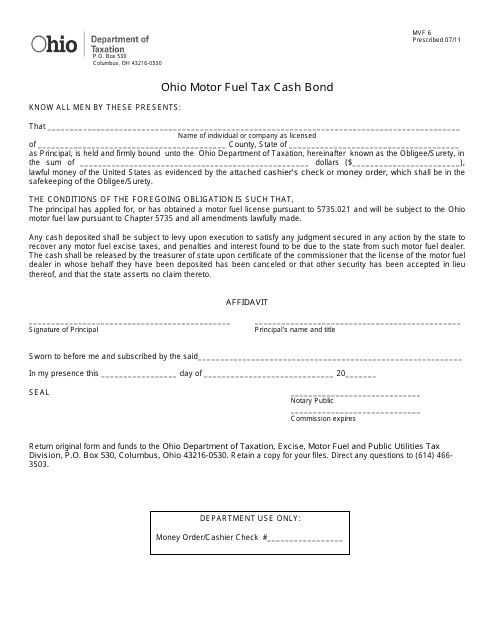

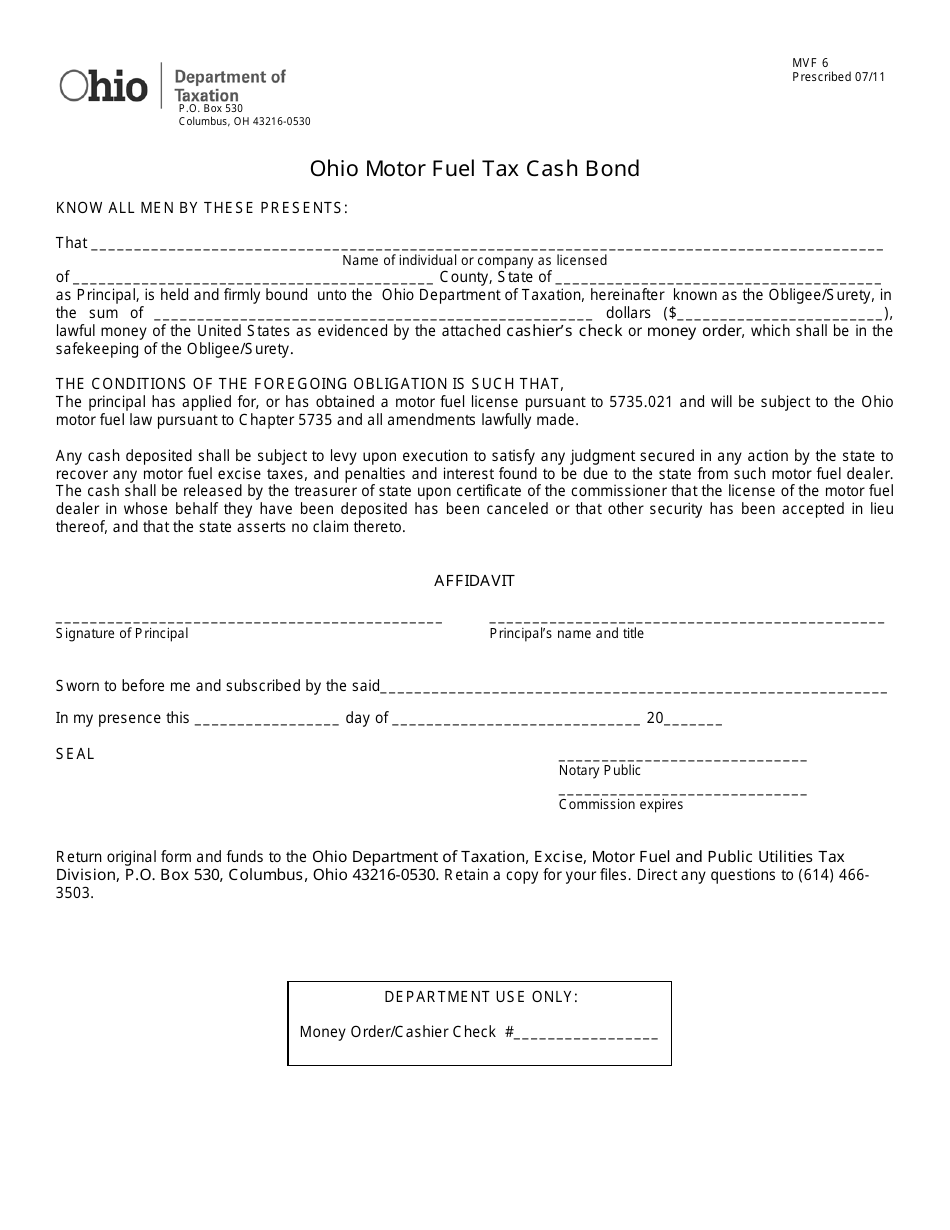

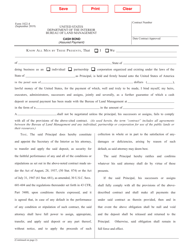

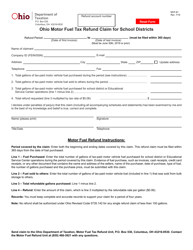

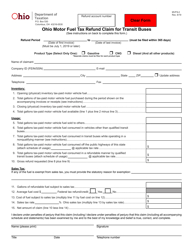

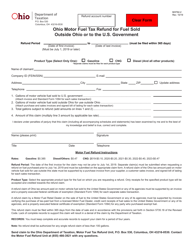

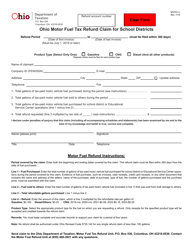

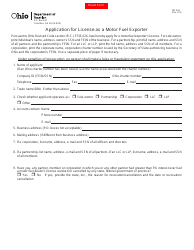

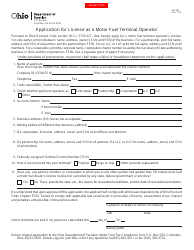

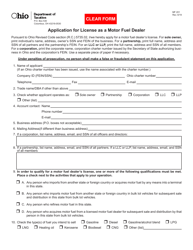

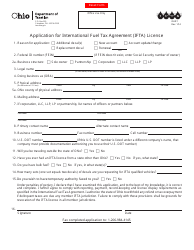

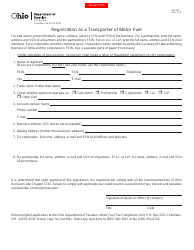

Form MVF6 Ohio Motor Fuel Tax Cash Bond - Ohio

What Is Form MVF6?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

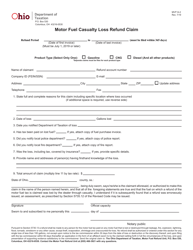

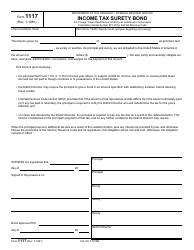

Q: What is the MVF6 Ohio Motor Fuel Tax Cash Bond?

A: The MVF6 Ohio Motor Fuel Tax Cash Bond is a form used in Ohio to obtain a bond for motor fueltax purposes.

Q: Who needs to file the MVF6 Ohio Motor Fuel Tax Cash Bond?

A: Any person or entity engaged in the distribution, sale, or use of motor fuel in Ohio may be required to file the MVF6 Ohio Motor Fuel Tax Cash Bond.

Q: What is the purpose of the MVF6 Ohio Motor Fuel Tax Cash Bond?

A: The purpose of the MVF6 Ohio Motor Fuel Tax Cash Bond is to ensure compliance with Ohio's motor fuel tax laws and to provide financial security for any unpaid taxes, penalties, or interest.

Q: How much does the MVF6 Ohio Motor Fuel Tax Cash Bond cost?

A: The cost of the MVF6 Ohio Motor Fuel Tax Cash Bond varies depending on the amount of fuel being distributed, sold, or used. It is best to contact the Ohio Department of Taxation for specific pricing information.

