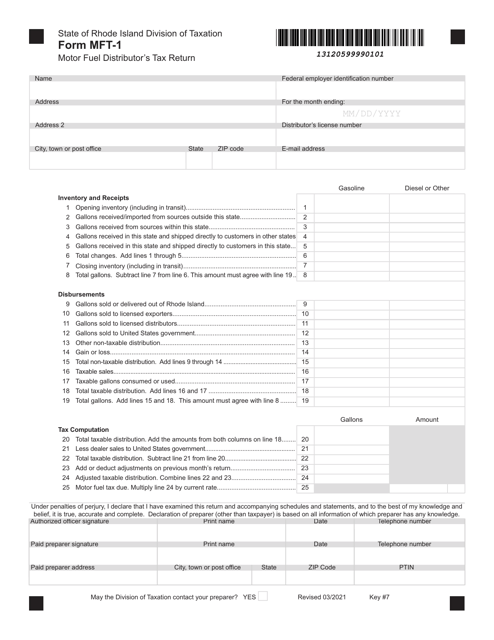

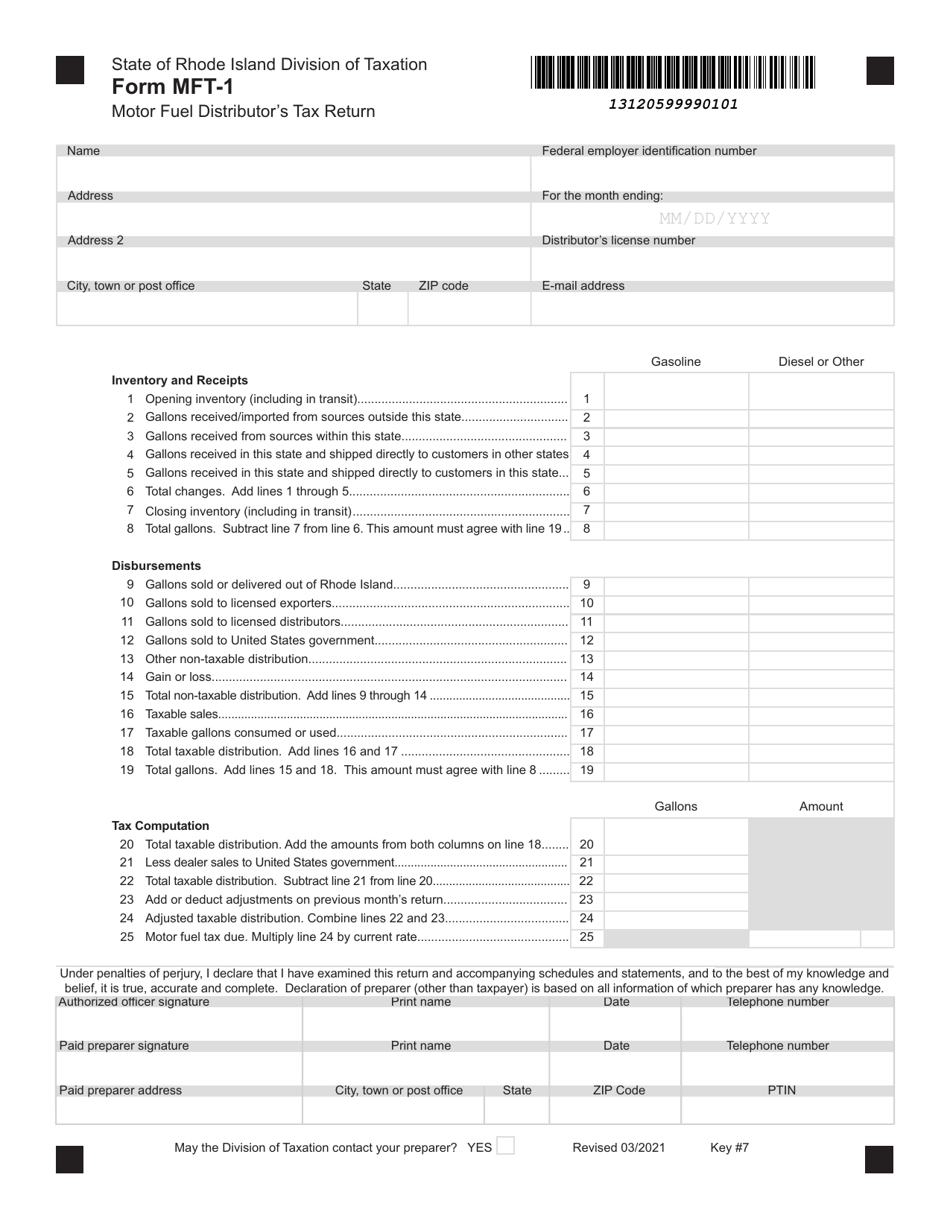

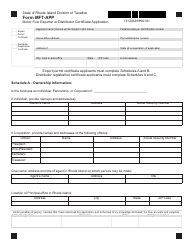

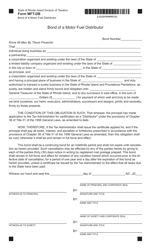

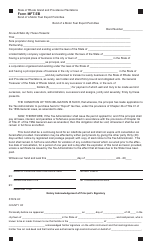

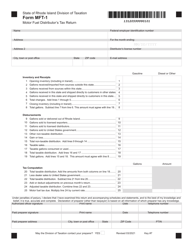

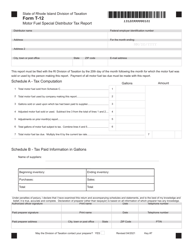

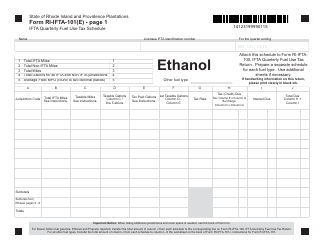

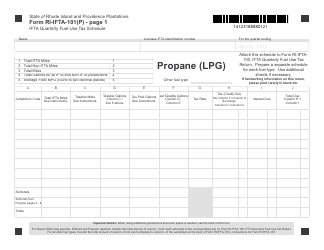

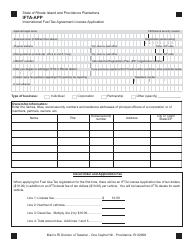

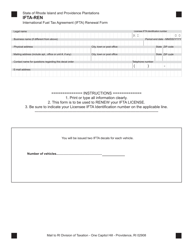

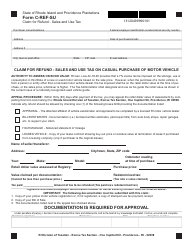

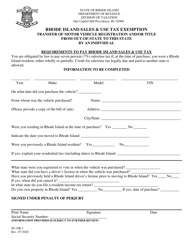

Form MFT-1 Motor Fuel Distributor Tax Report - Rhode Island

What Is Form MFT-1?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form MFT-1?A: Form MFT-1 is a Motor Fuel Distributor Tax Report in Rhode Island.

Q: Who needs to file Form MFT-1?A: Motor fuel distributors in Rhode Island need to file Form MFT-1.

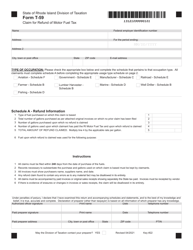

Q: What is the purpose of Form MFT-1?A: Form MFT-1 is used to report and pay motor fuel taxes in Rhode Island.

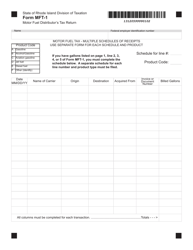

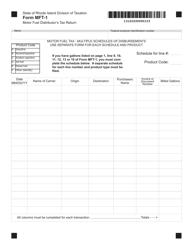

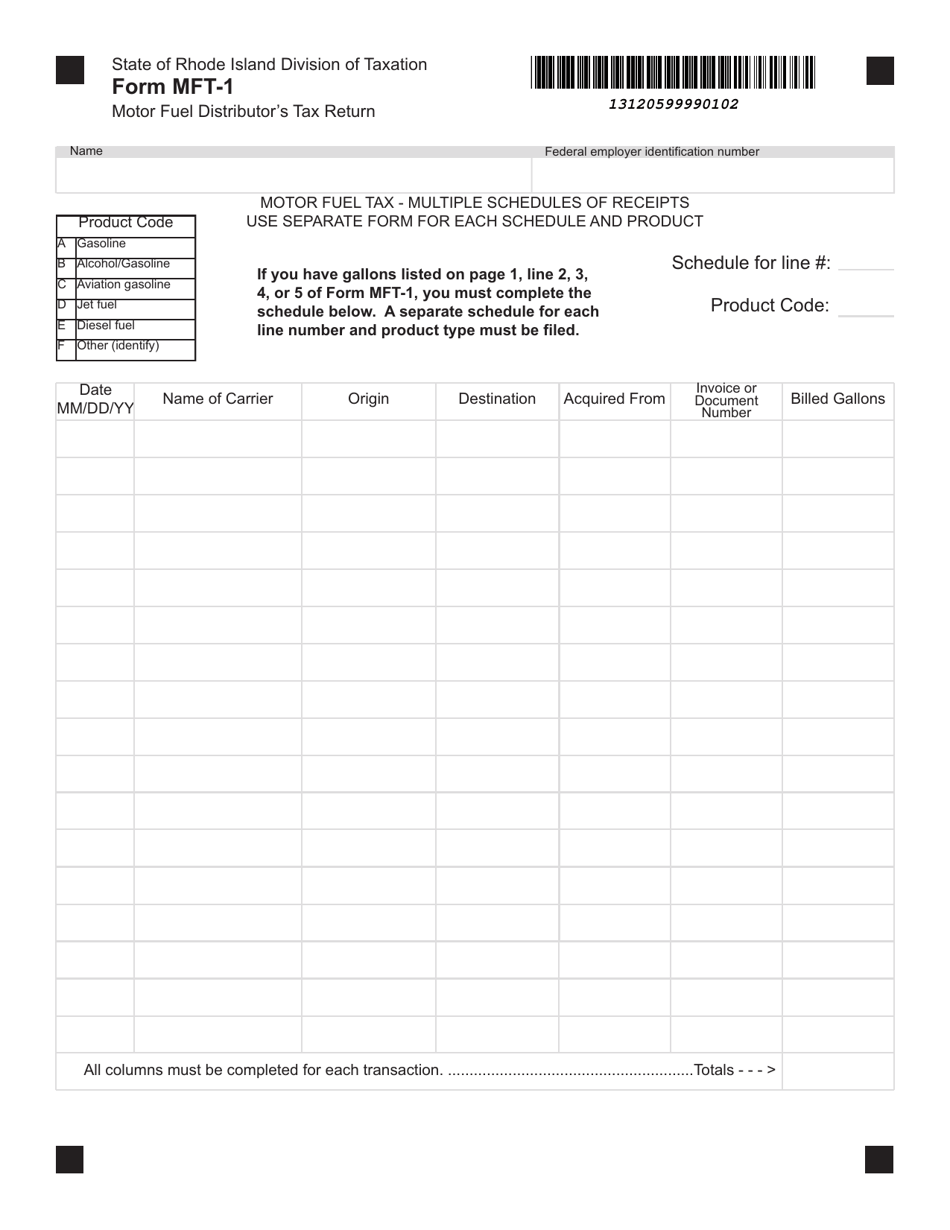

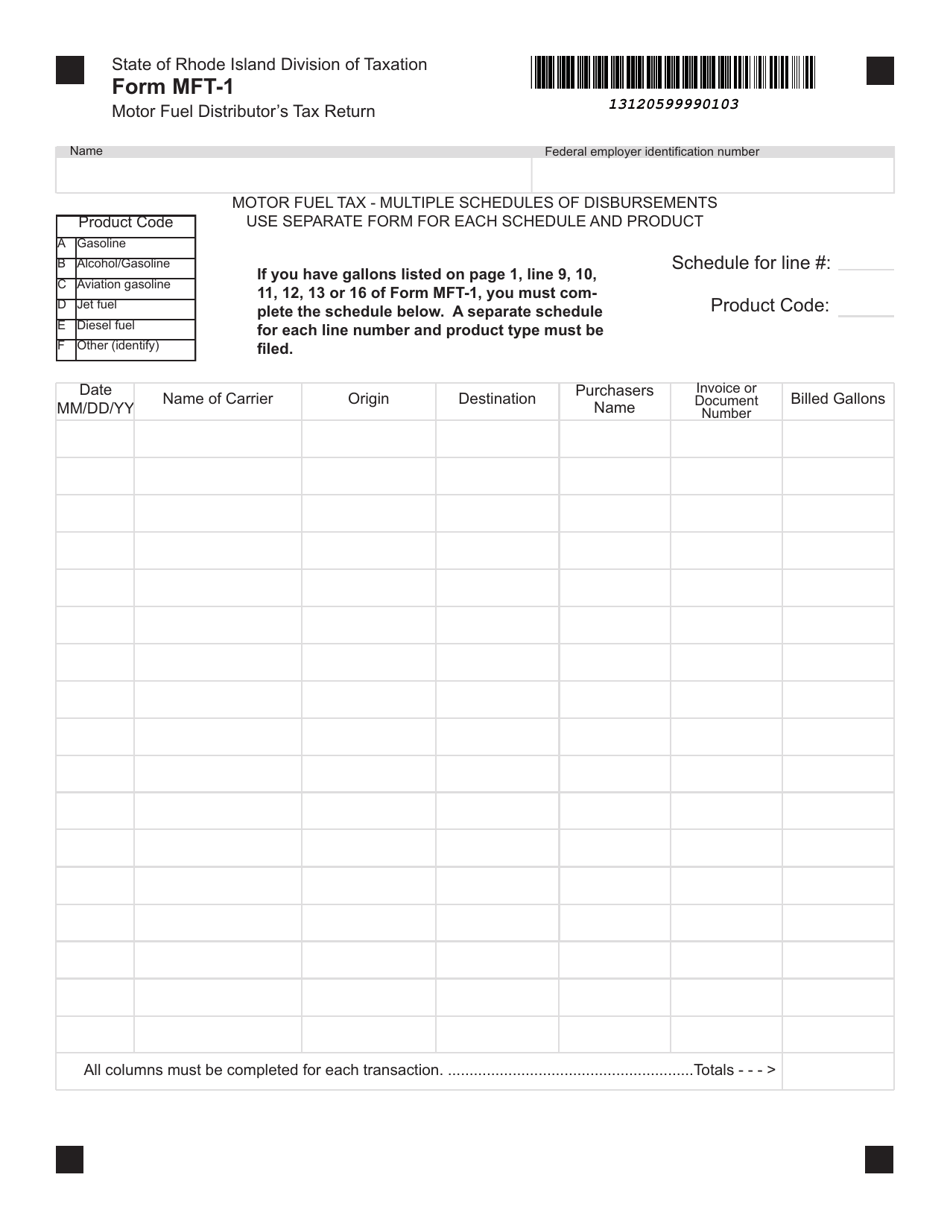

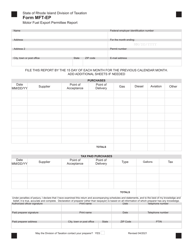

Q: What information is required on Form MFT-1?A: Form MFT-1 requires detailed information about motor fuel sales and gallons sold in Rhode Island.

Q: When is Form MFT-1 due?A: Form MFT-1 is due on the last day of the month following the end of the reporting period.

Q: How can I file Form MFT-1?A: Form MFT-1 can be filed electronically or by mail.

Q: Are there any penalties for late filing of Form MFT-1?A: Yes, there are penalties for late filing of Form MFT-1, including interest and potential penalties.

Q: Can I amend Form MFT-1 if I made a mistake?A: Yes, you can amend Form MFT-1 if you made a mistake on the original filing.