This version of the form is not currently in use and is provided for reference only. Download this version of

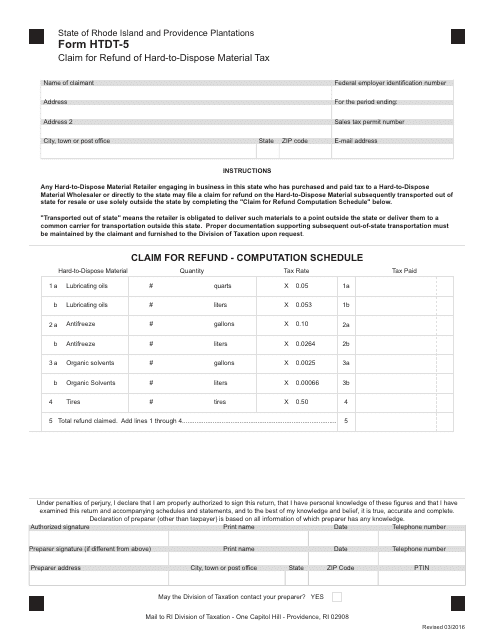

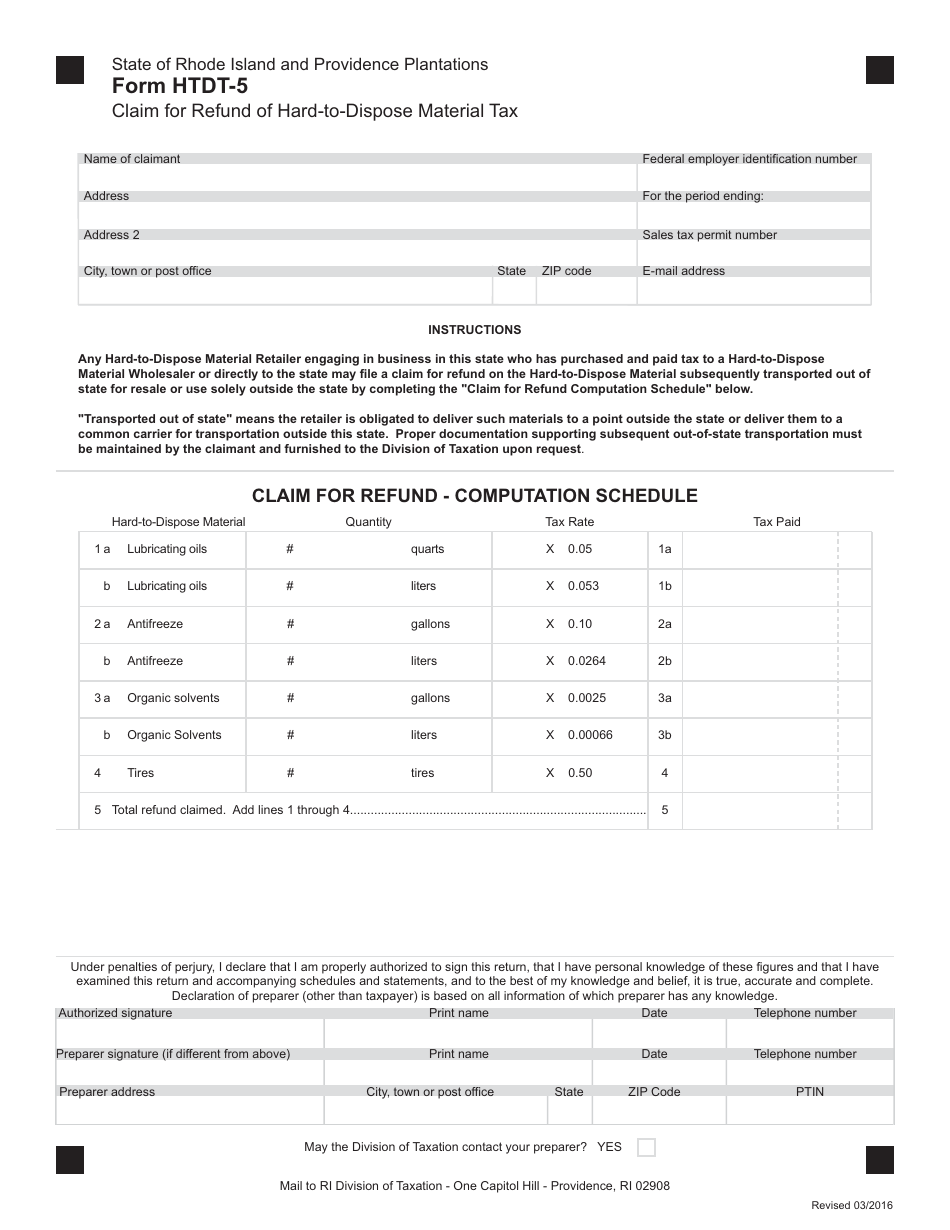

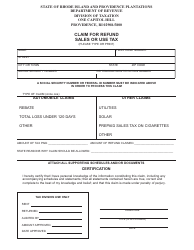

Form HTDT-5

for the current year.

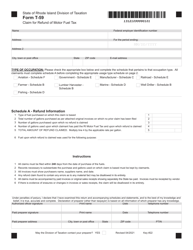

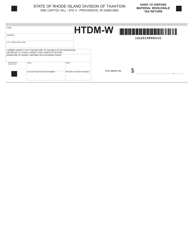

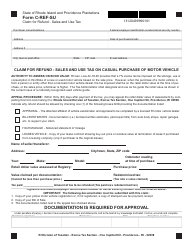

Form HTDT-5 Claim for Refund of Hard-To-Dispose Material Tax - Rhode Island

What Is Form HTDT-5?

This is a legal form that was released by the Rhode Island Department of Revenue - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form HTDT-5?

A: Form HTDT-5 is the Claim for Refund of Hard-To-Dispose Material Tax form in Rhode Island.

Q: What is the purpose of Form HTDT-5?

A: The purpose of Form HTDT-5 is to claim a refund of the Hard-To-Dispose Material Tax.

Q: Who needs to file Form HTDT-5?

A: Any individual or business that has paid the Hard-To-Dispose Material Tax and wishes to claim a refund needs to file Form HTDT-5.

Q: What is the Hard-To-Dispose Material Tax?

A: The Hard-To-Dispose Material Tax is a tax imposed in Rhode Island on certain types of waste materials that are difficult to dispose of.

Q: Are there any deadlines for filing Form HTDT-5?

A: Yes, Form HTDT-5 must be filed within 3 years from the due date of the tax return for the period in which the tax was paid.

Q: What supporting documents do I need to include with Form HTDT-5?

A: You will need to include copies of all paid invoices or receipts for the Hard-To-Dispose Material Tax that you are claiming a refund for.

Q: Can I claim a refund for multiple periods on one Form HTDT-5?

A: Yes, you can claim a refund for multiple periods on one Form HTDT-5 by including all the necessary information and supporting documents for each period.

Q: What happens after I file Form HTDT-5?

A: After you file Form HTDT-5, the Rhode Island Division of Taxation will review your claim and notify you of the status of your refund.

Form Details:

- Released on March 1, 2016;

- The latest edition provided by the Rhode Island Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form HTDT-5 by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue.