This version of the form is not currently in use and is provided for reference only. Download this version of

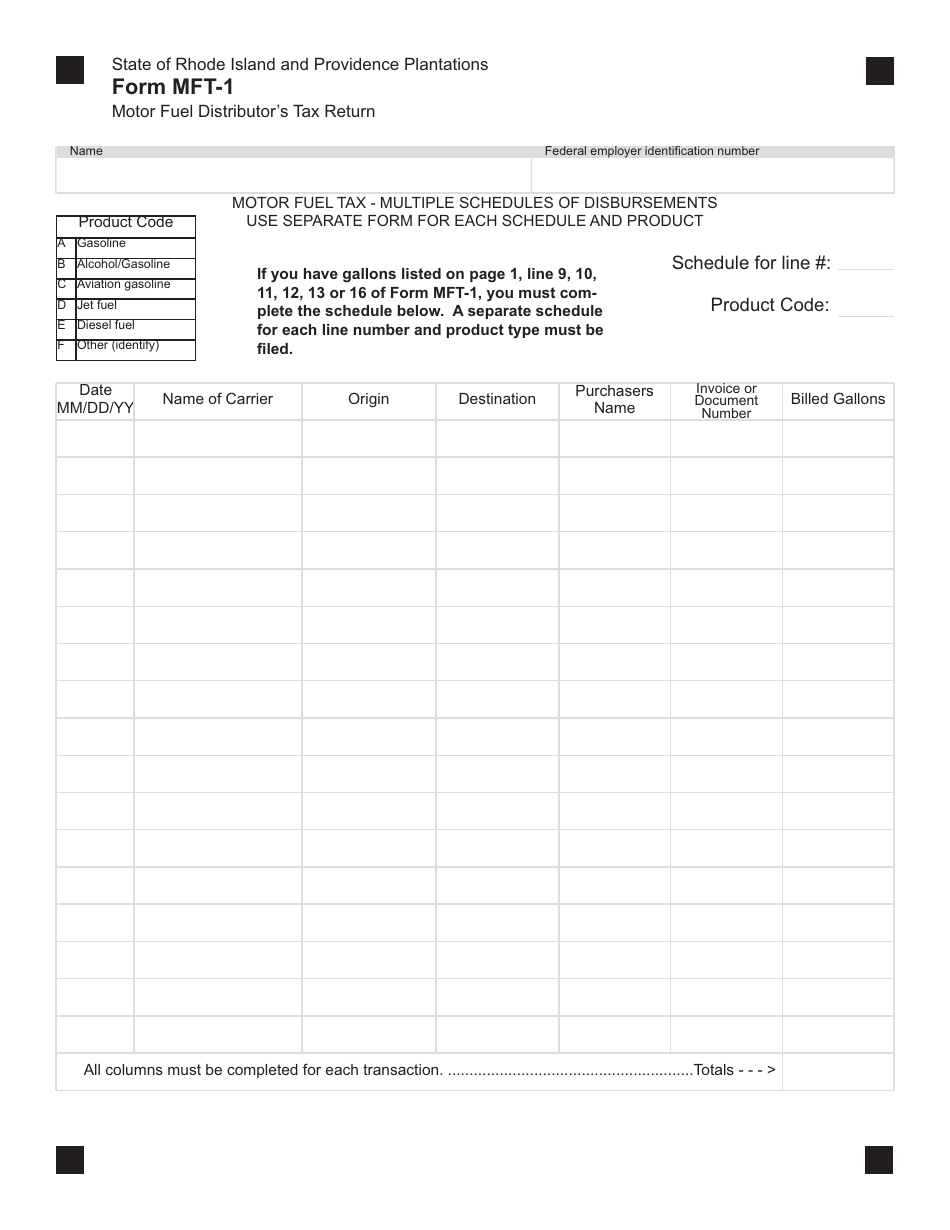

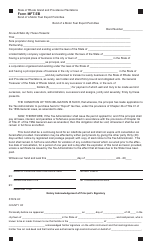

Form MFT-1

for the current year.

