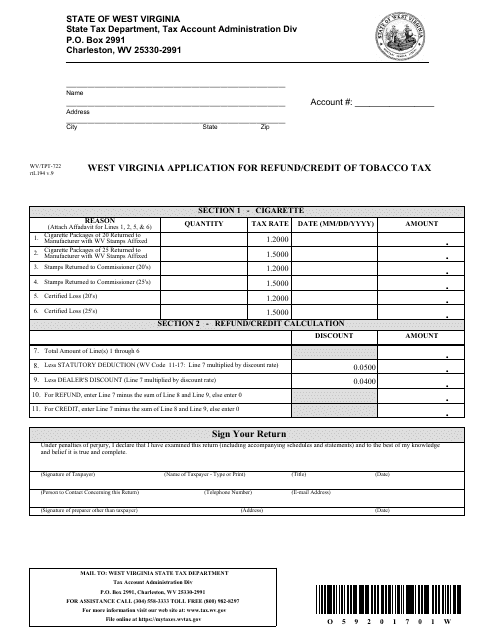

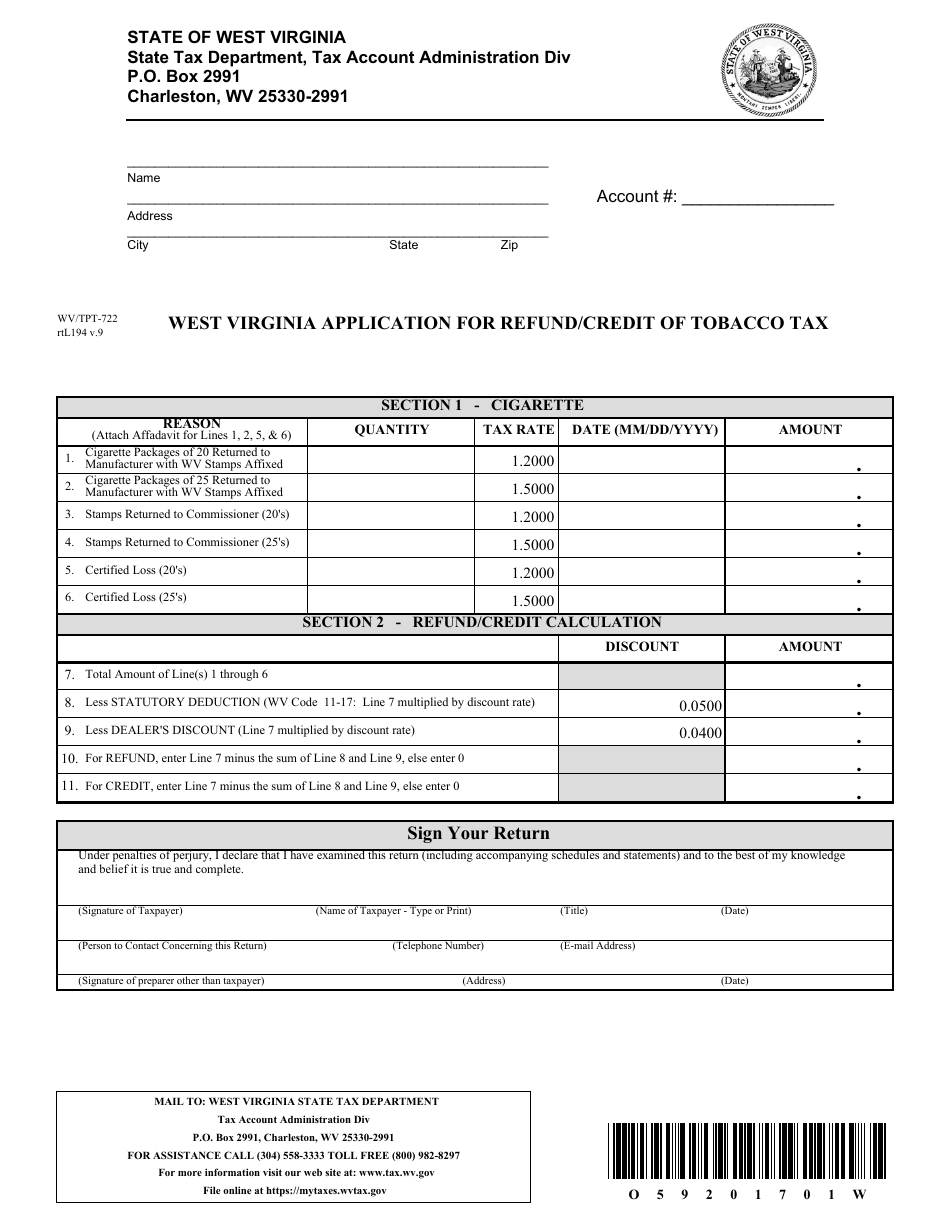

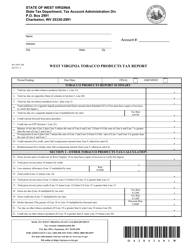

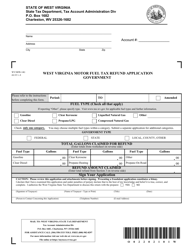

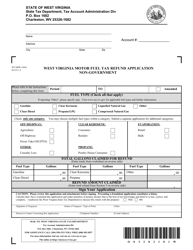

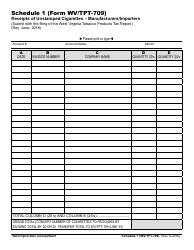

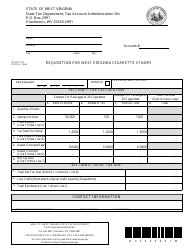

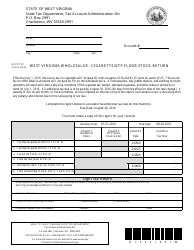

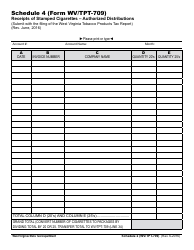

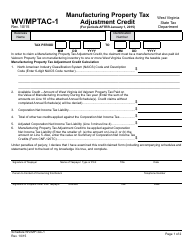

Form WV / TPT-722 West Virginia Application for Refund / Credit of Tobacco Tax - West Virginia

What Is Form WV/TPT-722?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. Check the official instructions before completing and submitting the form.

FAQ

Q: What is WV/TPT-722?

A: WV/TPT-722 is the abbreviation for the West Virginia Application for Refund/Credit of Tobacco Tax.

Q: What is the purpose of WV/TPT-722?

A: The purpose of WV/TPT-722 is to apply for a refund or credit of tobacco tax paid in West Virginia.

Q: Who can use WV/TPT-722?

A: WV/TPT-722 can be used by individuals or businesses who have paid tobacco tax in West Virginia and want to request a refund or credit.

Q: What information is required on WV/TPT-722?

A: WV/TPT-722 requires various information such as the taxpayer's name, address, tax account number, details of the refund or credit being requested, and supporting documentation.

Q: Is there a deadline to submit WV/TPT-722?

A: Yes, there is a deadline to submit WV/TPT-722. Generally, it must be filed within three years from the date the tax was paid.

Q: How long does it take to process WV/TPT-722?

A: The processing time for WV/TPT-722 varies, but it may take several weeks to receive a decision on your refund or credit request.

Q: Are there any fees associated with filing WV/TPT-722?

A: No, there are no fees associated with filing WV/TPT-722.

Q: What should I do if I have questions about WV/TPT-722?

A: If you have questions about WV/TPT-722, you can contact the West Virginia Department of Revenue for assistance.

Form Details:

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form WV/TPT-722 by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.