Q: How long is the MVF6 Ohio Motor Fuel Tax Cash Bond valid?

A: The MVF6 Ohio Motor Fuel Tax Cash Bond is typically valid for one year. It may need to be renewed annually depending on the requirements of the Ohio Department of Taxation.

Q: What happens if I fail to file the MVF6 Ohio Motor Fuel Tax Cash Bond?

A: Failure to file the MVF6 Ohio Motor Fuel Tax Cash Bond when required may result in penalties, interest, or other enforcement actions by the Ohio Department of Taxation.

Q: Can I cancel the MVF6 Ohio Motor Fuel Tax Cash Bond?

A: Yes, you can cancel the MVF6 Ohio Motor Fuel Tax Cash Bond. However, you must notify the Ohio Department of Taxation in writing and provide a replacement bond or alternative form of security.

Q: What if I have more questions about the MVF6 Ohio Motor Fuel Tax Cash Bond?

A: If you have more questions about the MVF6 Ohio Motor Fuel Tax Cash Bond, it is recommended to contact the Ohio Department of Taxation or consult with a legal or financial professional.

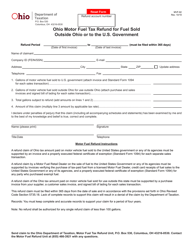

Q: Are there any exemptions to filing the MVF6 Ohio Motor Fuel Tax Cash Bond?

A: Yes, there are certain exemptions available for filing the MVF6 Ohio Motor Fuel Tax Cash Bond. It is advisable to check with the Ohio Department of Taxation for specific exemption criteria.

Form Details:

- Released on July 1, 2011;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form MVF6 by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.