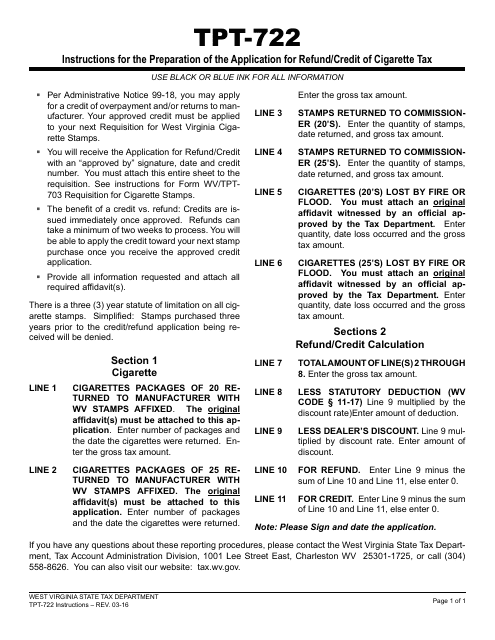

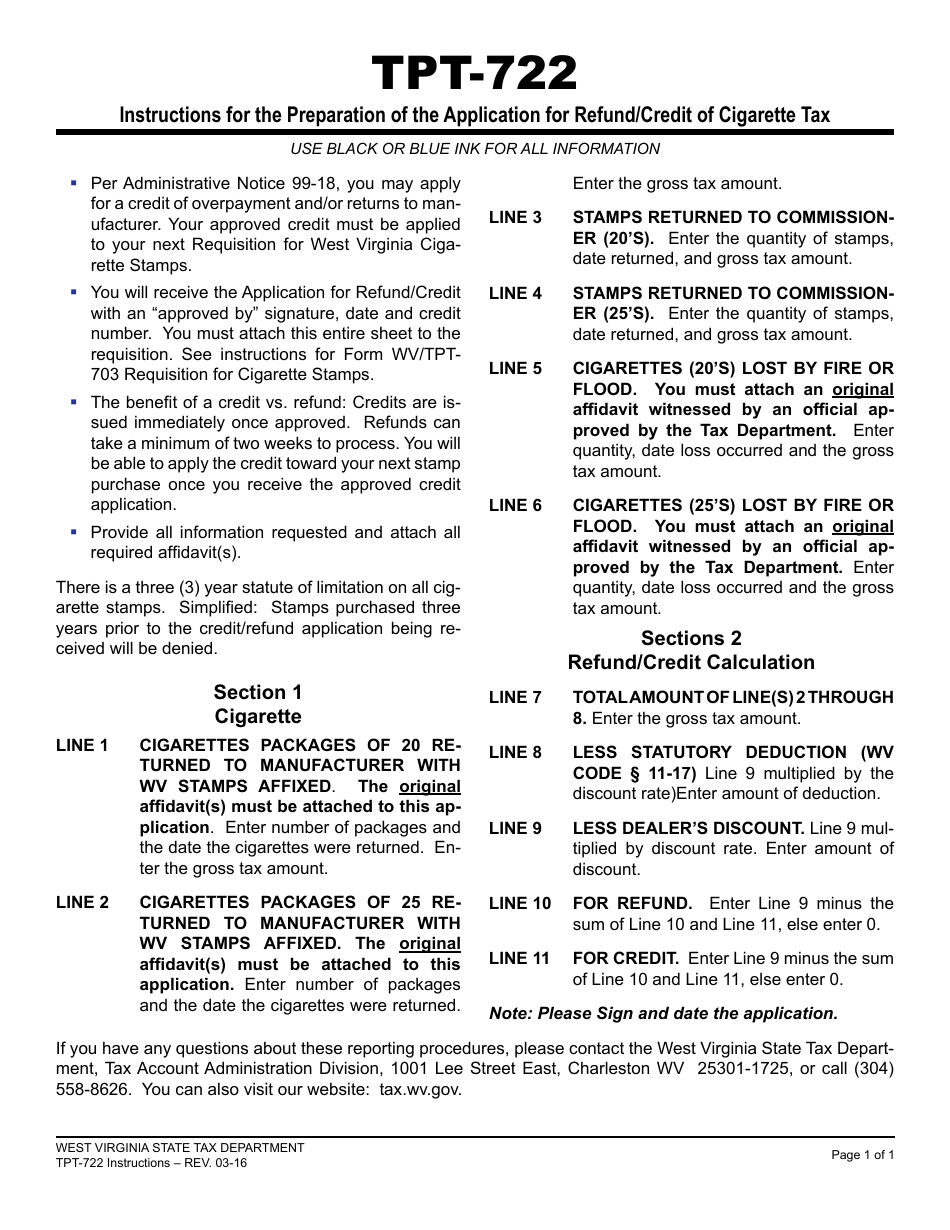

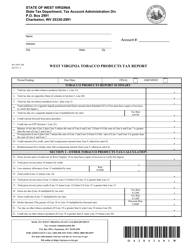

Instructions for Form WV / TPT-722 West Virginia Application for Refund / Credit of Tobacco Tax - West Virginia

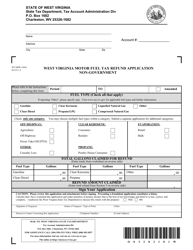

This document contains official instructions for Form WV/TPT-722 , West Virginia Application for Refund/Credit of Tobacco Tax - a form released and collected by the West Virginia State Tax Department. An up-to-date fillable Form WV/TPT-722 is available for download through this link.

FAQ

Q: What is Form WV/TPT-722?

A: Form WV/TPT-722 is the West Virginia Application for Refund/Credit of Tobacco Tax.

Q: Who should use Form WV/TPT-722?

A: Any individual or entity that wants to request a refund or credit for tobacco tax paid in West Virginia should use Form WV/TPT-722.

Q: What information do I need to complete Form WV/TPT-722?

A: You will need to provide your name, address, account number, the amount of tax paid, and the reason for the refund or credit request.

Q: Do I need to attach any supporting documents with Form WV/TPT-722?

A: Yes, you may need to attach supporting documents such as invoices, receipts, or other proof of payment.

Q: What is the deadline for filing Form WV/TPT-722?

A: Form WV/TPT-722 must be filed within three years from the date of the overpayment or the close of the tax period, whichever is later.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the West Virginia State Tax Department.