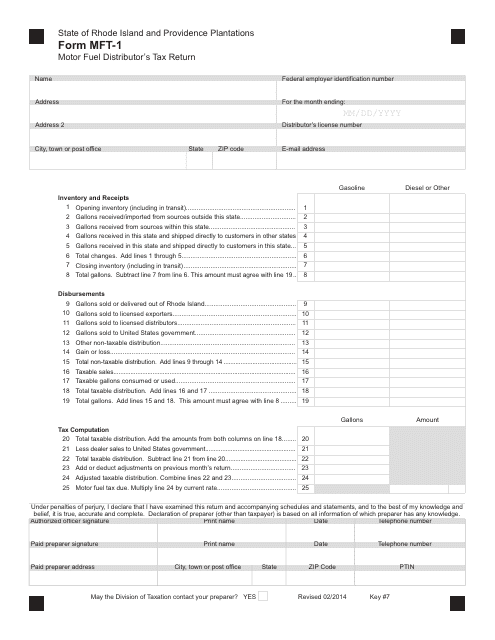

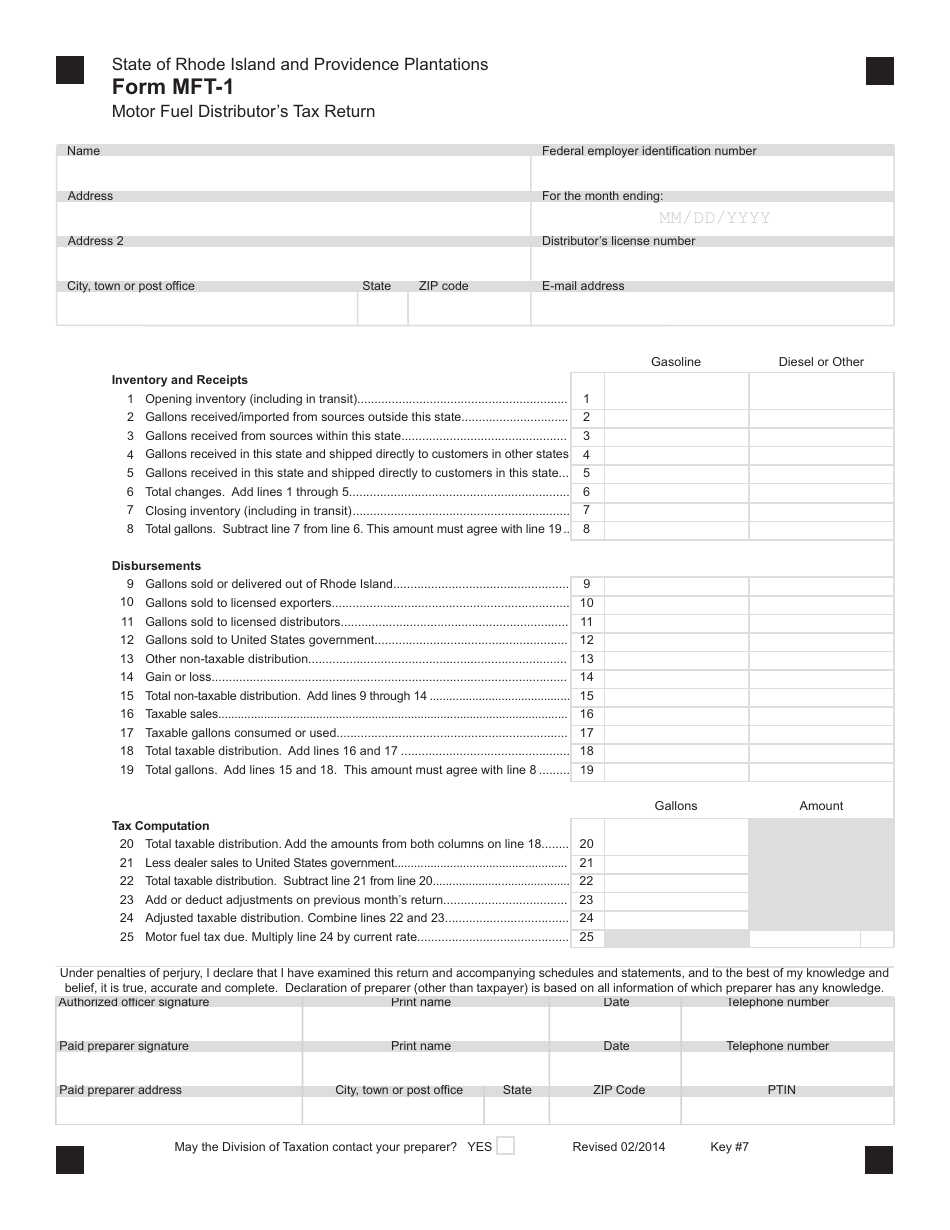

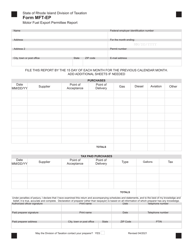

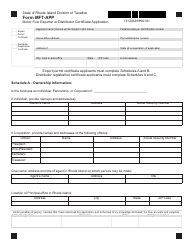

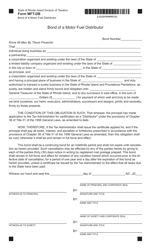

Form MFT-1 Motor Fuel Distributor's Tax Return - Rhode Island

What Is Form MFT-1?

This is a legal form that was released by the Rhode Island Department of Revenue - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form MFT-1?

A: Form MFT-1 is the Motor Fuel Distributor's Tax Return in Rhode Island.

Q: Who needs to file Form MFT-1?

A: Motor fuel distributors in Rhode Island need to file Form MFT-1.

Q: What is the purpose of Form MFT-1?

A: Form MFT-1 is used to report and pay motor fuel distributor taxes in Rhode Island.

