This version of the form is not currently in use and is provided for reference only. Download this version of

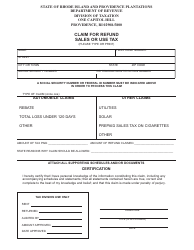

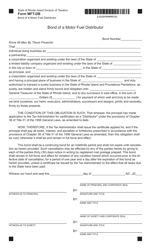

Form T-59

for the current year.

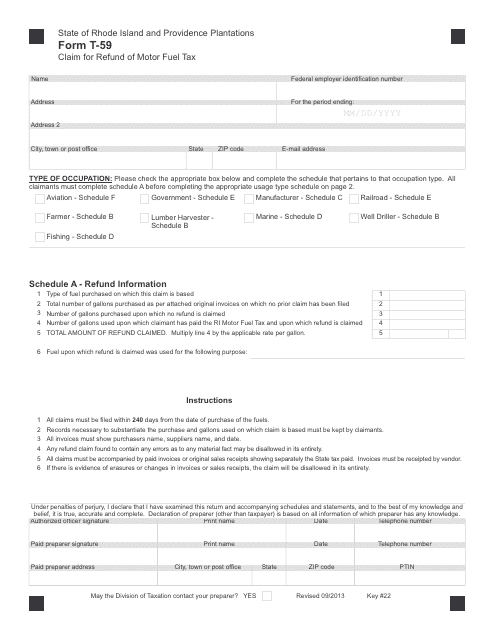

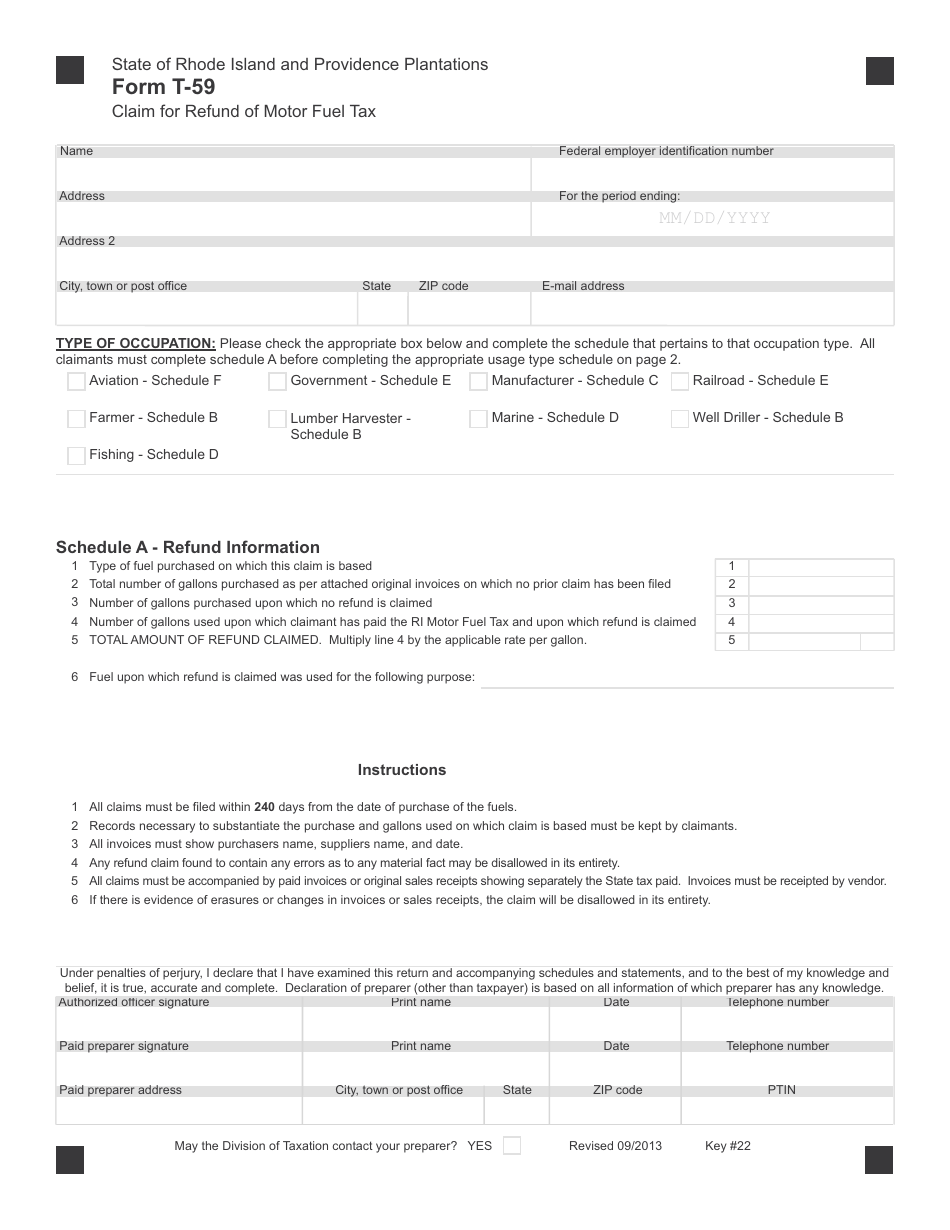

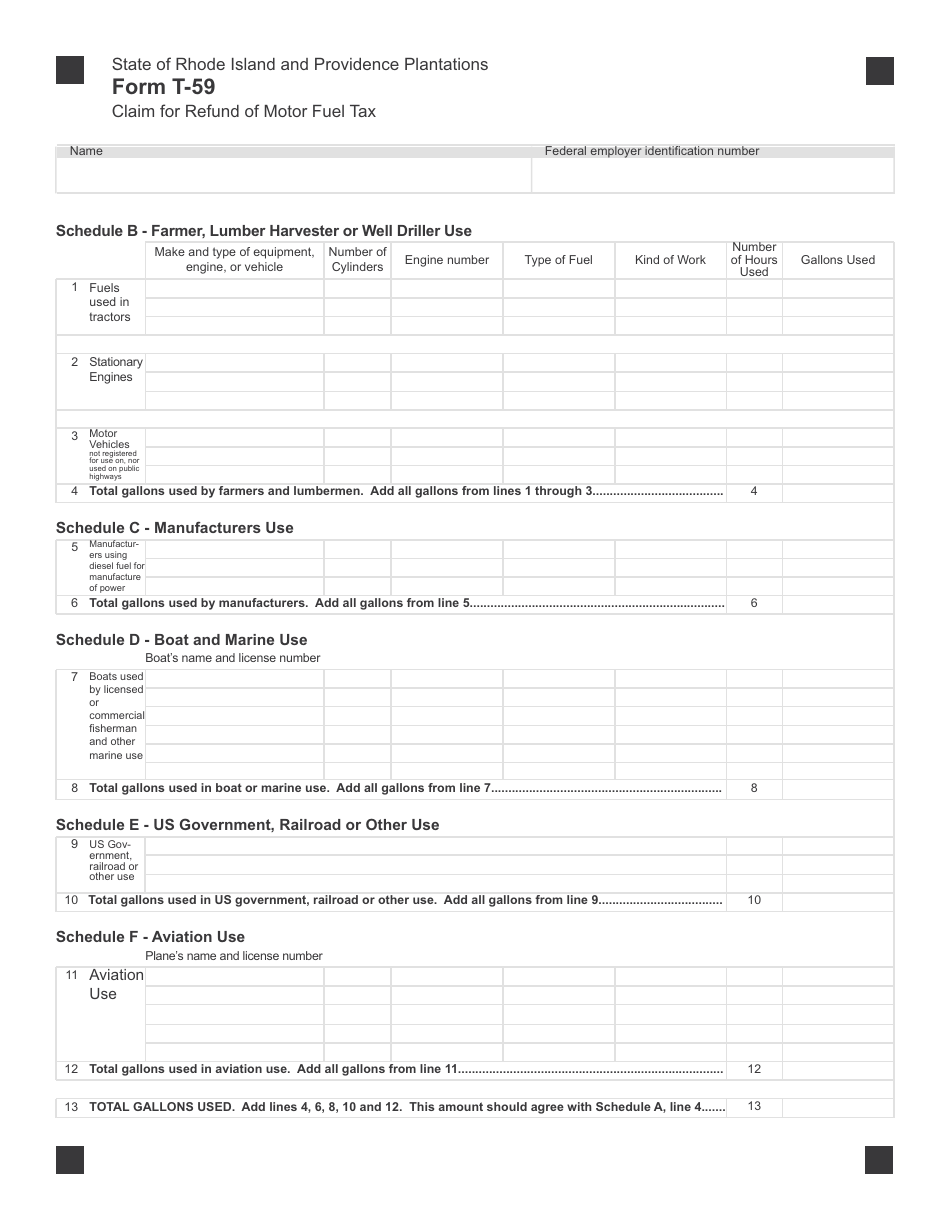

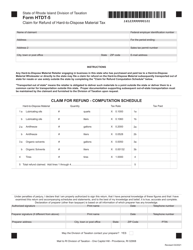

Form T-59 Claim for Refund of Motor Fuel Tax - Rhode Island

What Is Form T-59?

This is a legal form that was released by the Rhode Island Department of Revenue - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form T-59?

A: Form T-59 is the Claim for Refund of Motor Fuel Tax in Rhode Island.

Q: What is the purpose of Form T-59?

A: The purpose of Form T-59 is to request a refund of motor fueltax paid in Rhode Island.

Q: Who can use Form T-59?

A: Anyone who has paid motor fuel tax in Rhode Island and wants to request a refund can use Form T-59.

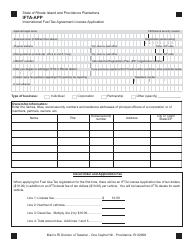

Q: What information is required on Form T-59?

A: Form T-59 requires information such as the taxpayer's name, address, the amount of fuel purchased, and the reason for the refund request.

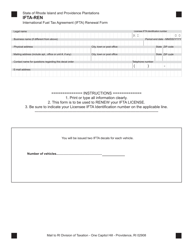

Q: How do I submit Form T-59?

A: Form T-59 can be submitted by mail or electronically, as specified by the Rhode Island Division of Taxation.

Q: What is the deadline for submitting Form T-59?

A: The deadline for submitting Form T-59 is generally within three years from the date the tax was paid.

Q: Are there any supporting documents required with Form T-59?

A: Yes, supporting documents such as fuel receipts or invoices may be required to substantiate the refund claim.

Q: How long does it take to process a refund claim with Form T-59?

A: Processing times for refund claims with Form T-59 may vary, but it typically takes several weeks to a few months.

Q: What should I do if I have additional questions about Form T-59?

A: For additional questions about Form T-59, it is best to contact the Rhode Island Division of Taxation directly.

Form Details:

- Released on September 1, 2013;

- The latest edition provided by the Rhode Island Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form T-59 by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue.