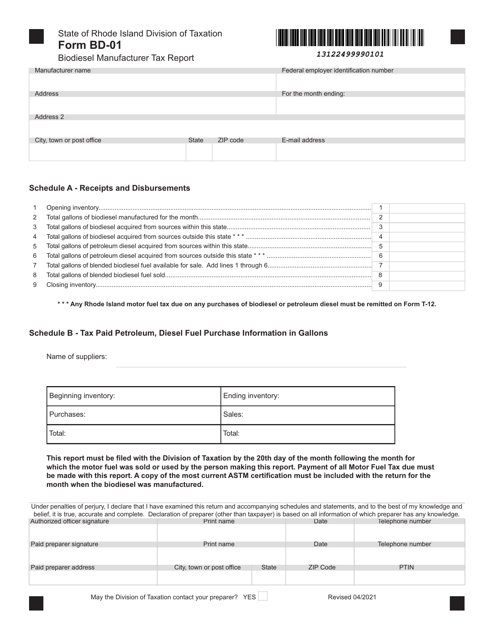

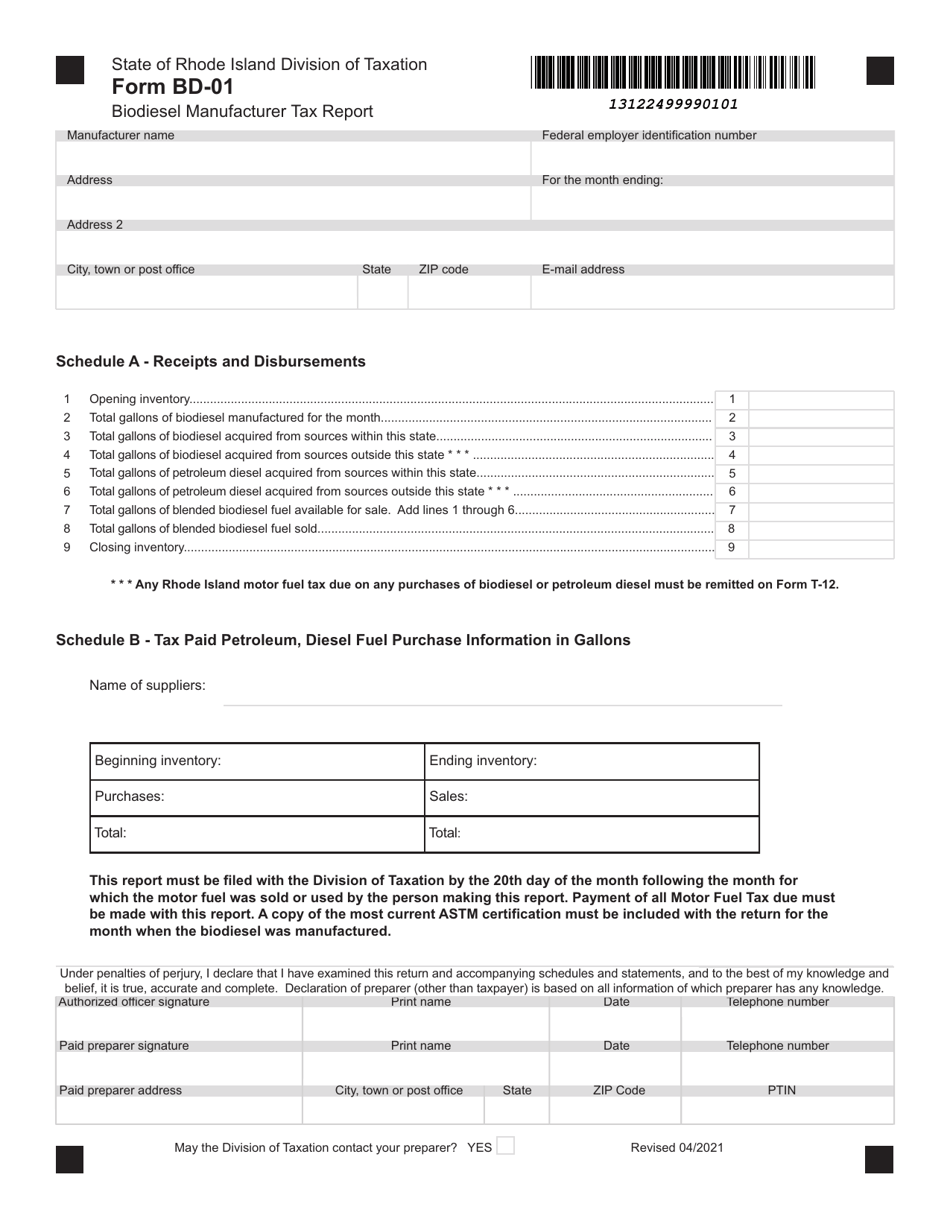

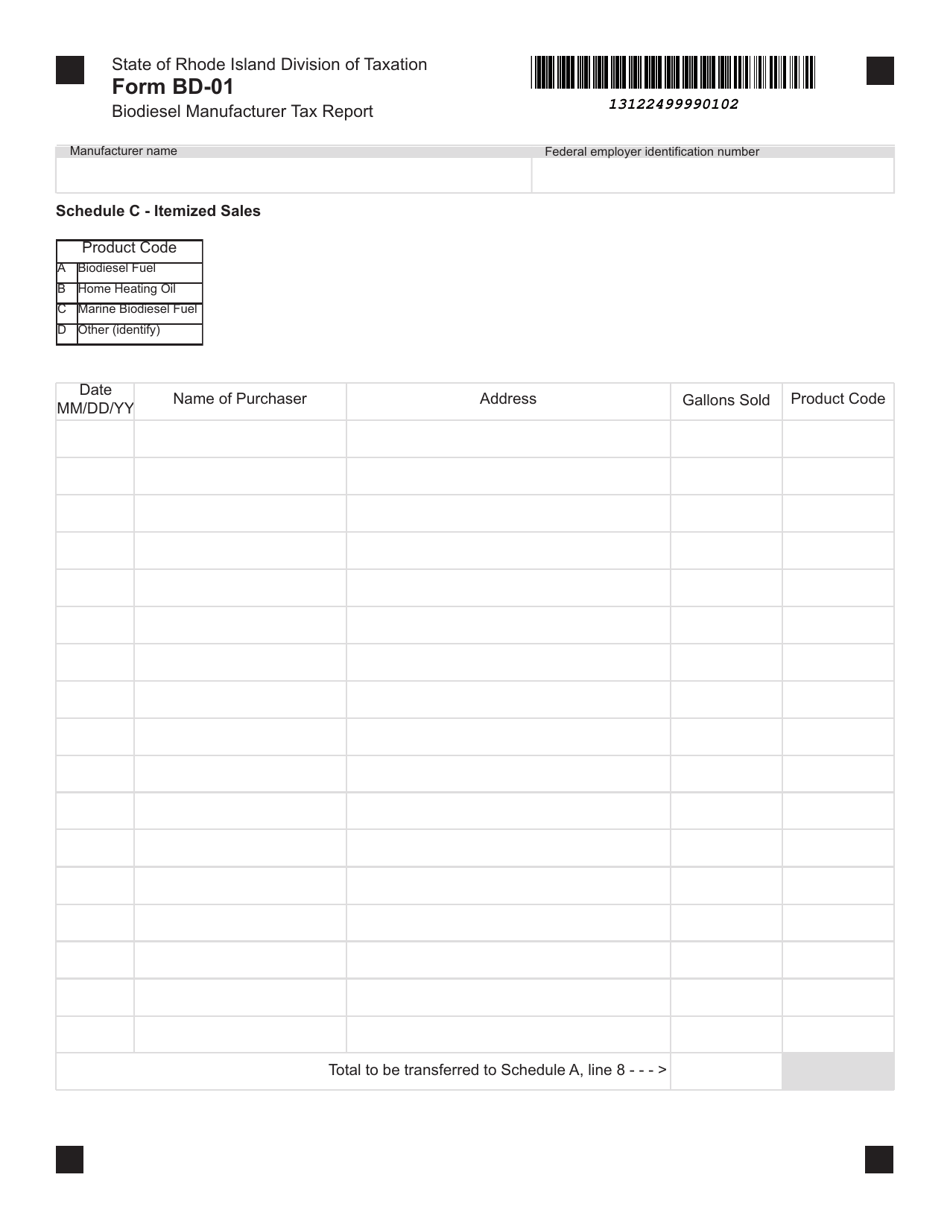

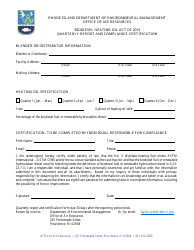

Form BD-01 Biodiesel Manufacturer Tax Report - Rhode Island

What Is Form BD-01?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

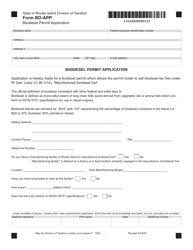

Q: What is Form BD-01?A: Form BD-01 is the Biodiesel Manufacturer Tax Report.

Q: Who should file Form BD-01?A: Biodiesel manufacturers in Rhode Island should file Form BD-01.

Q: What is the purpose of Form BD-01?A: Form BD-01 is used to report the biodiesel production and pay the applicable taxes.

Q: When should Form BD-01 be filed?A: Form BD-01 should be filed on a quarterly basis, by the 20th day of the month following the end of the quarter.

Q: Is there a penalty for late filing of Form BD-01?A: Yes, there is a penalty for late filing of Form BD-01.

Q: Are there any instructions available for filling out Form BD-01?A: Yes, detailed instructions are provided with Form BD-01.

Q: What taxes are applicable for biodiesel manufacturers in Rhode Island?A: Rhode Island imposes a tax on the production and sale of biodiesel.

Q: Is there a fee for filing Form BD-01?A: No, there is no fee for filing Form BD-01.