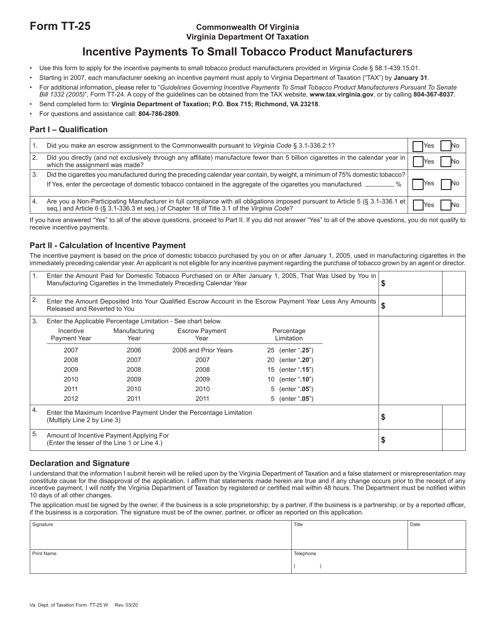

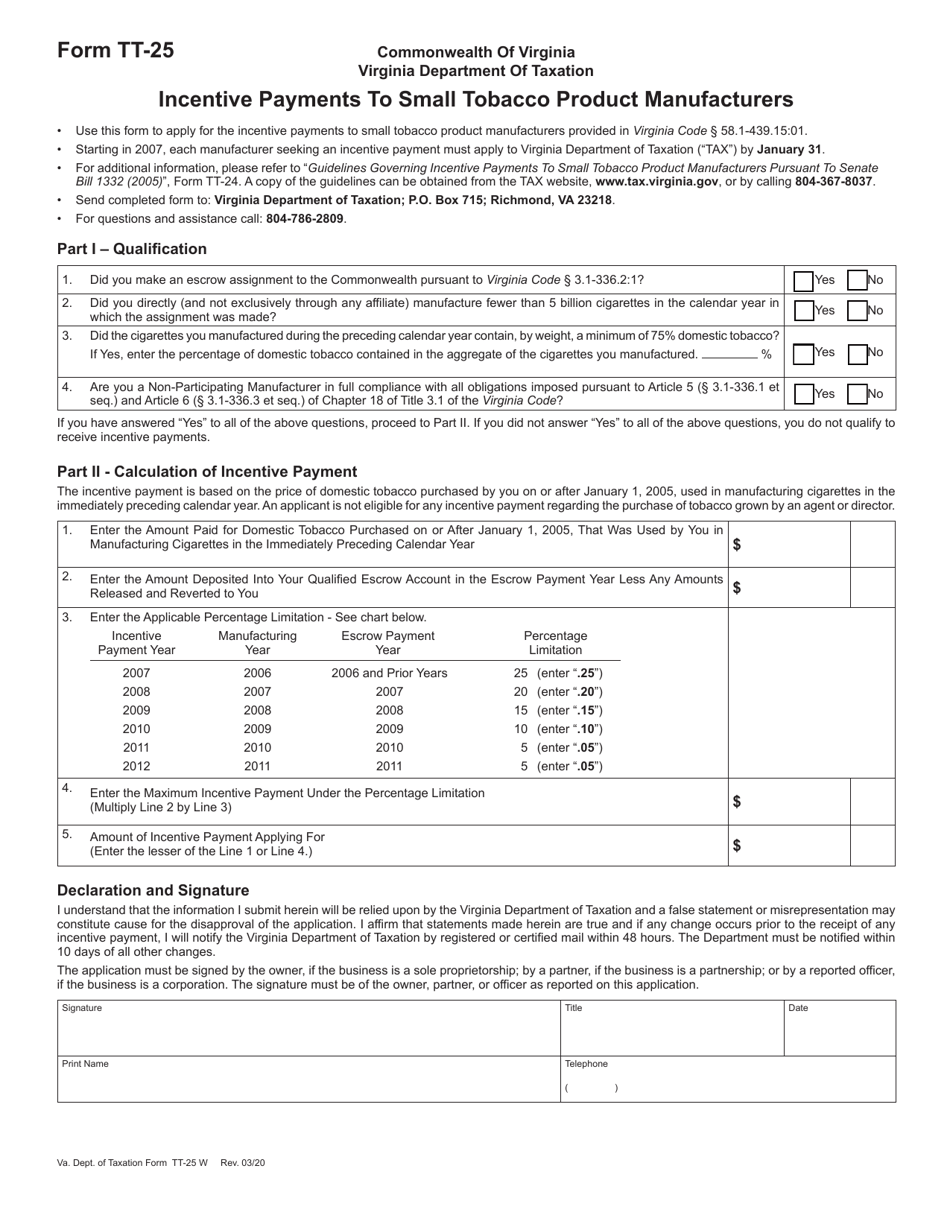

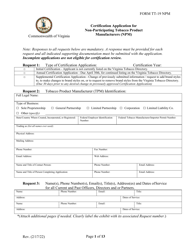

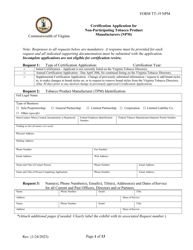

Form TT-25 Incentive Payments to Small Tobacco Product Manufacturers - Virginia

What Is Form TT-25?

This is a legal form that was released by the Virginia Department of Taxation - a government authority operating within Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form TT-25?

A: Form TT-25 is a tax form used in Virginia for reporting and submitting incentive payments to small tobacco product manufacturers.

Q: What are incentive payments to small tobacco product manufacturers?

A: Incentive payments are payments made to qualifying small tobacco product manufacturers as part of a settlement agreement.

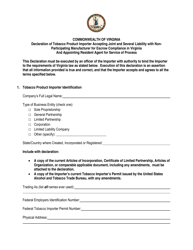

Q: Who is required to file Form TT-25?

A: Small tobacco product manufacturers in Virginia who are eligible for incentive payments must file Form TT-25.

Q: How do I qualify as a small tobacco product manufacturer?

A: To qualify as a small tobacco product manufacturer, you must meet the specific criteria outlined in the settlement agreement.

Q: When is the deadline to file Form TT-25?

A: The deadline for filing Form TT-25 is specified in the settlement agreement.

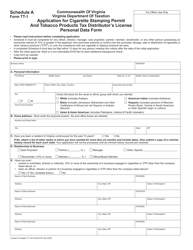

Q: What information do I need to complete Form TT-25?

A: You will need to provide basic information about your company, details of the incentive payment calculations, and any supporting documentation as required.

Q: Are there any penalties for late filing or incorrect information on Form TT-25?

A: Penalties may apply for late filing or providing incorrect information on Form TT-25. It is important to comply with the filing requirements and ensure the accuracy of the information provided.

Q: Who can I contact for further assistance with Form TT-25?

A: For further assistance with Form TT-25, you can contact the Virginia Department of Taxation or consult a tax professional.

Form Details:

- Released on March 1, 2020;

- The latest edition provided by the Virginia Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TT-25 by clicking the link below or browse more documents and templates provided by the Virginia Department of Taxation.