This version of the form is not currently in use and is provided for reference only. Download this version of

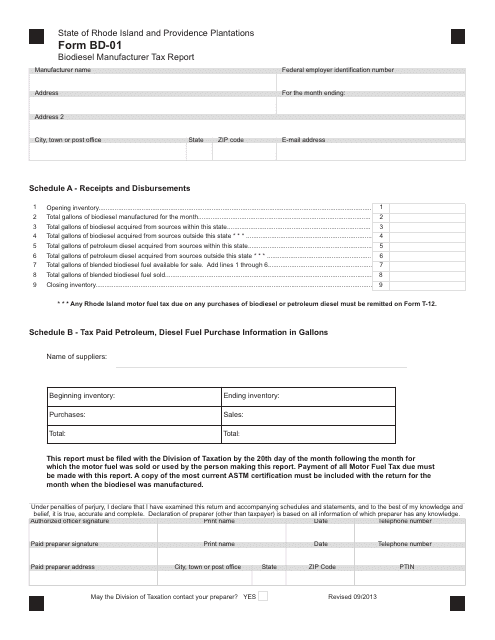

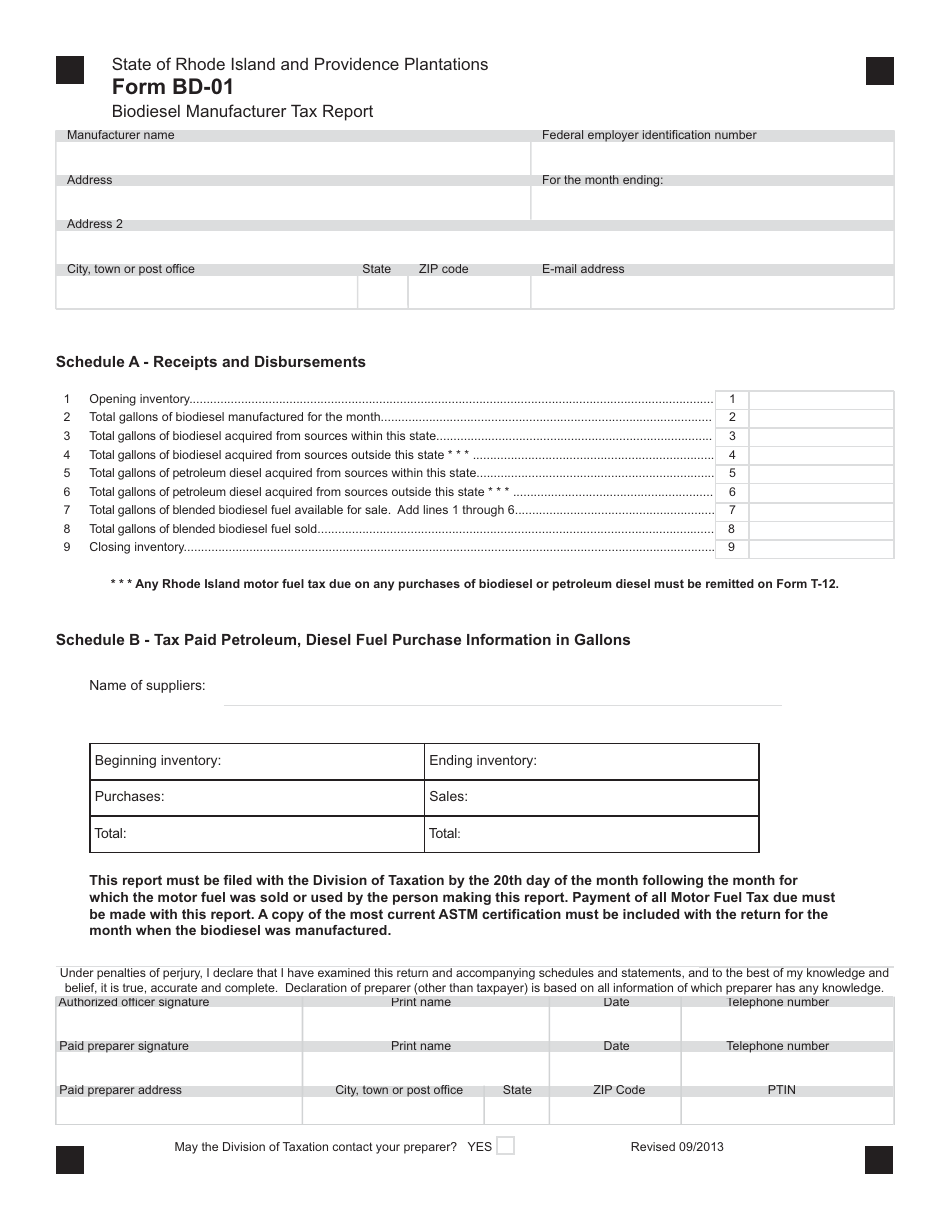

Form BD-01

for the current year.

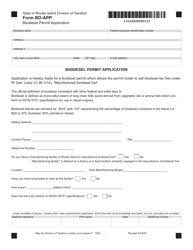

Form BD-01 Biodiesel Manufacturer Tax Report - Rhode Island

What Is Form BD-01?

This is a legal form that was released by the Rhode Island Department of Revenue - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form BD-01?

A: Form BD-01 is the Biodiesel Manufacturer Tax Report for Rhode Island.

Q: Who needs to file Form BD-01?

A: Biodiesel manufacturers in Rhode Island need to file Form BD-01.

Q: What is the purpose of Form BD-01?

A: Form BD-01 is used to report biodiesel production and calculate the associated tax in Rhode Island.

Q: When is Form BD-01 due?

A: Form BD-01 is due on a quarterly basis, with specific due dates provided by the Rhode Island Department of Revenue.

Q: Are there any penalties for late filing of Form BD-01?

A: Yes, there may be penalties for late filing, so it is important to submit the form on time.

Q: What information is required on Form BD-01?

A: Form BD-01 requires information about biodiesel production, sales, and other relevant details as specified by the Rhode Island Department of Revenue.

Q: Is Form BD-01 only for biodiesel manufacturers in Rhode Island?

A: Yes, Form BD-01 is specifically for biodiesel manufacturers operating in Rhode Island.

Q: Is there any additional documentation required along with Form BD-01?

A: Additional documentation may be required depending on the specific circumstances, so it is advisable to review the instructions provided with the form.

Form Details:

- Released on September 1, 2013;

- The latest edition provided by the Rhode Island Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form BD-01 by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue.