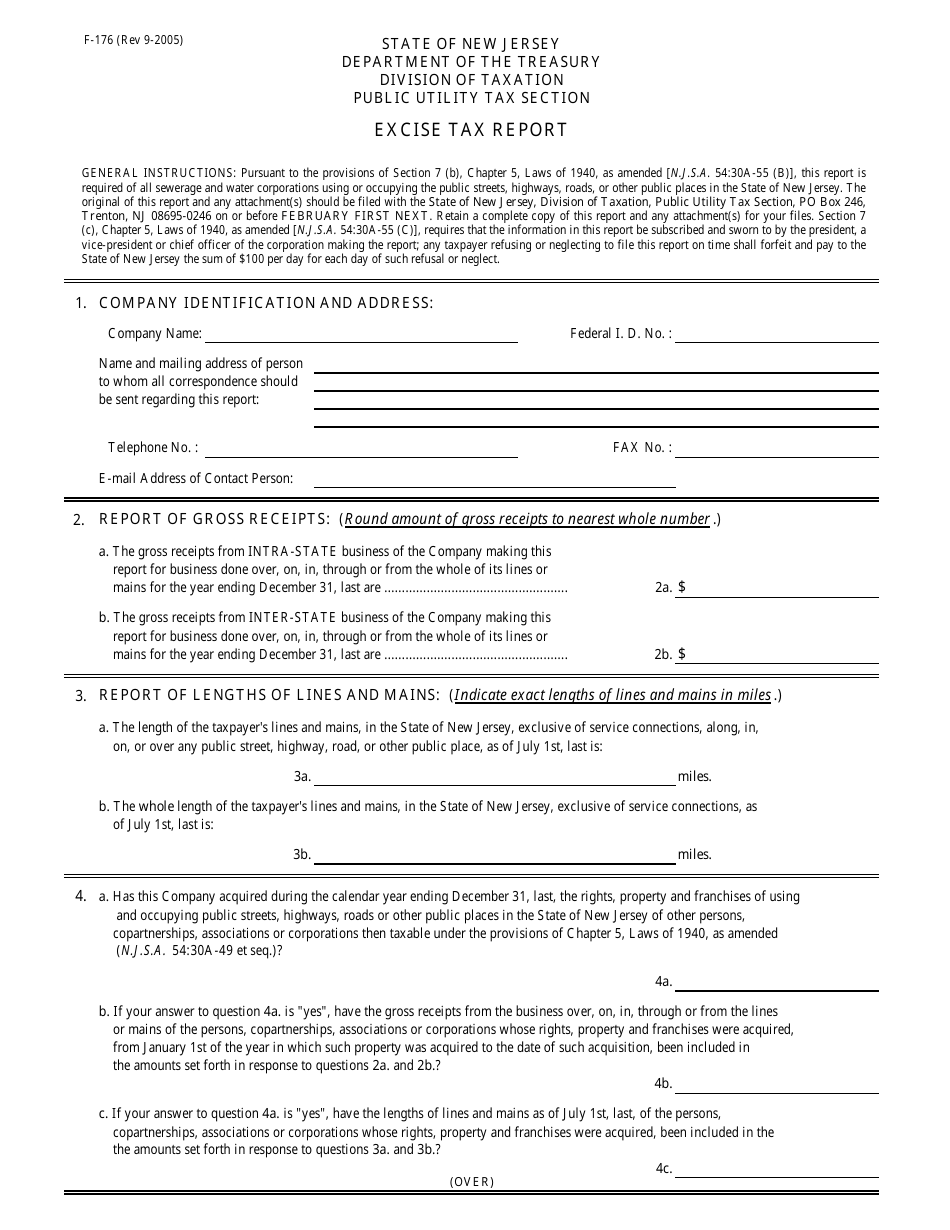

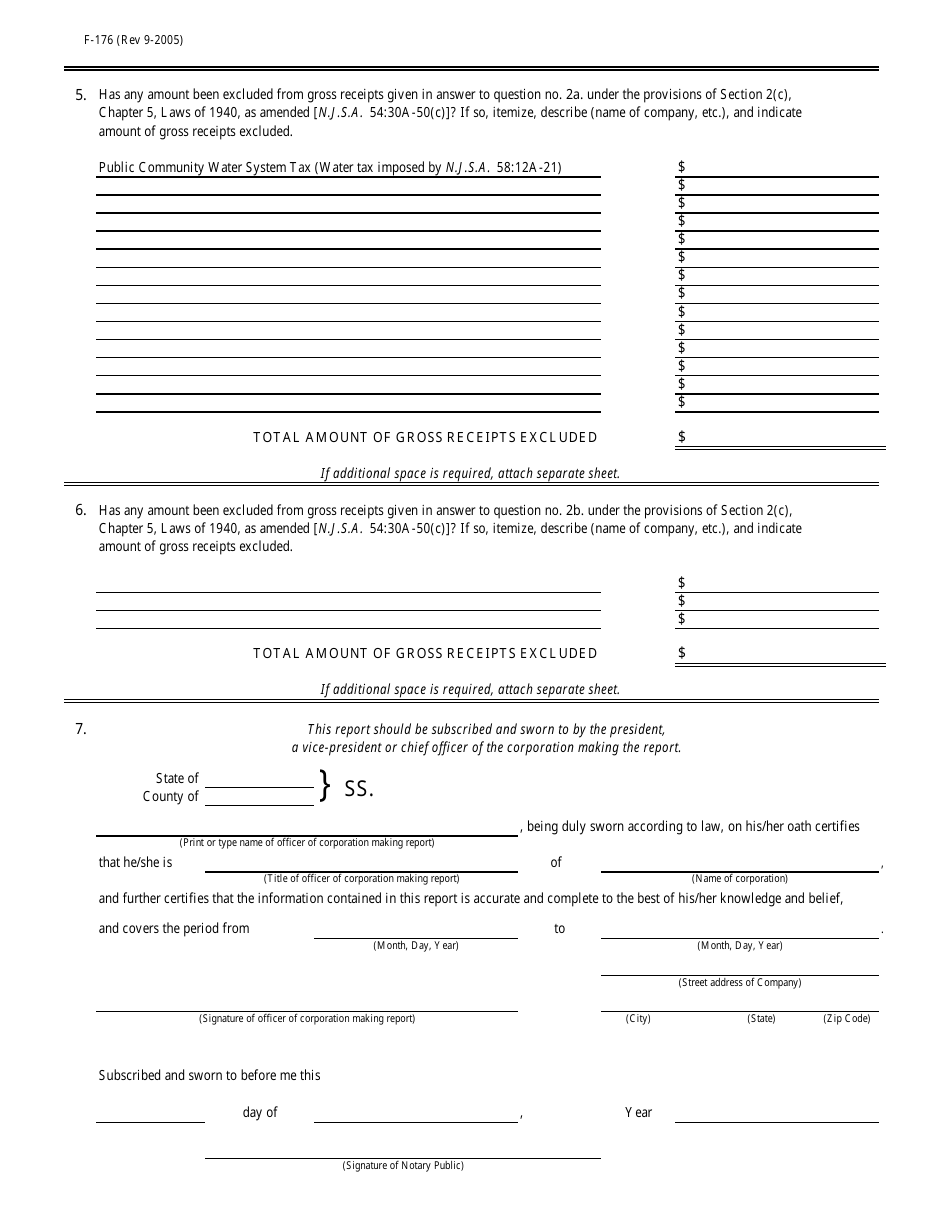

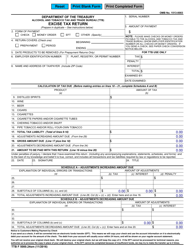

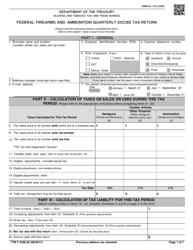

Form F-176 Excise Tax Report - New Jersey

What Is Form F-176?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form F-176?

A: Form F-176 is an Excise Tax Report used in New Jersey.

Q: What is an excise tax?

A: An excise tax is a tax imposed on specific goods or activities, such as the sale of alcohol or cigarettes.

Q: Who is required to file Form F-176?

A: Businesses engaged in certain activities subject to excise tax in New Jersey are required to file Form F-176.

Q: What are some examples of activities subject to excise tax in New Jersey?

A: Some examples include the sale of alcohol, tobacco products, motor fuel, and petroleum products.

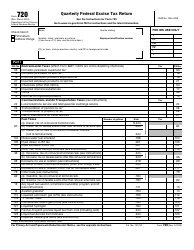

Q: When is Form F-176 due?

A: Form F-176 is typically due on a quarterly basis, with specific due dates outlined by the New Jersey Division of Taxation.

Q: Are there any penalties for late filing of Form F-176?

A: Yes, penalties may apply for late filing or failure to file Form F-176.

Q: Is there any additional documentation required to accompany Form F-176?

A: Depending on the nature of the excise tax activity, additional supporting documentation may be required.

Form Details:

- Released on September 1, 2005;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form F-176 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.