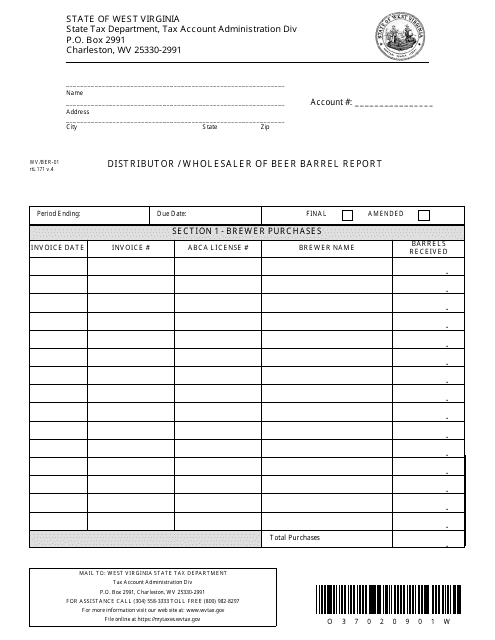

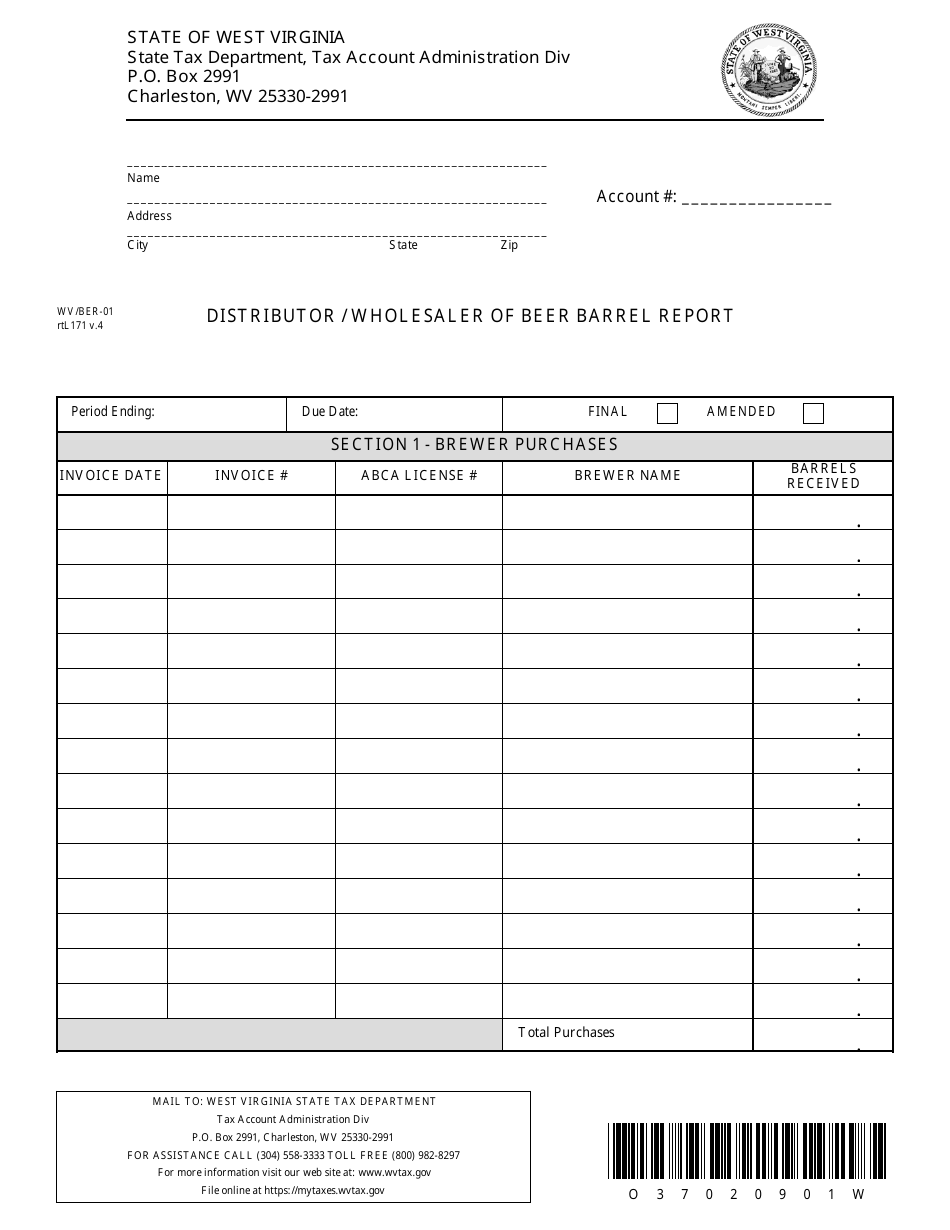

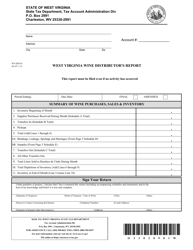

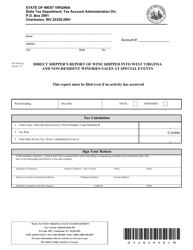

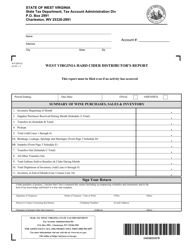

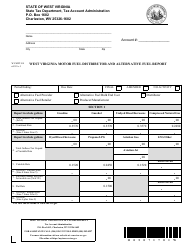

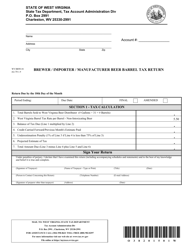

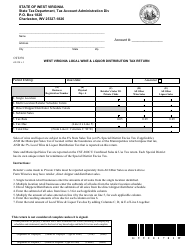

Form WV / BER-01 Distributor / Wholesaler of Beer Barrel Report - West Virginia

What Is Form WV/BER-01?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. Check the official instructions before completing and submitting the form.

FAQ

Q: What is the WV/BER-01 form?

A: The WV/BER-01 form is the Distributor/Wholesaler of Beer Barrel Report in West Virginia.

Q: Who needs to file the WV/BER-01 form?

A: Distributors and wholesalers of beer in West Virginia need to file the WV/BER-01 form.

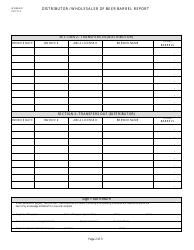

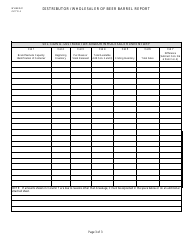

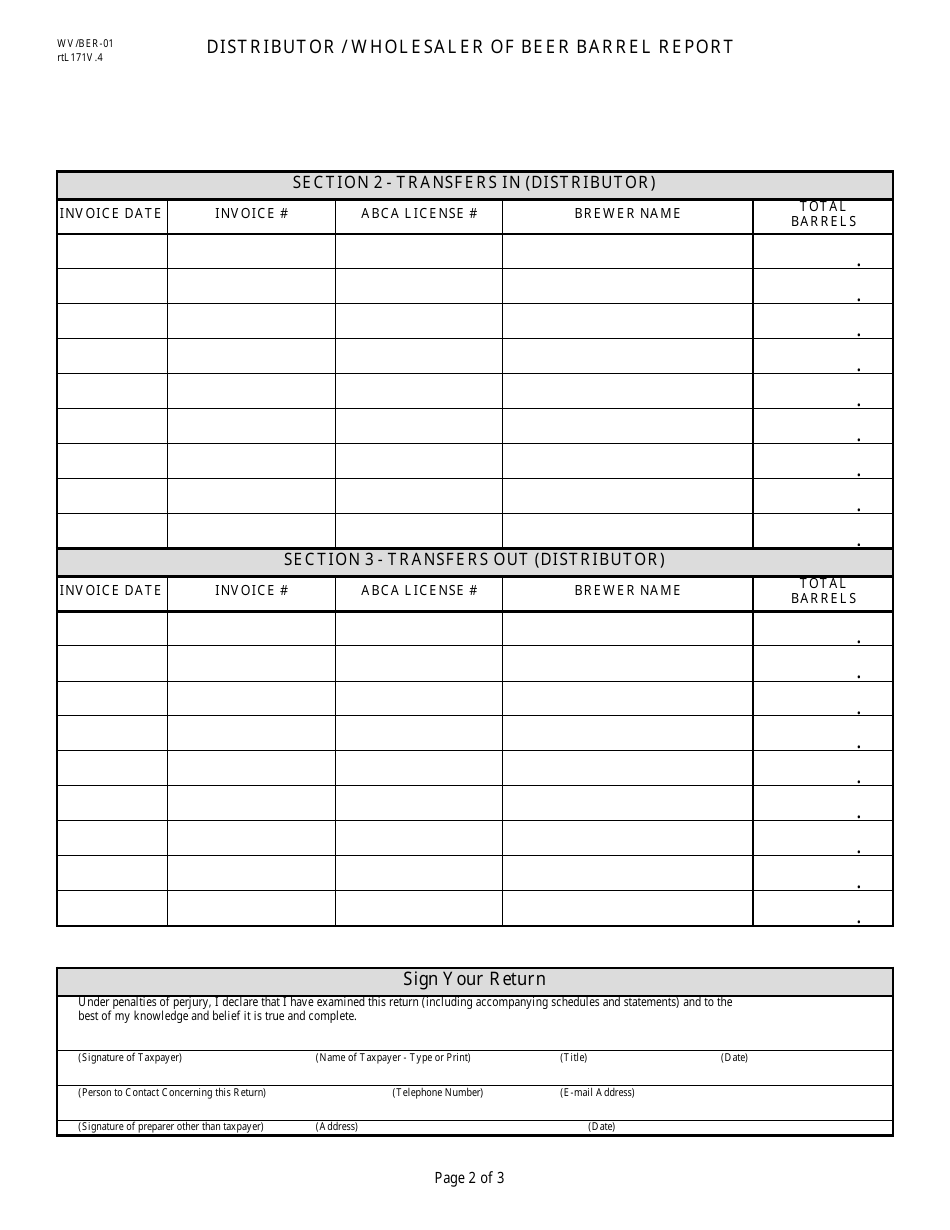

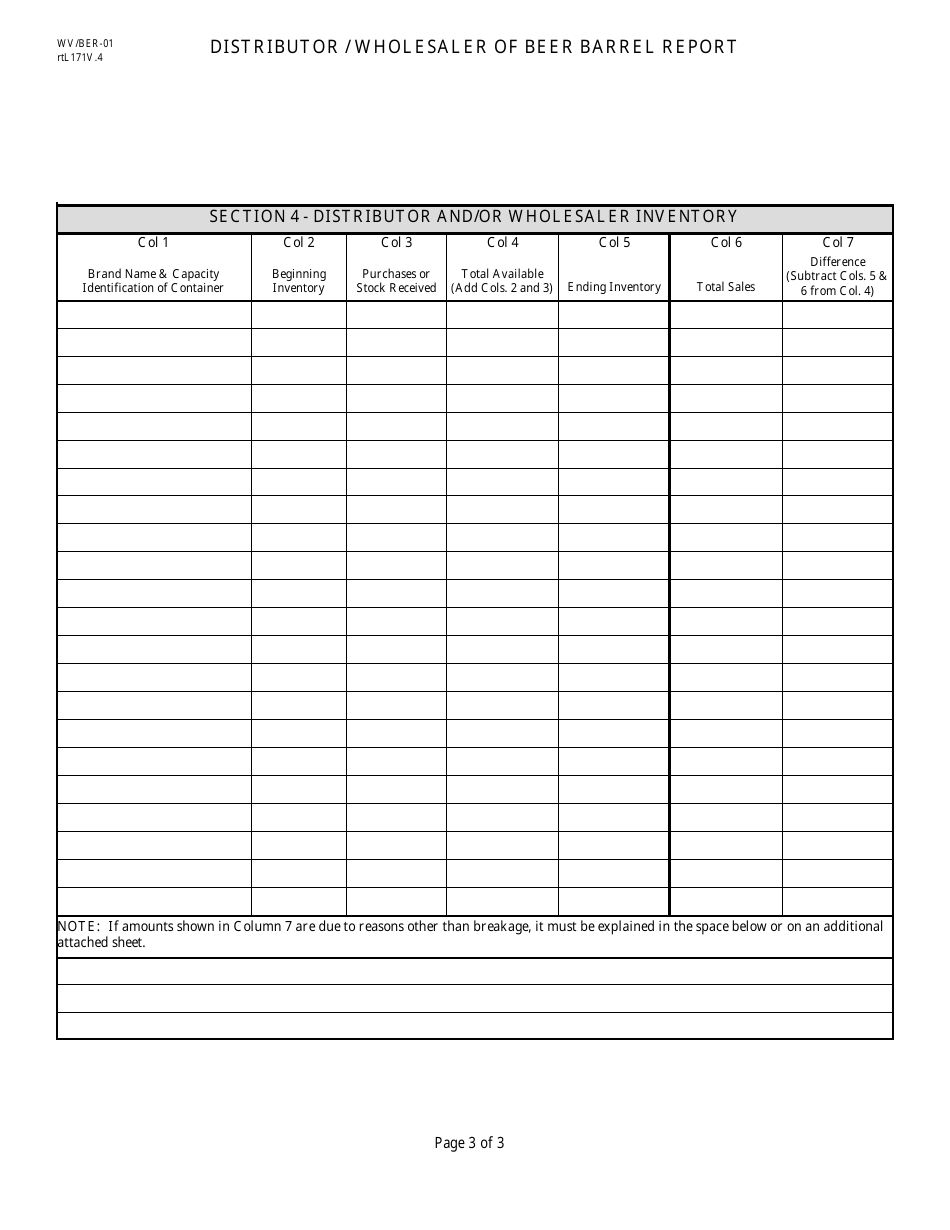

Q: What information is required on the WV/BER-01 form?

A: The WV/BER-01 form requires information about beer barrel sales, deliveries, returns, and inventory.

Q: How often does the WV/BER-01 form need to be filed?

A: The WV/BER-01 form must be filed monthly, by the 20th of the following month.

Q: Is there a fee to file the WV/BER-01 form?

A: No, there is no fee to file the WV/BER-01 form.

Q: Are there any penalties for late or non-filing of the WV/BER-01 form?

A: Yes, late or non-filing of the WV/BER-01 form may result in penalties and fines.

Form Details:

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form WV/BER-01 by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.