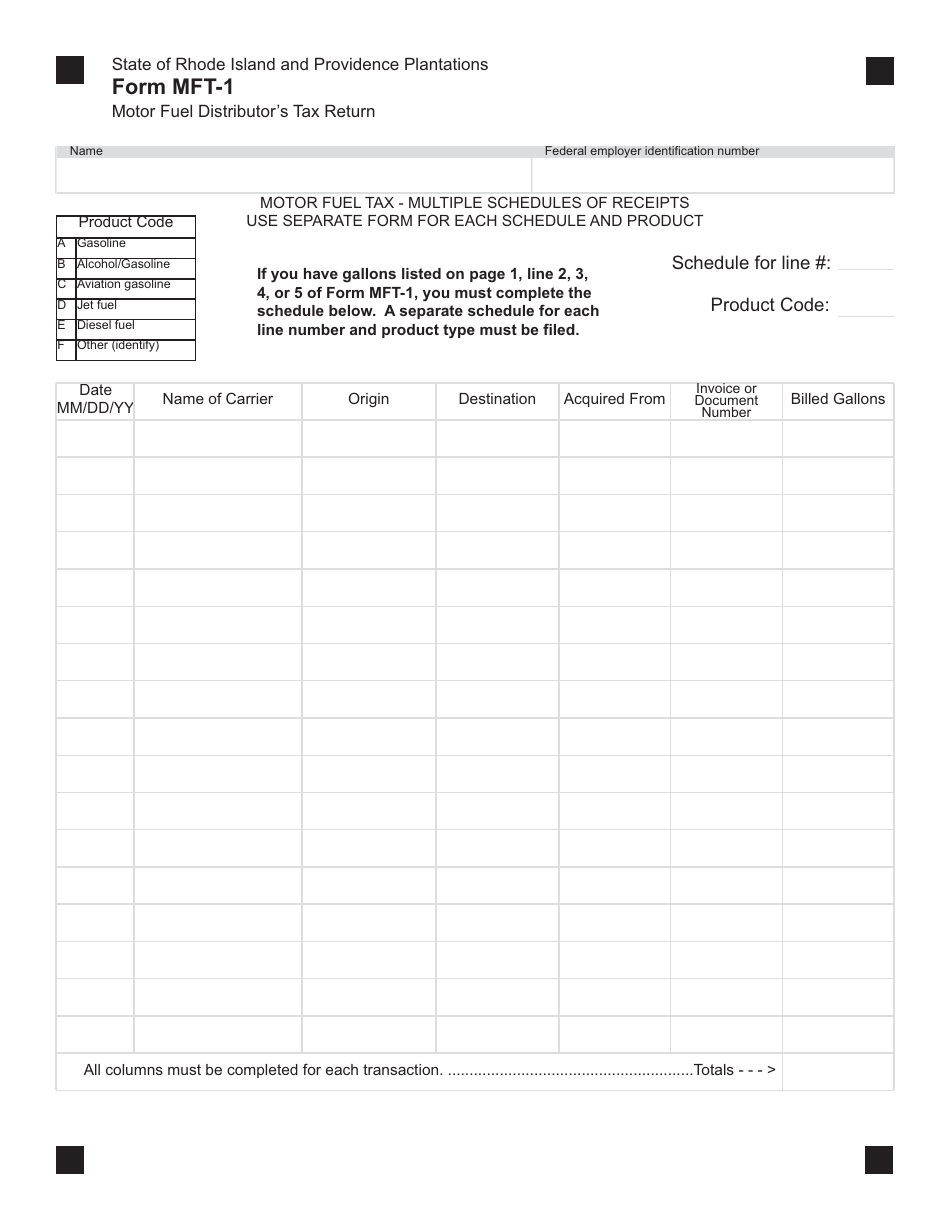

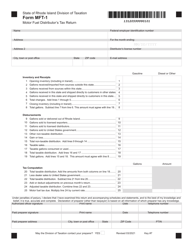

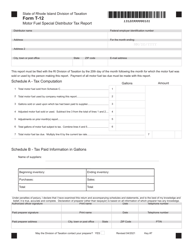

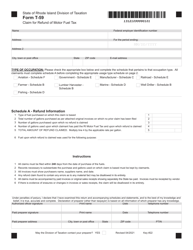

Q: What information is required on Form MFT-1?

A: Form MFT-1 requires information about fuel sales, gallons distributed, and tax calculations.

Q: When is Form MFT-1 due?

A: Form MFT-1 is due on a monthly basis, with the returns and payments due by the 25th of the following month.

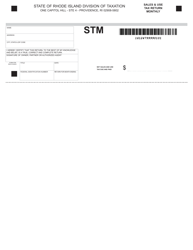

Q: Are there any penalties for late filing or non-compliance?

A: Yes, there are penalties for late filing or non-compliance, including interest charges and fines.

Q: Are there any exemptions or deductions available for motor fuel distributors?

A: Yes, there are certain exemptions and deductions available for motor fuel distributors in Rhode Island. Please consult the instructions for Form MFT-1 for more information.

Q: What should I do if I have questions or need assistance with Form MFT-1?

A: If you have questions or need assistance with Form MFT-1, you can contact the Rhode Island Division of Taxation for guidance.

Form Details:

- Released on February 1, 2014;

- The latest edition provided by the Rhode Island Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MFT-1 by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue.