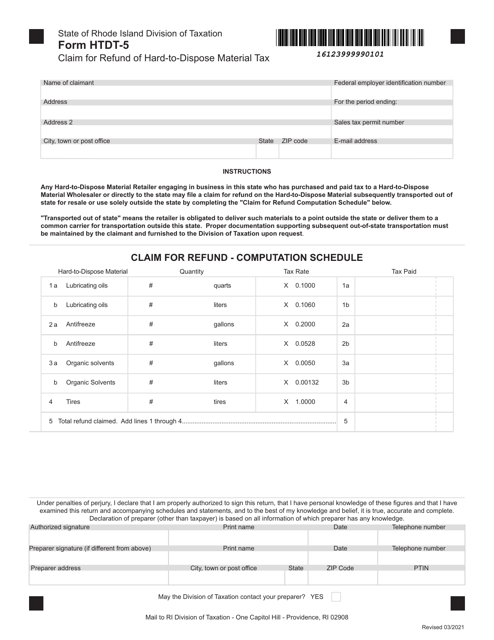

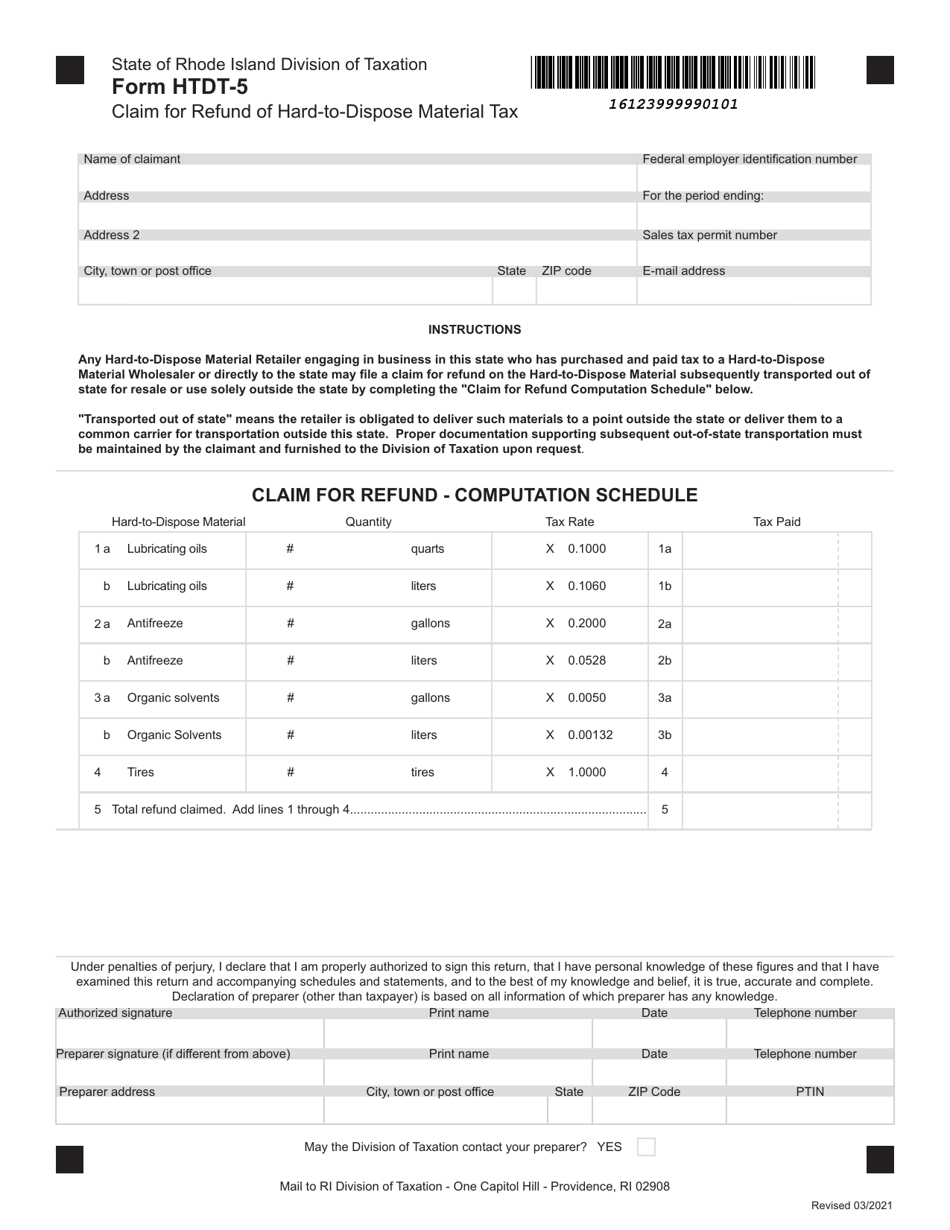

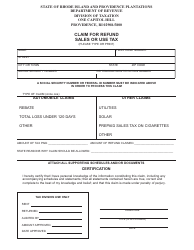

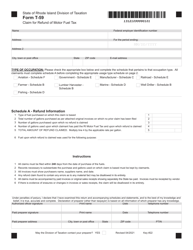

Form HTDT-5 Claim for Refund of Hard-To-Dispose Material Tax - Rhode Island

What Is Form HTDT-5?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the HTDT-5 form?A: The HTDT-5 form is the Claim for Refund of Hard-To-Dispose Material Tax.

Q: What does the HTDT-5 form allow you to claim?A: The HTDT-5 form allows you to claim a refund of Hard-To-Dispose Material Tax.

Q: What state is the HTDT-5 form used in?A: The HTDT-5 form is used in Rhode Island.

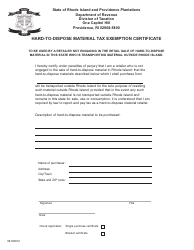

Q: What is the purpose of the Hard-To-Dispose Material Tax?A: The purpose of the Hard-To-Dispose Material Tax is to encourage proper disposal of certain hazardous materials.

Q: Who is eligible to file a claim using the HTDT-5 form?A: Anyone who has paid the Hard-To-Dispose Material Tax and meets the eligibility requirements can file a claim using the HTDT-5 form.

Q: What supporting documents are required when filing a claim with the HTDT-5 form?A: When filing a claim with the HTDT-5 form, you may be required to provide supporting documents such as receipts or invoices.

Q: How long does it take to process a refund claim submitted with the HTDT-5 form?A: The processing time for a refund claim submitted with the HTDT-5 form can vary, but it typically takes several weeks.

Q: Is there a deadline for filing a claim with the HTDT-5 form?A: Yes, there is a deadline for filing a claim with the HTDT-5 form. It is typically within three years from the date the tax was paid.